OLEDs are potentially a dream come true to the smartphone industry, enabling manufacturers to raise prices by improving display performance, increasing display sizes and enabling innovative form factors like curved, flexible, foldable, rollable, etc. We expect OLEDs to enable greater differentiation in the smartphone industry for years, which should keep prices high.

OLED panel suppliers should be major beneficiaries, as smartphone brands will be clamoring for OLED panels for years, until the market is saturated with OLEDs, and, even then, there will be opportunities to differentiate and create strong demand for more advanced form factors. With OLED demand expected to be tight until the market is saturated, which panel suppliers and brands are likely to benefit?

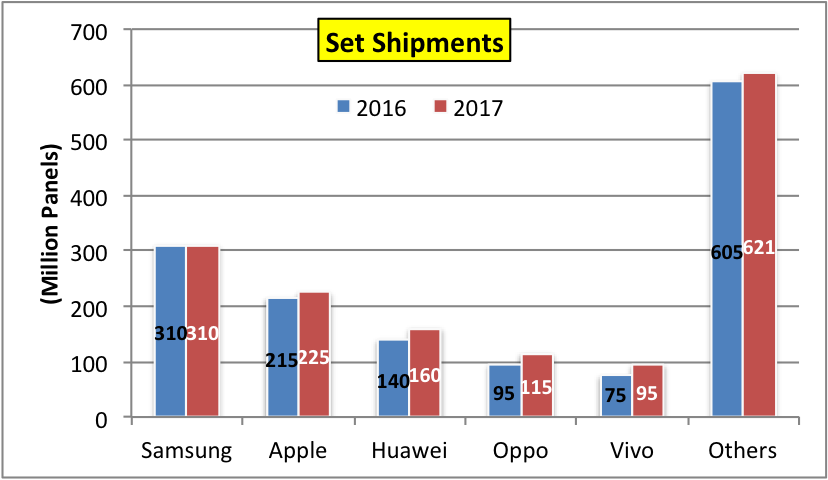

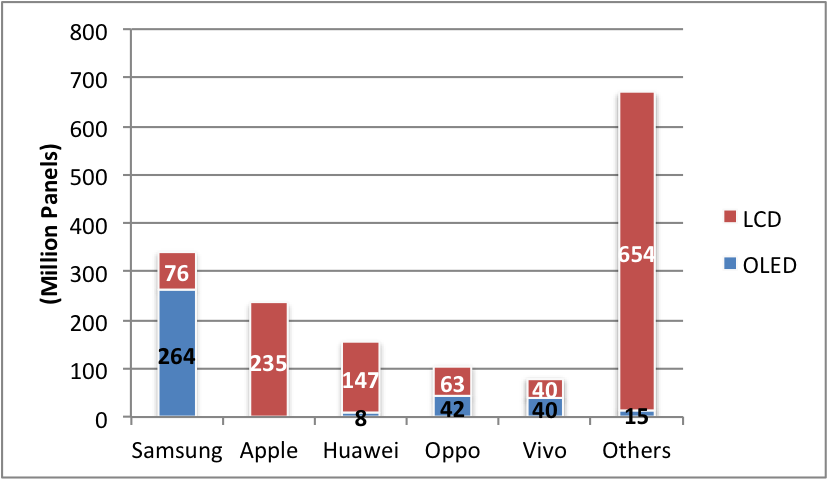

Figure 1 shows smartphone shipments in 2016 and 2017. As indicated, the top five players are Samsung and Apple and Chinese brands, Huawei, Oppo and Vivo with the Chinese brands enjoying the fastest growth. As shown in Figure 2, in 2016, Samsung consumed most of the OLED smartphone panels at 264M or 72%. Oppo and Vivo each accounted for 11% of the OLED volumes. 0% of Apple’s panels were OLED with Huawei at just 2%.

Figure 1: Smartphone Shipments by Brand

Figure 1: Smartphone Shipments by Brand

Figure 2: 2016 Smartphone Display Procurement by Brand

Figure 2: 2016 Smartphone Display Procurement by Brand

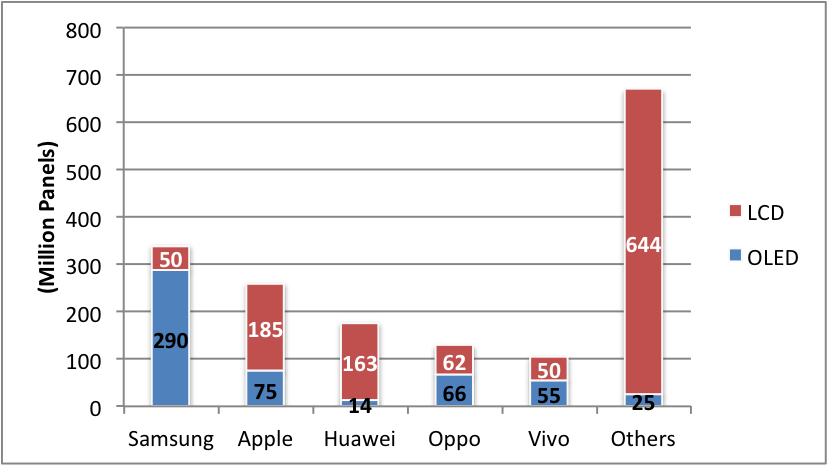

In 2017, OLED smartphone panel shipments are expected to grow 42% to 525M. Samsung is expected to consume 55% of smartphone panel shipments in 2017 or 290M as shown in Figure 3. Apple is expected to consume 75M or 14% of OLED smartphone panel shipments followed by Oppo at 63M and a 13% share and Vivo at 55M and a 10% share. Oppo and Vivo have secured supply with Samsung. Conversely, Huawei’s share of OLED panel shipments is insignificant and is expected to remain behind that of Oppo and Vivo. Huawei is not engaged sufficiently with Samsung and will likely need to wait until BOE ramps from 2020 to capture significant OLED volumes.

