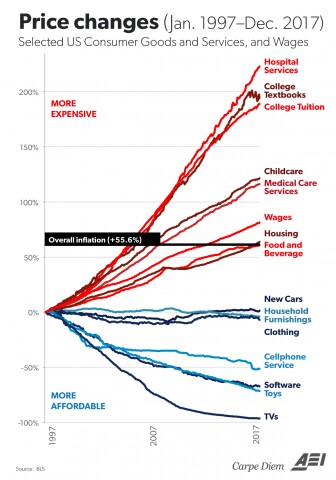

In case you missed it, a chart on pricing changes illustrated just how far south TV prices in the US have plummeted over the long-term. The must-have electronic entertainment commodity, still centerpiece of the modern living room ranked dead last among key commodities with almost (minus) 100% price change over the two decade (twenty year) period 1997 to 2017.

The chart came from University of Michigan’s Prof. Mark Perry in his AEI (American Enterprise Institute) blog Carpe Diem, and was republished as a submission in the recent MarketWatch story considering the most important charts about the economy in this century. When the numbers went live on social media this past February, the chart racked up over 43K “shares” on Facebook (OK Fluffy the cat got 1.2M but still, not bad for economic stuff).

While lower prices means a better value for consumers overall, a flooded market of LCD panels from mostly Asian fabs use the technology to achieve non economic aims that go well beyond the assumptions of “perfect” market driven forces. History shows that when building next generation display fabs for TVs, factors like national employment goals, investment in critical technology development and specific top-down command decisions on investment, all literally seeeconomic prudence thrown to the wind when making these billion dollar decisions requires multi-year commitments.

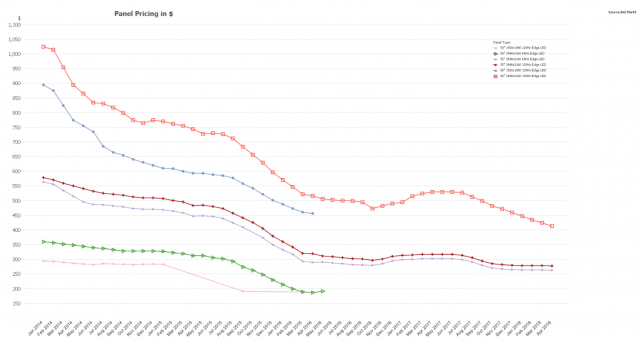

Just how bad is it? Our publisher, Bob Raikes, recently wrote: “Taiwanese sources are pointing to challenges in large area panel pricing for panel makers, so we checked it out. It seems that not only are panel makers under price pressure, but TV brands are also under a lot of price pressure on larger sizes (e.g. 65″), especially in China where IHS has suggested that fighter models of 65” UltraHD TVs might even get down to $575 in Q3 under pressure from Foxconn’s desire to boost its volumes.

When we looked, Amazon had a 65″ 2018 UltraHD Roku model from Hisense at $646, already. Our sources suggest pricing of $260 for open cell panels in March (UltraHD, 60Hz) as an average and prices are getting close to costs.” Yep that would do it, push TV prices to the bottom of the AEI price tracking chart. This is just the beginning according to Raikes, “The crystal cycle and periods of bleeding money are not new in the LCD business, but it is of some concern that, so far, only one of the planned big fabs in China has come into operation so far, and yet prices are already under severe pressure.”

Sony’s razor thin OLED TV

Such is the state of the LCD display industry today. Enter OLED TVs. Displays that are almost paper thin, that translates into sexy wall mount profiles, with eye-popping UHD images to match, including black as never before seen on-screen. At present AMOLEDs are still much more expensive than LCD-based flat screen TVs. Case in point: Sony recently announced pricing for its stunningly beautiful (XBR-A8F) Flagship OLED model confirming the 55″ will sell for $3000 and the 60″ at $4000. The Japan-based company also has a 77″ (XBR-A1 the former top of the line for Sony) that still sells for $13K.

For its part LG, became the OLED TV dominant player finding its way to profitable commercial production using white OLED panels and a more conventional color filter (ummm, can you say Kodak?) Earlier this year, LG announced its Korean sales of high-end OLED TVs surpassed 14K units in January 2018, or 220% higher than year-on-year sales for the same period in 2017. Prices meanwhile remain relatively steady at 2.39M won ($2,200) and 3.09M won ($2,840) for the 55″ model. Truth be told, that LG OLED TV first launched in 2013 in Korea for 15M won (roughly $13,500).

OLED Demand is Strong

On the market research side, OLED TV panel demand is strong, with shipments of overall AMOLED panels by area forecast to grow by 4X (up 22.4M square meters by 2024 from 5.0 million square meters in 2017, according to IHS Markit). The share of TV panels in total AMOLED panel shipments increased to 32% from 21% in 2016. To get here, the group reported last year shipments of AMOLED TV panels had doubled to 1.6M square meters in 2017 from about 800K square meters in 2016, resulting in total (all types) AMOLED panel shipment growth of more than 30% to 5M square meters in 2017 from 3.8M square meters in 2016.

So if prices can hold for AMOLED TVs, the manufacturers just may avoid a total bloodbath in the high-end of their market. That said all TV pricing is a moving target, and OLED fabs are not insulated from the same pressures that have driven the display industry for decades. Shall we make something else instead… anything? But then, where’s the joy? Stephen Sechrist

TV Panel Prices Under Pressure

US-China TV Tariff Could Cost Americans $711 Million Over Next Year

TCL Multimedia Announces LCD TV Sales Volume for 2018 Q1

Sony Announces Price of New A8F OLED TV

LG’s OLED TV Sales Up 220% YoY in January 2018