Information Display Magazine‘s Jay Morreale loves to repeat the old bromide, “Even a broken clock is right twice a day.” In that spirit, even an Apple rumor that has proved to be wrong for as long as I can remember may eventually turn out to be right. And so it is (or appears to be) with the oft-repeated rumor of an iPhone with an OLED display.

It’s no secret that Apple has been interested in OLED displays for iPhones for years. When it first looked into the possibility, what is now Samsung Display – the only manufacturer at the time – barely had enough capacity to supply Samsung’s own smartphone needs. That situation has changed, with Samsung, LGD and several Chinese manufacturers energetically ramping capacity or planning to do so.

Last week, shares of LG Display dropped 7%. The reason, according to EE Times Asia, was that there were multiple reports in the Korean media that Apple has agreed to purchase OLED displays from Samsung for the generation of iPhones appearing in 2017. Why did this puncture LGD’s share price? The Samsung Display OLEDs will obviously replace LCDs, and 40% of those LCDs are made by LGD.

Based on the Korean media reports, EET Asia said “Samsung is forecast to supply an annual 100 million OLED panels, worth $2.6 billion, to Apple from the 2Q17 for three years.”

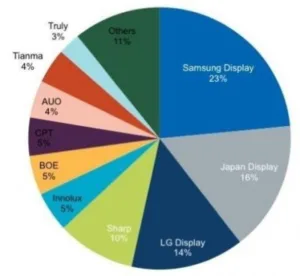

IHS has reported that Samsung Display captured 23% of the 2015 revenue for 9-inch-and-under displays (for all technologies). Japan Display followed with 16%, LGD with 14%, and Sharp with 10%. Innolux, BOE, CPT, AUO, and Tianma trailed along, each in the mid single digits. AMOLED and LTPS-LCD unit shipments grew in 2015 over 2014, but a-Si shipments fell 10%.

There have been some reports that OLED displays in cell-phone sizes can now be made at a lower cost that AMLCDs.

With this background, you might suspect that it’s not only Samsung Display and LGD that are pouring money into increased OLED display capacity, and you would be right. Japan Display has announced investments in high-volume OLED manufacturing, as has Sharp. Word is that new majority-owner Hon Hai pressured Sharp to move into OLED displays more aggressively than Sharp’s management had intended.

None of the figures mentioned above address the growth of flexible OLED displays. ET News has reported that Samsung is making 9 million flexible OLED panels per month for the Galaxy S7 Edge and other products that used flexible OLEDs. Samsung has reported sales of the GS7 and GS7 Edge at about 2.5 times higher than for the preceding models. Our colleague Ray Soneira has evaluated these displays with his usual precision and praised them highly.

And we haven’t talked about the decreasing prices and increasing sales of OLED TVs. Just as Samsung is the 800-pound gorilla in the small-to-medium OLED world, LG holds that weighty position for OLED TVs, and it is LG that is pushing higher volume, higher yield, lower cost and lower prices for consumer TV sets. But Samsung, whose management is admirably cold-blooded about not committing to a product before its time, has a growing engineering team working on OLED TV. At first, reports were that, for TV, Samsung was abandoning its RGB OLED pixel architecture for some version of LG’s color-by-white approach. More recently, rumors have it that Samsung is investigating both approaches. Regardless of which one it ultimately pursues, it’s clear that OLED is once again making an O-leap forward, with highly significant growth in OLED panel area virtually guaranteed. (KW)

Ken Werner is Principal of Nutmeg Consultants, specializing in the display industry, manufacturing, technology, and applications, including mobile devices and television. He consults for attorneys, investment analysts, and companies re-positioning themselves within the display industry or using displays in their products. You can reach him at [email protected].