The success of AR and VR technology (or the lack thereof) is a highly debated issue in the media between bloggers, analysts, journalists and all the marketing groups pushing their respective products. Besides almost ideological differences between the two groups of ‘yea’ and ‘nay’ sayers, there are few suggestions by analysts for the reasons why AR/VR is not taking off like the smartphone or tablet during the last two decades.

To be clear, we are looking at the underlying hardware for AR/VR and not their use in software and marketing.

The growth of sales of tablets and smartphones indicated that consumers are willing to adopt a new technology in no time at all. In many cases the product growth was limited by actual production capacity and not by the willingness of the consumer to shell out a few hundred dollars. For most observers the uptake was actually surprisingly fast and unprecedented among earlier consumer technology products.

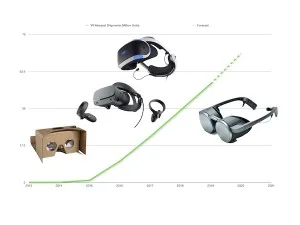

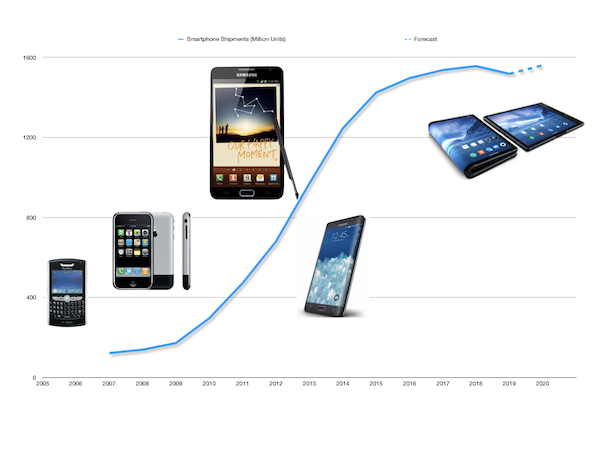

Smartphone Shipment History based on data from Statista

Smartphone Shipment History based on data from Statista

So, what went wrong with the AR/VR technology?

While people have different opinions of the real reason behind the slow uptake of AR and VR, we have to admit that these two technologies are not on the same timeline when it comes to product introduction. While both technologies have been around for quite some time in various forms, they were based on inadequate display technologies leading to very expensive units with limited capabilities. Besides research centers, military applications were the driver for this technology segment.

With the development of powerful microdisplays, better microcomputer technology, battery improvements and sensor technology, the whole segment got a new lease on life, with improving image quality and overall performance. Within the last decade AR/VR has been dubbed the up and coming technology in every field you can think of.

However, besides a limited success in gaming and some accepted value for the enterprise market and medical applications AR/VR is not living up to its hype so far. Let me apologize right here to all the other small applications where AR/VR hardware is changing the landscape already. I do not want to to talk them down, but when we look at the bigger picture of unit shipments they have not tipped the scales so far. I also want to be clear that we are still early in the adoption cycle. Things can change quickly, as the smartphone has clearly shown.

I am also going on record as saying that I personally believe in this technology in the long run. So to speak, I am a ‘yea’ sayer although with reasonable doubts about the short term success in the consumer market.

I am looking at just one specific aspect of these products in comparison to the smartphones at the same time of their adoption cycle. I am not aiming to add all the aspects of short comings I see, just one for now.

When we look at the smartphones prior to 2007, we see the BlackBerry with its unique keyboard and some Nokia phones adding cameras and messaging, which ironically are the highlight of today’s smartphones. This all changed when Apple took the leap and banked on touch control and almost no buttons at all. Many saw this as a very risky move, which turned out to be ingenious and made Apple the most valuable company in the world a decade later.

Looking at phones after the initial iPhone we see that there is basically no change in the used form factor, when we agree that simply making a phone larger is not a real change in form factor. It seems that Apple nailed it with the iPhone and everybody coming afterwards focused on changing the design just enough to call it something different than iPhone. Looking forward, the only real disruption of this product path may be the introduction of the foldable smartphone / tablet in coming years. We will have to wait to see how this this will turn out.

For now, we can say that at annual shipments of 1.6 billion units the consumer smartphone market has reached its full market potential. Considering that we have close to 8 billion people living on this planet this means that statistically speaking the average replacement cycle for the smartphone is 5 years. A more sarcastic view would be that the useful life of a smartphone is about 5 years before it isn’t working effectively anymore.

