In the continuous effort to improve LCD TV, to stave off the threat of OLED as well as to try to keep TV price declines to a minimum, manufacturers are pushing innovation in many ways. One weapon in the LCD maker’s armoury might be a light saver (if not a light sabre!).

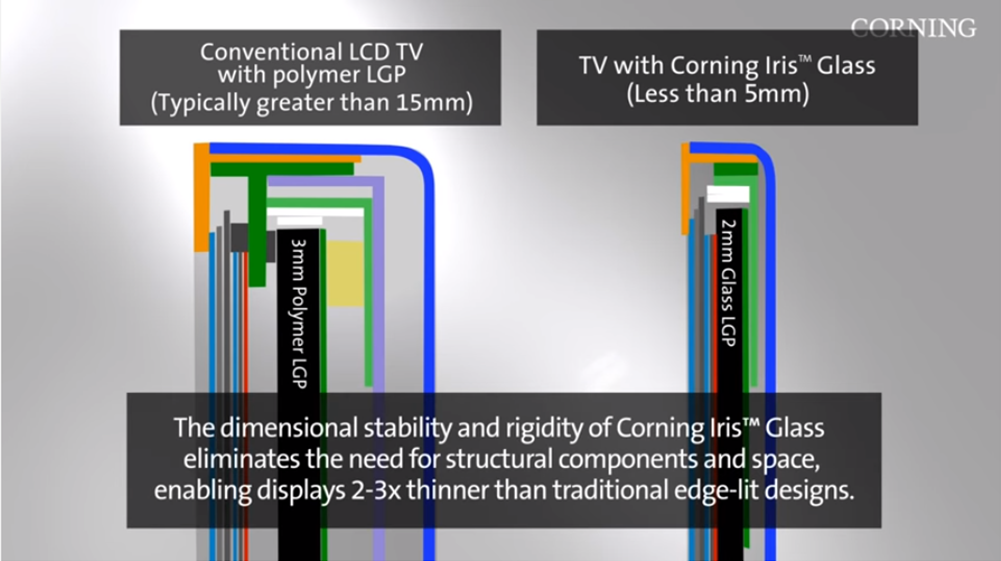

High Dynamic Range and Quantum Dot technologies are minimizing, if not eliminating, the OLED advantages in contrast and color. Another approach is to match the ultra-slim form factor of OLED TV with another technology highlighted at the SID Display Week last month: glass light-guide plates (LGP). Among the 2016 Display Industry Awards presented, both Asahi and Corning received awards for Display Components of the Year for glass LGPs: Asahi for its XCV Glass substrate and Corning for its Iris Glass LGP. Both products offer similar benefits: a glass LGP enables a thin profile with a narrow bezel, in comparison with product designs using polyamide LGPs.

Source: Asahi Glass

Source: Asahi Glass

According to Corning, Iris Glass is 36 times stiffer than plastic, with 90% lower thermal expansion. Similarly, Asahi says that. “Thanks to the rigidity of the glass, we can realize the thinner TV without additional support structure to secure enough rigidity,” which is also explained in a promotional video from Corning (see the end of the article).

Products using glass LGPs were first shown at CES 2015, and introduced later last year. Corning’s Iris glass has appeared in TVs primarily sold in China, including Sharp 60” and 70” UHD models and a 70” product from LeTV, while Asahi’s XCV glass appeared in Sony’s flagship X900C series, distributed worldwide, with an edge thickness of only 4.9mm. For folks like me who started in the display industry in CRTs, the thin design of these products represents quite an achievement: a 65” TV with the profile of an iPhone.

So what’s not to like? Well, one of the first problems is that the initial products using a glass LGP did not include High Dynamic Range. The edge-lit LED design did not allow for local dimming. This may be addressed going forward; more on that later.

