5G is a hot topic right now. Connectivity was one of the themes of Mobile World Congress (MWC), held in Barcelona 25-28 February 2019. MWC’s pre-show discussion of connectivity said:

“5G will create speed and flexibility to allow for far greater services and performance with higher reliability. Connectivity [theme at MWC] highlights the requirements needed to make 5G a reality, from implementation, business models, spectrum and regulation, to the challenges of working with diverse markets.”

You read this and you might assume that 5G is the only type of next-generation connectivity of interest. You’d be right, too, because no one is talking about other advanced connectivity schemes. Nor, as far as I can tell, is anyone working quietly on other next-generation connectivity schemes: 5G is it! The only realistic competition with 5G? 5G NR.

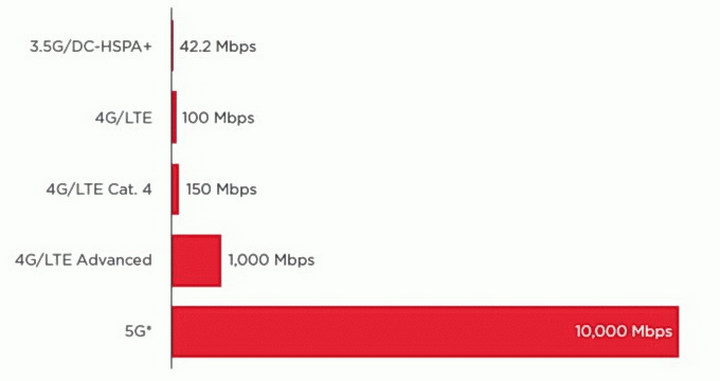

Maximum theoretical downlink speed by technology generation, MBPS (*10Gbps is the minimum theoretical upper limit speed specified for 5G) (Source: GSMA Intelligence)

Maximum theoretical downlink speed by technology generation, MBPS (*10Gbps is the minimum theoretical upper limit speed specified for 5G) (Source: GSMA Intelligence)

Everyone touts the benefits of 5G, especially its ultra-high speeds for downloading and uploading content which in turn enables 5G’s ultra-low latency. One of the applications of this high speed is the enabling of real-time augmented reality (AR) and virtual reality (VR) mobile content. VR, where the system must react nearly instantly to actions like head motion by the HMD wearer, is particularly dependent on high speed. 16mS latency (60Hz) is considered too long by dedicated gamers. This 16mS or better latency target is hard to meet at the display alone with a local display controller but for cloud-based VR, the 16mS includes not only latency at the display but the time to upload, for example, the head motion to the server and download the server response. 5G networks, theoretically at least, can meet this requirement quite easily while even the fastest version of 4G/LTE cannot realistically meet it.

Incidentally, the astonishing speed promised for 5G connectivity will not be seen by most 5G end-users. The speed is predicated on mm-wave wireless technology, which requires a new transmitter and receiving antenna at essentially every street corner in the world and another inside every room with 5G connectivity. Most users will get 5G NR connectivity, which uses the same RF frequencies and wavelengths used by 4G/LTE but with improved coding and RF modulation techniques. These users will probably still see a speed improvement but it will be in the range of 1.1X – 2X improvement compared to 4G/LTE advanced, not the 10X improvement 5G mm-wave users will (maybe) see.

One of the issues with 5G is what additional revenue it will provide to the cellular system operators who need to make relatively large capital improvements to switch to 5G from 4G. ‘Switch’ is perhaps not the right word. Service providers will augment their 4G networks in dense urban areas with 5G and in more rural areas with 5G NR. Still, the capital investment required will be large. Dario Talmesio, Principal Analyst and Practice Leader for service provider markets at the market research firm Ovum said (emphasis his):

“Early movers have announced their 5G launch plans, but the bulk of operators will only launch commercial services in 2020 when consumer and business devices start to become mass-market ready. However, monetization will be a major challenge and is the primary focus of Ovum’s 5G Accelerator research agenda in 2019.”

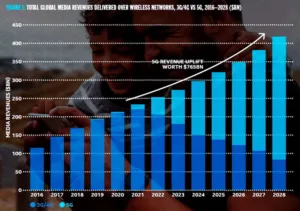

Total Global Media Revenues Delivered over Wireless Networks. (Source: Ovum)

In a 5G market research study Ovum did that was commissioned by Intel and released to the public in October 2018, Ovum said there will be a 5G revenue uplift worth $765 Billion over the 2021 – 2028 time period, as shown in the figure. I interpret this figure differently, however. The wireless media revenue growth over the 2016 – 2028 time frame is roughly constant with a revenue CAGR for the whole period of 11%. Starting in 2021, the revenue for 4G will start to decline and the growth will be exclusively in 5G, according to this Ovum forecast. The whole period can be broken down into two periods, 2016 – 2020, where the growth was dominated by 4G and 2021 – 2028 period where the growth is expected to be dominated by 5G. This breakdown shows a CAGR of about 17% for the 4G period and a CAGR of 9% for the 5G period. I don’t know what Ovum and Intel mean by “Revenue Uplift,” but this Ovum data certainly doesn’t inspire me with the belief that 5G will accelerate growth in media revenue compared to what has been seen for 4G media.

