MiniLED backlights have the potential to transform LCDs by reducing the performance gap with OLED displays. They can help LCDs by improving contrast ratio, increasing color gamut, reducing response time, and increasing brightness.

MiniLED backlight-based LCD products can provide differentiation in a highly competitive display market. They have the potential to be positioned in between conventional LCDs (with LED backlights) and OLEDs for many different applications including TV, monitors, notebooks, smartphones, automotive and VR. If MiniLED back-light based LCD’s can be cost competitive, it can empower LCDs in the smartphone market, trigger replacement demand in TV market, open up new possibilities in auto market and increase sales in high end gaming notebook, monitor and VR market.

The shift from CCFL backlights to LED helped LCD market transformation in the past. MiniLED backlights also have the potential to create a similar transformation, if they can match cost, production volume and technology requirements. But these opportunities could also be reduced or lost by strong competition from OLED displays with high volume production and aggressive price reductions. Suppliers have to capture the window of opportunity by aggressive cost reductions and timely technology developments.

MiniLED backlight LCD: Coming to market

MiniLED has a similar architecture to current conventional LED backlighing. It can use current equipment and manufacturing processes with minimal change. According to suppliers, MiniLED costs are still high, but it does not need a big infrastructure change and the manufacturing challenges are not that high. Cost reductions are expected in 2019 and beyond. That is why suppliers such as AUO, BOE, Tianma and many others showcased prototypes of MiniLED-based products, in different sizes and applications, at DisplayWeek 2018.

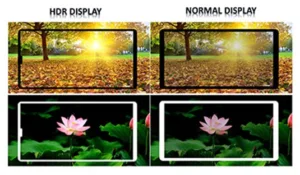

MiniLED backlight based LCDs have many advantages: high contrast, high color saturation, better support for HDR (High Dynamic Range), higher brightness, faster response time, potential for thinner form factors, lower power consumptions and use of flexible substrate for curved form factors. MiniLED backlights can also be combined with direct backlight and local area dimming, to provide very high contrast, better HDR performance.

Mini LED chip size is 100 to 300 micron. With small size LEDs, higher number of chips will be needed. It can benefit players in the entire supply chain (LEDs, backlights, other components, panels and devices) with increased sales and higher profits. There are still many issues such as pick and place production, bonding, manufacturing yield, heat dissipation, right balance of chip size, numbers and cost efficiency.

MiniLED backlight LCD: Empowering LTPS LCD smartphone display:

OLED displays for smartphones are gaining market share with Samsung’s Galaxy and Apple’s iPhone X products. Flexible OLED is poised to dominate the smartphone display market in the next few years with differentiated design flexibility, foldable phones, thinner form factors, higher contrast faster response times and even lower power consumption. Even though flexible OLED display sales have been lower than expected in 1H 2018, especially for iPhone X, volume production is expected to expand. New fab capacity that will be coming from China in the near future may lead to aggressive price reductions.

LCD a-Si panels are serving the low-end market and losing market share. LTPS LCD is facing strong competition in the high-end market from flexible OLED displays. Rigid OLED display’s cost has the potential to come closer to LTPS LCD’s cost, especially for Samsung Display. But new suppliers will face cost challenges. The possibility of lower price gaps with LTPS LCD combined with the advantages of OLED is bringing renewed interest in rigid OLED. There is very little design differentiation between LTPS LCD and rigid OLED smartphones due to new 18:9 full active bezel less screen designs.

Tianma- WQHD HDR LTPS LCD with mini LED backlight

MiniLED backlight options are coming to LTPS offering higher contrast (by using local area dimming), faster response time and so reducing the performance gap with OLED. Tianma received a “best in the show” award in the large exhibitor category for its 6.46″ HDR LTPS LCD smartphone display prototype, with peak brightness above 1000 cd/m² and maximum local contrast over 3,000,000:1 using mini LED backlights.

Smartphone vendors, especially those from China, are looking for alternative options due to limited OLED display supply in 2018. However, miniLED backlight-based LTPS LCD cost is still high. A 5.5″ LTPS smartphone may use 5000 to 10,000 Mini LEDs for backlights compared to less than 30 for conventional LED-based LCD. But LED chip suppliers such as Epistar are aggressively planning to offer cost competitive products. For success, the price has to be in between rigid OLED and conventional LTPS LCD. MiniLED can have a window of opportunity in 2018 and 2019 if they can reduce cost and increase production.

MiniLED backlight LCD: Bringing new opportunities to TV

LCD TV demand unit growth rate has slowed down in recent years even though there has been a major shift towards larger screen size and higher resolution displays. LCD TV (a-Si LCD) has the dominant share of the market but OLED TV has been gaining strong market share in the high-end market with thinner form factor, higher contrast, wider viewing angle, deeper black level, better color gamut and faster response time. Still OLED has very small presence in terms of units. High end LCD TV with MiniLED backlight can provide higher brightness, higher contrast, higher dynamic range and possibly a thinner form factor. With a direct lit blinking backlight, makers can improve LCD TV performance significantly. Performance can even improve further with the use of Quantum dot technology in addition.

Higher cost is a major issue with MiniLED backlight. Also as the number of chips increases significantly it may lead to longer processing time, lower yield, bonding issues and other challenges. High cost may restrict it to the high end TV market, initially. MiniLED can help to reduce the performance gap with OLED TV. In the long run, if cost can be reduced, it can open up new opportunities for TVs by triggering replacement demand.

MiniLED backlight LCD: Providing new possibilities for the automotive market

The auto display market will experience strong growth as number of displays within each auto increases. Growth in electric cars, connected cars and autonomous car, in the future, will drive display demand. Automakers are also looking for design differentiation. LCD is still the dominant technology in this application but OLED interest is growing due to higher display performance and flexibility in design. Companies such as Innolux at SID were showcasing 10.1″ active matrix auto display with miniLED backlight, that can achieve 1000 cd/m² brightness, 1,000,000:1 contrast ratio and very high sunlight readability. MiniLED backlight can also be used for curved LCDs providing design flexibility and opening up new opportunities.

MiniLED backlight LCD: Serving the high-end niche market

Suppliers such as AUO are focusing on higher value gaming market requiring very high performance. AUO is planning to deliver samples of MiniLED backlight LCD panels for gaming monitor in 2018. AUO showcased a 27″ Ultra HD 144Hz high refresh rate gaming monitor panel, a 15.6″ UHD LTPS gaming notebook panel, a 6″ in-cell touch smartphone panel and a 2″ LTPS panel for VR headsets at DisplayWeek 2018. BOE also used MiniLED in its 27″ prototype display to get very high brightness and contrast ratio.

AUO’s LCD panels mini LED backlight for gaming monitors and gaming notebook PCs

AUO’s LCD panels mini LED backlight for gaming monitors and gaming notebook PCs

With expected high LCD capacity coming from 10.5 Gen fabs in the next few years, MiniLED backlights have the potential to truly transform LCD technology with higher performance. But it has to be combined with higher production volumes and lower costs. But these opportunities can also be reduced or lost by strong competition from OLED displays. Suppliers have to capture the window of opportunity with the right strategies. – Sweta Dash

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insight.com