The health of retail in the UK remained flat in Q4 despite an exceptional Black Friday. Following retail health dropping in Q3 for the first time since 2012, sluggish results and unseasonal warm weather in October and November started the quarter off in a negative manner. Retailers rallied in December, meaning the quarter ended in the same state of retail health as it started.

• The health of the UK retail market remained flat in Q4 of 2014, resulting in the year- end finishing one point higher than it started.

• The unseasonal warm weather in September carried on into October and November, impacting on fashion retailers and getting Q4 off to a poor start.

• Black Friday rang in exceptional sales for retailers, however these figures proved not to be additional spend for the month, as consumers spent early to make the most of promotions and discounts.

• The health of UK retail is set to remain flat in Q1 of 2015, with demand suffering from the uncertainty caused by the upcoming General Election and margin pressure cancelling out falling fuel and petrol prices.

Following its quarterly meeting in January, the KPMG/Ipsos Retail Think Tank (RTT) has released its latest findings that state the health of UK retail remained flat in Q4 2014.

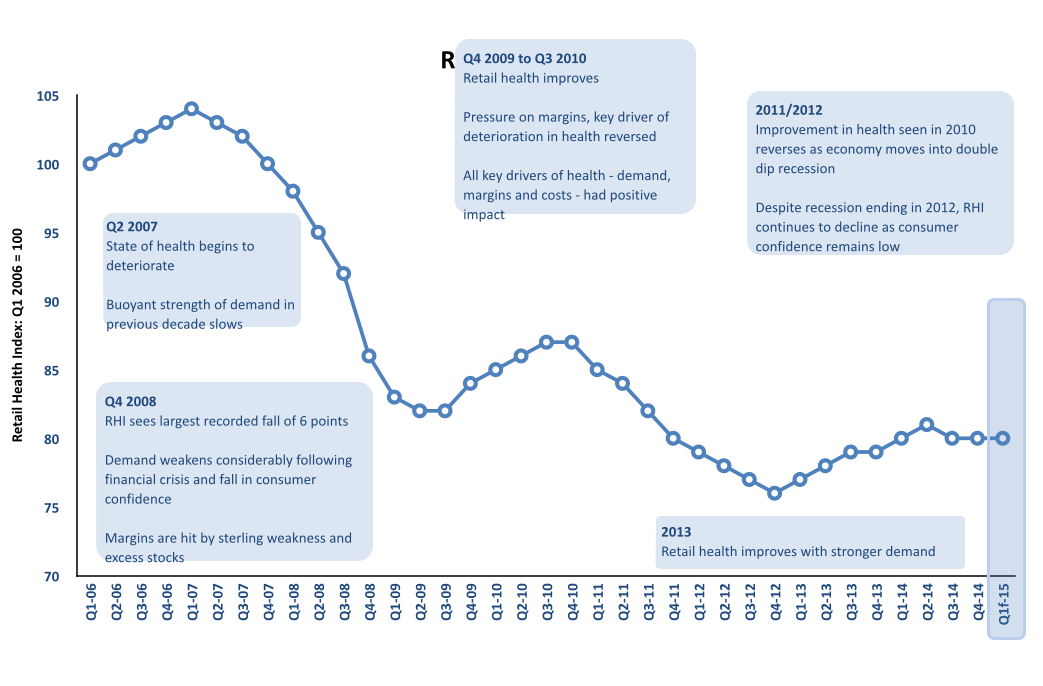

The RTT’s Retail Health Index failed to improve on the fall back in Q3, with a score of 80 over the three months. The quarter started poorly, with the unseasonal warm weather carrying on from September and impacting on fashion sales. This was against a backdrop of a continuing decline in food sales. The quarter improved with a strong showing around Black Friday. However, in the run up to Christmas, sales didn’t build the momentum required to increase the index.

Of the three key drivers of retail health – demand, margin and cost – demand was slightly stronger in Q4, helped by Black Friday and the sales rush after Christmas. However this was impaired by tightening margins as a result of retailers discounting through planned and unplanned promotions. Retail health in the quarter was also impacted by the increased costs to fulfil the growing number of on-line orders, though volume-based costs were not as heavy as expected. This balance of slightly stronger demand, margins under pressure and relatively neutral costs, kept retail health flat for the quarter.

One highlight of the last three months of the year, and one that was the topic of much discussion during the RTT meeting was the impact of Black Friday on retailers’ fortunes in December. It was universally agreed that the day had proven to be a hit with shoppers and that participation from retailers and demand for discounted goods both exceeded expectations, although clearly it tested the websites and fulfilment systems of many. There was consensus that part of these additional sales were brought forward from December, but that also many of the purchases made on Black Friday were an overhang from October and November and that many were simply opportunistic bargain hunting.

As has been a trend right through 2014, food retailers struggled throughout the quarter and weighed down the rest of the sector. Price deflation and competitive discounting dominated this segment although December saw less year-on-year decline than previous months.

The RTT was keen to stress that although it was a difficult quarter for retailers, it was clear there were winners, specifically for those that fully embraced Black Friday and protected their margins. Additionally, it was highlighted that those retailers whose systems coped with peak demands and had efficient omni-channel processes fared well, and that discounting wasn’t the only path to positive figures, with numerous high street retailers achieving their percentage of full-price sales for the month and posting impressive results.