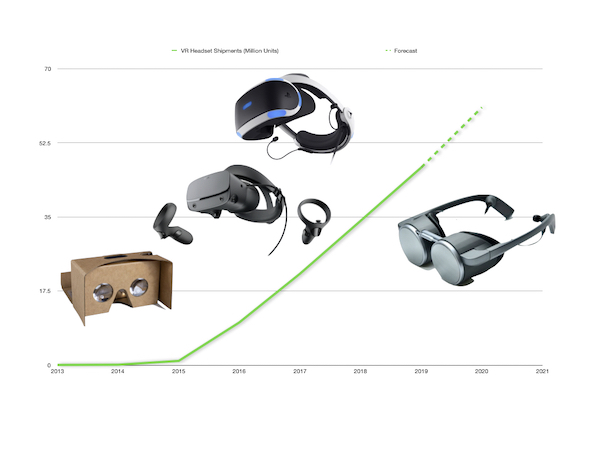

VR Headset Shipment History based on data from Statista

VR Headset Shipment History based on data from Statista

When we compare this to the shipment development of VR headsets we see that the form factor was developed early on and has remained the same until this year. This form factor of a box strapped to the face was dictated by the display technology and no marketing wisdom was able to change this. From the Cardboard through to the latest Oculus model, they all look the same. Panasonic may change this with their model previewed at CES 2020 and we have to wait until next year to see if their form factor will fare any better than the current box idea.

In all honesty, VR has an intrinsic issue with the form factor. By definition, VR replaces everything we see with a virtual environment. Replacing means that the user is completely separated from the real world by blocking all visual stimuli from reaching the user. In other words the user is being put into a dark box and there is not much you can do to make this box look pretty.

In marketing, making a product look ‘sexy’ means it is appealing to the consumer in certain ways and VR headsets are not ’sexy’ based on this understanding. Maybe the new Panasonic headset is about to change this as it as at least more appealing than all the other headsets combined?

AR technology is seen as having more potential in the future compared to VR. For one, the technology is not separating the user from reality but is aiming at enhancing reality. While there is no clear understanding today what an enhanced reality will look like, the AR hardware itself has way more degrees of freedom in terms of the form factor that’s used than VR will ever have.

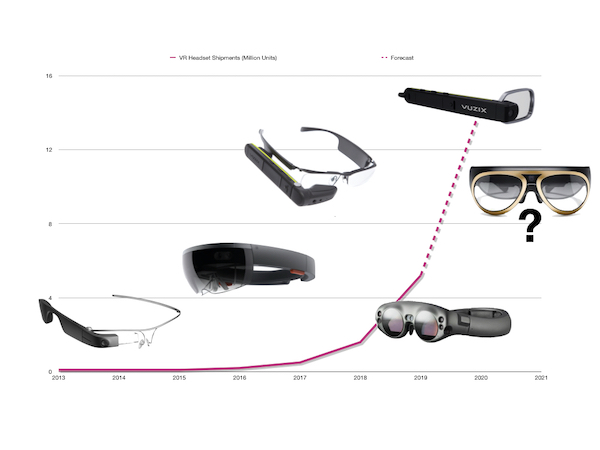

AR Glasses Shipment History based on data from Statista

AR Glasses Shipment History based on data from Statista

For beginners there are monocular (for example Google Glass and Vuzix) and binocular options (like Microsoft HoloLens and Magic One) that lead to very different form factors. In addition, AR glasses have many other hurdles to overcome that play no role in the VR hardware. The most obvious one is the required optical combiner that is still under development, with no clear winner in the market so far.

One of the main issues for AR headsets is the easily understood comparison with sunglasses. They are used to alter the environment (bright sunlight that is) and look pretty ‘sexy’ for most people. The easy solution, when it comes to the AR glasses form factor, is exactly this sunglasses design. However, this means that batteries, electronics, displays and optical combiner have to be much smaller than is possible today. As a result the AR form factor is still falling short of the consumer’s expectations but at least they all know what they have to aim for. Instead of finding an acceptable form factor, they have to shrink technology so that they can get closer the expected form factor. Based on the current limitations in this development, alternative form factors like the BMW Mini headset design maybe acceptable for now.

All in all, the form factor may not be the most important hurdle for AR / VR adoption, but it is an indication that both technologies have not yet found a hardware from factor the consumer is absolutely happy with. Once we know what hardware is selling in high quantities (comparable to the smartphone that is) we will know what form factor the consumer accepts. – NH