Figure 3: 2017 Smartphone Display Procurement by Brand

Figure 3: 2017 Smartphone Display Procurement by Brand

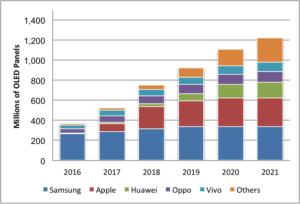

As shown in Figure 4, we believe it will take until 2020 for Huawei to secure enough OLED capacity to enable OLEDs to account for a majority of its panel procurement. We expect Apple to quickly ramp to 100% OLED, following Samsung, which will limit the number of OLED panels available for other brands as the OLED smartphone market climbs to over 1.2B units in 2021 as shown in Figure 5. In fact, we show Apple and Samsung accounting for 72% of 2016 OLED smartphone panel shipments, 70% in 2017, 72% in 2018, 64% in 2019, 57% in 2020 and 51% in 2021. Thus, the OLED smartphone market will basically move from a monopoly to a duopoly with Samsung and Apple controlling at least a 50% share through 2021. But what does the panel supplier situation look like? Can any panel suppliers disrupt this duopoly and who will be the 3rd OLED supplier to Apple?

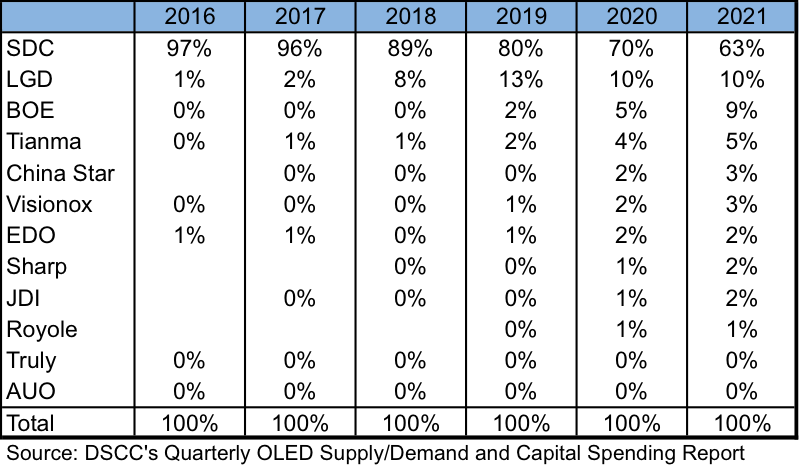

Figure 5: 2016 – 2021 OLED Smartphone Panel ProcurementIn our Quarterly OLED Supply/Demand and Capital Spending Report, we track and forecast OLED fab glass input, yield and output by fab by application. This enables us to track each panel suppliers’ shipments by application. Mobile OLED output share is shown in Table 1. As indicated:

- Samsung had a 97% share of shipments in 2016, is expected to have a 96% share in 2017 and fall to a still dominant 63% share in 2021. They are the only panel supplier shipping smartphones in high volume with bets on other suppliers quite risky given their lack of production experience. In addition, Samsung has some exclusive agreements with certain equipment and materials suppliers, has developed and manufactures their own evaporation source technology, and has bought up certain equipment suppliers’ capacity, making it impossible for competitors to replicate their process.

- LG Display, which has primarily been making OLED TVs and OLED smart watches/wearables, will begin supplying Apple with OLED iPhone panels in 2018. While Apple has been dividing their iPhone LCD supply over 3 panel suppliers, it appears likely that Apple will only be able to source OLEDs from 2 suppliers until 2020 when BOE’s capacity jumps to 5% or 70M panels and nearly doubling to 135M panels in 2020. LG Display will also supply to LG and is rumored to be supplying to Google as well.

- Note that in 2021 the #3 – #7 suppliers will all be based in China. BOE is best positioned to become Apple’s #3 supplier as well as sell to the Chinese smartphone brands who may fall well behind Samsung and Apple until they can capture sufficient supply. Tianma is also positioned to pick up a lot of OLED share given Chinese brands struggles to acquire enough supply.

- JDI, which has been one of Apple’s top 2 LCD suppliers for years, is in danger of losing significant share. It will likely remain Apple’s LCD supplier while Apple phases out LCD given Apple’s significant prepayment to JDI. However, with the market rapidly switching to OLED, JDI needs to accelerate its OLED commercialization plans. Meanwhile, its diversification plan away from smartphones is of paramount importance for its survival.

Table 1: Mobile OLED Output Share by Panel Supplier

Table 1: Mobile OLED Output Share by Panel Supplier

The authors of this article were Ross Young & Yoshio Tamura

This article was originally published on the Display Supply Chain Consultants’ blog and is republished with permission. DSCC is working with SID to organise the Business Conference and specialist conferences during Display Week 2017.