Going into Q1 2015, the RTT believes that the health of UK retail in the first three months of the year will remain pretty much ‘as you are’ following on from Christmas. Positive external influences on retailers, including stronger employment figures, potential wage rate inflation and falling petrol prices, will largely be cancelled out by the uncertainty of the General Election and developments in the Eurozone. Costs will also be a factor throughout 2015, and in Q1 retailers will start to look at further investment in multichannel and online support, as many big retailers struggled to cope with the demand of Black Friday.

Decisions made by Dave Lewis at Tesco will have a major part to play in shaping the fortunes of the grocery market in 2015. The pressure is on to deliver a strategy that will turn around the fortunes of the UK’s biggest retailer. Whilst announcements have been made in terms of store closures and price cuts, there has yet to be any decisions in terms of customer or financial strategy, both of which have the power to swing the mood of the retail market one way or another.

Nick Bubb, retail consultant, said: “The performance of the retail market in Q4 really cemented the UK’s title of being a ‘discount nation’. Consumers only started to hit the stores and websites with any real effect in late November, when the UK seemed to welcome the Black Friday tradition from the US with open arms. Time will tell as to how the performance of the embattled Tesco will affect retail health in 2015, as it tries to close the grocery pricing gap against its rivals and battles with surplus hypermarket space”

David McCorquodale, head of retail, KPMG, UK, said: “The fear that came to fruition for retailers in December was that the exceptional sales seen on Black Friday were in fact just bringing Christmas trade forward. Whilst costs remained flat in the quarter as petrol and fuel prices fell and minimum wage rose, the popularity of click and collect ordering over in-store shopping meant that retailers’ margins were squeezed even tighter. However, the high level of demand in the last six weeks was enough to drag the quarter towards a flat result.”

Dr Tim Denison, head of retail intelligence at Ipsos Retail Performance, said: “Q4 was a tale of real contrasts. Sales figures in October and November will have got retailers nervous, but the goliath that was Black Friday was double-edged: it kick-started demand for sure, but it also further conditioned the consumer’s mindset towards deals and discounts. December’s trading was sufficiently strong to bring the Quarter to a flat, rather than negative, close. Looking ahead to Q1 2015, the conundrums remain. Robust consumer confidence, record employment and real wage growth all point to a positive start to the year, and yet there is an inexplicable hesitance to call it out.”

James Knightley, senior global economist at ING, said: “Looking ahead to 2015, the story here in the UK is shaping up into a positive picture. The pay market is turning and real wages are finally improving, and alongside growing job confidence there is real momentum building within the economy, as people are seeing they have more money in their pockets. There are however influences in the Eurozone that could derail these positive gains, with elections in Greece and Spain taking place this year, there are serious political contenders in place that would actively look to distance themselves from Europe. This will all be happening in parallel to a General Election here in the UK, where the only certainty is uncertainty.”

Richard Lowe, head of retail & wholesale at Barclays, said: “The huge uptake on Black Friday by retailers and consumers alike brought money into the shops that may have been normally taken in not just late December, but also October and November. The margins of retailers were not hurt as badly as expected, as the majority of the promotional activity will have been planned into budgets since the beginning of the year. Q1 2015 is shaping up to continue along this path, with many of the retail trends from December carrying over into January.”

Martin Newman, founder and CEO of Practicology, said: “The impact that the unseasonal warm weather had on retailers in Q3 and the start of Q4 may well become a more common story in the future, as environmental variation is making the weather and seasonal changes far less predictable. It may be a case of ‘lessons to be learned’, as fashion retailers look towards more transitional ranges to reduce the effect of late winters and summers on retail sales. Retailers in general also need to pick up their game in terms of driving customer engagement in order to become more relevant throughout the full customer lifecycle. A good example of this being Tesco, which should outline it plans early on in the year. I would be hoping that the supermarket giant puts a greater emphasis on understanding and connecting with customers, for which the colossus that is the clubcard would be the perfect base.”

Neil Saunders, managing director of Columino, said: “Demand through December was generally good, although was a bit more muted because of the earlier boost of a successful Black Friday. Improving consumer confidence and rising wages mean that consumers not only had more money to spend, but they felt better about spending it. As far as how the health of UK retail stands as a whole, the increase in demand was largely balanced out by the smaller margins that were widely accepted by retailers due to increased promotional and sales activity.”

Mark Teale, head of retail research at CBRE, said: “Uncertainty is without a doubt going to be the buzzword of 2015. A General Election looms in May: electioneering has already started. Eurozone economic weakness appears to be worsening and Greece remains a wild-card. Price deflation in parts of the retail market is now apparent in Europe as well as in the UK. At the time of writing, fuel prices continue to fall and – in the UK – grocery markets are in turmoil as the ‘big four’ attempt to stem market share losses to discounters. It is easy to buy sales growth by discounting: what matters is profitability not headline sales trends. Whatever the strength of Christmas sales turns out to be, sector margins are still in a sorry way. It needs sustained real growth in household incomes, nationally not just in and around London, and for a very lengthy period, to return the retail sector to robust health. It is going to be a long hard slog.”

Mike Watkins, head of retailer and business insight, Nielsen, said: “This is an important period for UK supermarkets. Following an extended period of decline in the food market, it seems that the negative grocery trend may just beginning to turn. A relatively flat December for food will signal better things to come. However it will be decisions made early in the year by Tesco that will impact heavily and these will have far reaching effects on the entire grocery market, but potentially also setting up a more positive 2015.”