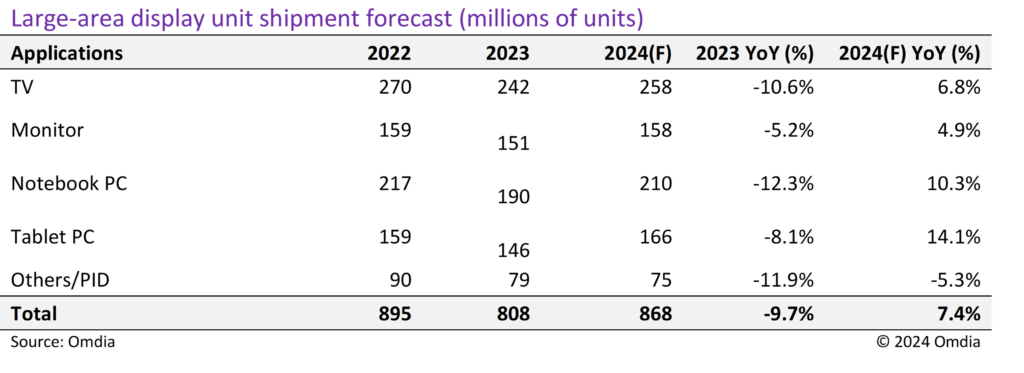

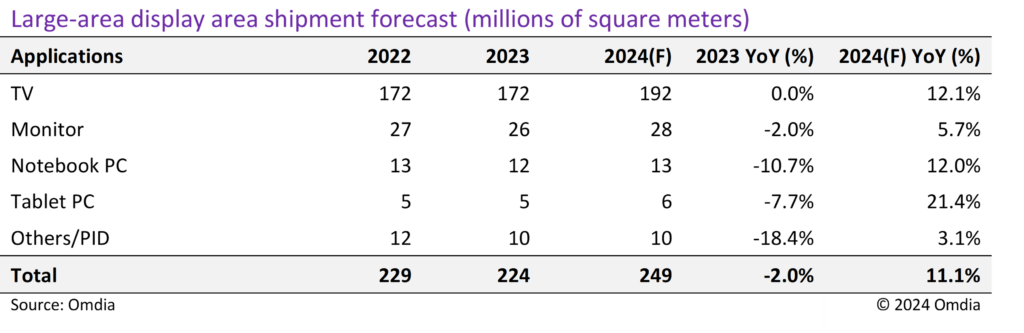

According to Omdia’, the market for large-area displays—defined as screens larger than 9 inches—is expected to see growth in the upcoming year after a big drop last year. Omdia forecasts a 7.4% year-over-year increase in unit shipments and an 11.1% rise in total area shipped in 2024.

The projection follows a period of subdued demand across several sectors. “In 2023, demand for IT display products such as mobile PCs and monitors was weaker despite fewer price increases. Demand for TV displays also decreased, but LCD TV display prices increased according to display makers’ production-to-order policies, especially for LCDs in 2023,” stated Peter Su, Senior Principal Analyst at Omdia.

The firm anticipates a balanced supply and demand for large-area displays in 2024, especially in the second half of the year. Su highlighted that the market is rebounding after a freeze in demand during 2022 and 2023, following a surge during the pandemic in 2020 and 2021. The anticipation of recovery is further bolstered by mid-2024 sporting events, expected to act as another catalyst for economic revival.

There is an expected surge in TV display shipments, which are projected to account for 77.1% of the total area shipped in 2024. Shipments of 98-inch and above LCDs are forecasted to reach 1.17 million units, marking an 81.6% increase from 0.65 million units in 2023.

Despite a challenging 2023, where large area display revenue fell by 7.2% year-over-year to US$61.1 billion due to slower demand and recovering IT display prices, revenue is expected to rebound to $74.2 billion in 2024—a 21.4% increase. This turnaround is driven primarily by the recovery in shipment volumes and prices, particularly in the TV display segment, which saw a revenue increase of 12.3% year-over-year until the third quarter of 2023.

In terms of market share, BOE led the pack in 2023, commanding a 33% share of large-area display unit shipments. It was followed by Innolux with 14.1% and AUO with 11.2%. For 2024, BOE is expected to maintain its lead with a forecasted market share of 31.1%, with Innolux and China Star trailing at 12.5% and 12.2%, respectively.

As manufacturers and market analysts look to the future, the large-area display industry appears set for a significant upswing, driven by both increased sizes in LCD TVs and a rebound in market dynamics.