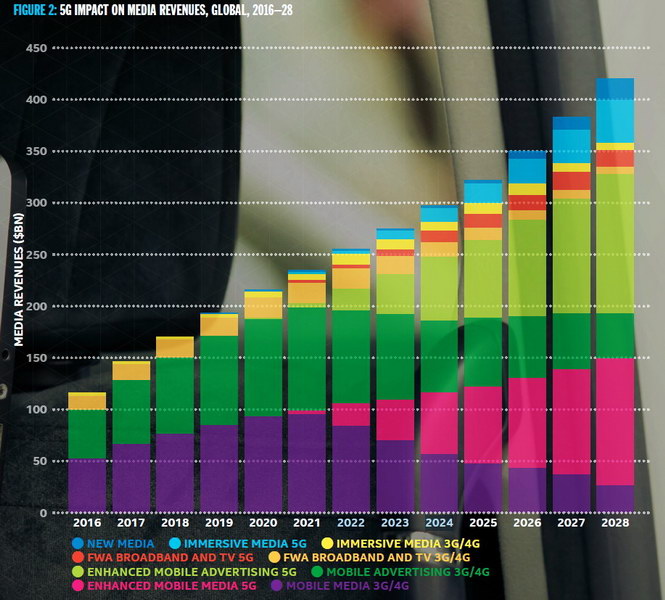

4G and 5G Revenue breakdown by Media Categories. (Source: Ovum)

4G and 5G Revenue breakdown by Media Categories. (Source: Ovum)

When you look at Ovum’s breakdown by media categories, you see the same effect for each individual category. Two Ovum categories, New Media and Immersive Media are enabled by the speed, low latency and total data throughput capacity of 5G and had virtually no revenue on 4G networks through 2020. The other Ovum categories clearly show the shift from 4G to 5G but do not show 5G accelerating their revenues.

Ovum defines immersive media as AR, VR and cloud-based gaming while they define new media as new applications that do not really exist today. New media, according to Ovum, includes entertainment in self-driving cars, 3D holographic displays, and connected haptic suits among other systems. In a self-driving car, the ‘driver’ is idle and bored and will consume more media, according to Ovum expectations. Since they don’t exist yet, these new media, by definition, have no revenue in the 4G world. By 2028 these two categories of media will represent about $84 billion per year, including the 4G revenues for immersive media. Nice, and without these revenues, the 2021 – 2028 CAGR would be only about 7% instead of 9%.

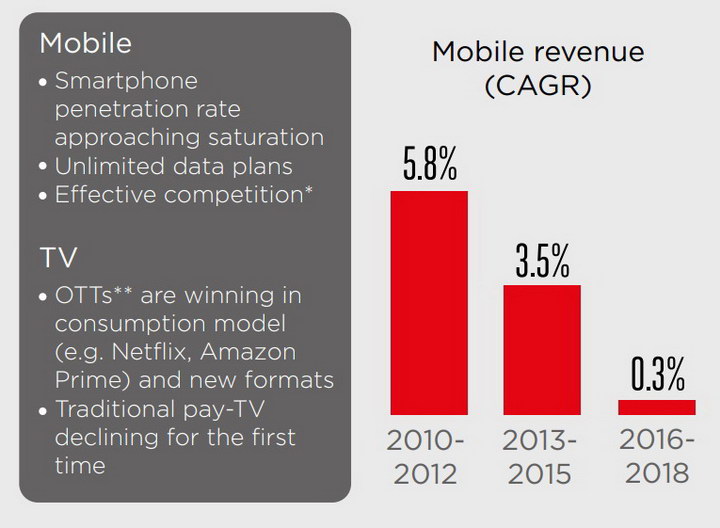

GSMA Intelligence sees unprecedented pressure on mobile revenue. (Credit GSMA)

GSMA Intelligence sees unprecedented pressure on mobile revenue. (Credit GSMA)

I’m not the only one to see revenue growth problems in the mobile industry. GSMA Intelligence sees a historical problem as shown in the figure. Growth in total revenues for the mobile industry has declined to almost no growth in the 2016 – 2018 time frame. This figure can’t be compared to the Ovum revenue figure because GSMA included all revenues while Ovum included only those revenues associated with media. This total revenue story from the GSMA is grim, if you are a mobile service provider. The solution? New mobile applications enabled by 5G, including significantly increased delivery of media.

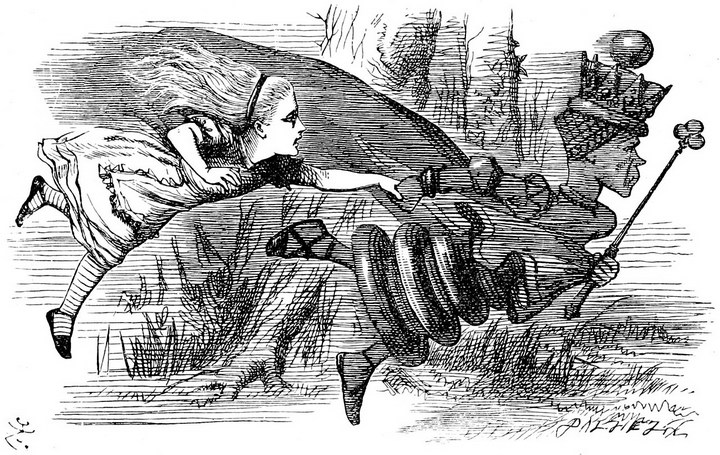

The Red Queen’s Race (Credit: John Tenniel)

The Red Queen’s Race (Credit: John Tenniel)

This 5G revenue forecast reminds me of what the Red Queen said in Lewis Carroll’s Through the Looking Glass and What Alice Found There:

“Well, in our country,” said Alice, still panting a little, “you’d generally get to somewhere else—if you run very fast for a long time, as we’ve been doing.”

“A slow sort of country!” said the Queen. “Now, here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!”

There are going to be profit and loss winners and losers in the 5G race, there is no doubt about that. Winning and increased profits, however, will only come to those companies that run twice as fast as everybody else, and everybody else in the 5G race is running very fast, indeed. –Matthew Brennesholtz