With CES just behind us and MWC looming on the horizon, we can see how the idea of augmented / virtual / mixed realities is dominating many of the headlines focusing on consumer electronics. I am a self-declared advocate of AR / VR and maybe also MR (mixed reality), if someone can explain the difference to AR, even though I have written many articles calling for more realistic expectations when it comes to speed of the consumer market introduction of such hardware and content.

While a movie or video can be watched on any display, from a small smartphone and tablet display to a TV, or even a large home video projection system, the same cannot be really said for 360º video or VR games and experiences. I have tried and the difference in perception makes it almost useless and does not add anything to the user’s experience. Of course, I would expect that watching ‘Space Odyssey 2001’ on a smartphone would detract from the overall experience, but the main storyline would still be the same. This cannot be said for 360º video and VR games. One of the most interesting features in the A/V/M-R world is that most users will experience VR completely differently from one another. It all depends on where you look.

While this is not so critical in AR applications, even here the user decides what he sees, by the movement of his head and eyes. The same content will appear very differently for two users. AR/VR content is more like a video game than a movie. The ultimate outcome maybe the same for all, but how you get there is very different for all users. This means that AR and VR content is pretty useless without the head-mounted display system it is designed for.

Software Depends on the Hardware Cycle

As a consequence the software and content developers are strongly tied into the hardware sales cycle. This creates a typical chicken – egg dilemma. The two sides are no hardware sales with good and plentiful content versus no content development without a strong hardware user base.

So, where are we in the hardware sales cycle? If you believe all these overly optimistic forecast numbers for VR hardware (consumer focused AR hardware isn’t really offered today) we have sold anywhere from one million to two million headsets so far. I would argue that this includes hardware solutions at the lower end of the quality spectrum as well as the giveaway of the Samsung Gear VR (you order a new Samsung Galaxy and you get a Gear VR for free). You might even include the cardboard solutions from Google and others. Many of these solutions are not meant to be used as a content consumption device in the first place, which makes the real number of VR users much smaller than the above mentioned numbers.

Even if we assume that there are 1-2 million VR users out there that are just waiting for VR content, who is going to develop it? For comparison, there are around two billion smartphone users worldwide, so two million smartphones equates to 0.1% of the install base. In addition, these users are then distributed over various infrastructures that will not always work together nicely. Ask smartphone app developers if they would develop apps for a smartphone that sells in this amount? My guess is that most would decline.

So if the content demand for AR/VR/MR devices is not really there yet, we can expect that content development will not see a sudden boom either. In all honesty, it seems that at least VR has reached the chasm of new product adoption. This raises the question of where are we going form here?

Turning to Google

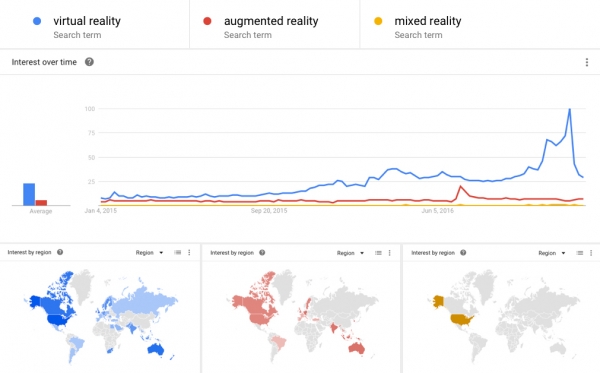

One way to judge the interest of consumers in a specific technology is to look at the relative number of searches for a specific term in Google. Google publishes this kind of trend including the geographical distribution of such searches. First I compared the search for augmented, virtual and mixed reality to each other.

Source: Google Trends

Source: Google Trends

First of all, we can see that virtual reality is still dominating the consumer interest in any such technologies. The interesting part is the sharp decline in Google searches for virtual reality after Christmas 2016. The number of searches fell down to the level of the last year. Not really a sign of a long term increased consumer interest. Looking at the geographical distribution, there is not much difference between the terms. With more searches overall for virtual reality, more countries are showing up as centers around the world, but the highest search densities are in the same countries for all terms.

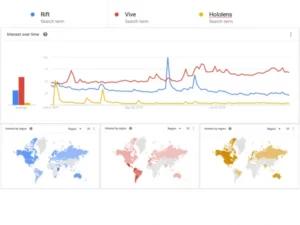

To be sure I ran the same search for the terms Rift, Vive and HoloLens. The results are a little different from what I expected. For most of the last two years, more searches were made for the HTC Vive compared to the Oculus Rift. Furthermore, there is a trend that is upwards for the Vive, while the trend for the Rift is actually downwards. Interest measured by Google searches for the HoloLens cannot match either of the other devices.

Source: Google Trends

From a global perspective, interest in these devices is not equally dispersed around the globe. While the Rift receives searches pretty equally around the globe, with slightly higher numbers in North America, the Rift creates more interest in South America and the Hololens seems to be more of a focus in North America.

This all hints at a much higher interest in these technologies and devices by analysts and writers compared to the consumer.

A recent article from Digitimes points out that orders for component manufacturers from AR / VR hardware makers are falling short of expectations. This article also includes a statement that shipments of HMD devices in China have been lower than expected. This reflects on companies that are working with Microsoft on a low cost version of a head mounted display device. They continue to explain that the companies working with Microsoft are trying to develop hardware that has some unique selling points for their respective brands and that this will take some more time.

However, looking at the worldwide consumer interest measured by Google Trends, it is completely possible that the manufacturers at this point are not convinced that they have a winner on their hands. VR as well as the AR and MR have still a steep mountain to climb before the hardware makers can start to fight over market share. – NH