Source: Sony

Source: Sony

Another problem area experienced in the first Sony product iteration was in the implementation. Many consumers complained about “Light Bleed”. A quick check on amazon.com on the Sony X900C product reveals that the average review was only 2.7 stars out of 5, and reviews titled “Light Bleed is TOTALLY UNACCEPTABLE” are typical (there are somewhat better reviews on bestbuy.com, at 4 stars out of 5, but it’s still the lowest rated 65” on offer and critical users cited light bleed). I’m sure that’s NOT what Sony wanted or expected with such a flagship product.

In Sony’s refresh of the TV for 2016, the X930D, they’ve introduced a slim design with a dual-layer LGP that allows for local dimming. Unfortunately for Asahi, this product does not use their glass (Corning also confirmed that Sony’s product does not use Iris glass). My source at Sony could not disclose the material used for the LGP, but Asahi confirmed that it’s not XCV. Whatever the material is, Sony appears to have solved its light bleed issues, based on the Amazon reviewers, with a healthy 4.4 stars and no light bleed comments.

Although not in the Sony X930D, Asahi is still optimistic about the glass LGP category, and promised that “several manufacturers have applied XCV for new models”, with details coming out later this year. Corning, if anything, may be more bullish on the category. Corning has been receiving interest from several regions and anticipates solid growth in the category, with additional models to be introduced in the second half of 2016.

Source: Corning

Source: Corning

According to Corning, one of the key elements of the product roadmaps involving glass LGP involves a continuing push to thinner glass. This allows the end device to be even thinner, enables an easier implementation in curved displays and drives the cost down. Corning is even discussing product configurations in the IT space: an All-in-One product with a glass LGP would allow a cost-effective implementation in a relatively high ASP product category with a premium on design. Corning is building its organization for LGP to take advantage of the opportunity posed by Iris Glass LGPs.

Is there a solution for glass LGP implementation that includes local dimming? In my opinion, this will be a critical success factor for this category going forward. High Dynamic Range is becoming (or soon will become) a must-have feature for a high-end TV set. Although none of my contacts could discuss the material that Sony is using in the X930D, it apparently is not glass. That doesn’t mean that such a solution using glass is impossible; the reasons for choosing another material are unclear. Corning has discussed products using glass LGP which apply 1D local dimming; this may be a path to enable a product which meets a High Dynamic Range criterion. Corning is also examining opportunities to add additional functionality to the LGP; a surface treatment or other optical mechanism may open up the possibility of removing existing layers of film, for example.

Finally, one additional factor to consider when thinking about this category is the potential impact to display glass (or cover glass) supply. Although TVs with glass LGPs are only a small portion of the market, they will have an outsize impact on glass supply because of their thickness and size. The typical glass LGP is 2.0mm, compared to the standard display glass substrate thickness of 0.5mm (combined 1.0mm, including both TFT and CF substrates). Furthermore, glass LGPs are used on the largest screen sizes, typically 55” and up, so the combined impact on glass supply is likely 4-5x as big as an average (~40”) TV. Although all the major display glass makers are managing with some idle capacity, this could be consumed quickly if glass LGP TVs could capture even 2-3% of the TV market (~10% of the 55”+ market). Both Corning and Asahi maintain that although glass LGPs are made on the same manufacturing platform as display glass (fusion melting for Corning, float process for Asahi), they can effectively balance supply/demand across their manufacturing platforms and don’t anticipate any supply problems.

In a display industry that is struggling to find areas for growth, and with the threat that OLED TV could reduce the demand for display glass (if using metal encapsulation, as LG does today), glass light guide plates represent a promising growth area. These SID award winners look like they will make an enduring mark on the display industry. – Bob O’Brien

Robert J (Bob) O’Brien is Co-Founder and President of Display Supply Chain Consultants. Bob has decades of experience turning market and business analysis into strategic insights in the display and electronics industries, most recently as Director of Market Intelligence and Strategy for Corning Glass Technologies.

(Full disclosure: the author is a former Corning employee and holds some Corning stock. The author also has a non-disclosure agreement regarding sensitive information learned while he was a Corning employee, but no confidential information is included in this report.)