I was struggling among the stream of news that is pouring in to find a topic for my Display Daily today, but as I worked on our weekly newsletter, I realised that the news was turning into something of an inflection point in the supply of LCD panels for TV – and as that is more than 50% of the market for panels – and there are implications for the whole TV industry.

There is clearly a big moment happening in the TV panel supply chain. Separately, we have reported in our newsletters that Sharp/Foxconn has failed to agree a supply deal for Samsung TV panels in 2017 and, as a result, Samsung is having to look around for new suppliers. Also in the newsletters, we have news of Sharp and Foxconn planning a new fab in China. HKC of China, which has been gathering momentum as a TV supplier, is also said to be looking at building a G11 fab in China.

BOE and CSOT are already building G11 fabs in China, so this will mean four big fabs in the country, bigger than any in Japan or Korea, if all of these plans go ahead. That would ensure that China is very much in the ‘driving seat’ for large LCD for TV as there will need to be significant supply chains for glass and other materials to support these investments.

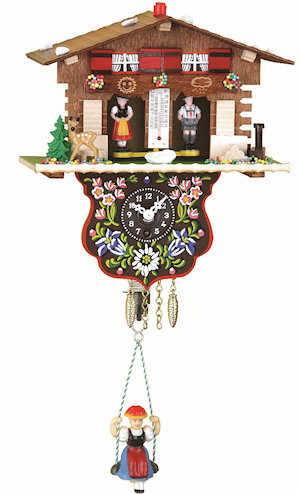

Image:www.cuckooclock.comUp to now, the Korean TV brands have developed strong businesses partly because of their strong vertical integration. I have regularly said that the set and panel makers are like the characters on a Black Forest clock with a weather forecaster – only one can be out at a time. If the panel makers are making profits, the set makers are unhappy and vice versa. They are never both happy at the same time as low prices for panels mean profits for set makers (I originally wrote ‘good profits’, but on second thoughts, took out the‘good’!) but losses for panel makers. High panel prices mean unhappy set makers, but smiles for panel makers.

Image:www.cuckooclock.comUp to now, the Korean TV brands have developed strong businesses partly because of their strong vertical integration. I have regularly said that the set and panel makers are like the characters on a Black Forest clock with a weather forecaster – only one can be out at a time. If the panel makers are making profits, the set makers are unhappy and vice versa. They are never both happy at the same time as low prices for panels mean profits for set makers (I originally wrote ‘good profits’, but on second thoughts, took out the‘good’!) but losses for panel makers. High panel prices mean unhappy set makers, but smiles for panel makers.

While Samsung and LG have had vertically integrated businesses, with panels as well as sets (as well as chips, panel materials and other parts of the supply chain), they have been able to ride the ebb and flow in the market (or the crystal cycle as it is known) to make some money, somewhere at any time. However, as we go forward, with more and more supply of panels coming from outside companies, it’s likely that Samsung, like the Japanese and European TV makers before them (and Americans before that), will gradually find the TV market less and less attractive.

There have been several reports that I have seen recently that suggest that Smart TVs are the preferred way for a lot of viewers to watch their OTT content, so Samsung may be able to leverage all the work that it has done to develop its products. LG may be able to exploit its investment in WebOS.

However, younger viewers like watching content on their mobile devices and ‘casting’ may become the standard way of controlling the content on the TV. I’ve just got a Chromecast Ultra, and although I haven’t spent much time with it, yet, already the experience of watching OTT is better using my mobile device than with my ‘not-so-smart’ TV or even the relatively recent and relatively smart UltraHD Blu-ray player.

I have been intrigued by the concept of the ‘Chromecast TV’. I felt for a long time that there has been an opportunity in the market for a monitor with multiple HDMIs, rather than having lots of tuners and smart functions. These days, I think you would need to add the option of supporting ChromeCast in the set as well, as Vizio does in some of its sets. In fact, this week LG said that it would show a Chromecast-enabled desktop monitor at CES. If I catch up with Vizio at CES, I’ll see how they are doing with the concept.

However, if Samsung is able to develop QLED displays for TV, as it suggests it would like to, and LG can continue to develop its OLED TV business, perhaps the companies can continue to develop in the TV panel supply chain? It’s not obvious, but it is possible! – Bob Raikes

(It’s of note that Samsung recently said that it would take a 9.76% share in the CSOT Gen 11 fab that is being developed in China)