The oxide semiconductor has always to my mind been the interesting middle ground in the display industry. But to date, it has been mastered by relatively few players Sharp and LGD come to mind) as the physics of the device are distinctly different to amorphous silicon (a-Si).

(For those that are new to this subject, backplanes based on oxide transistors have fewer masks than LTPS (typically between 4 and 8 compared to 11+) and higher mobility than a-Si (meaning smaller, faster transistors, larger aperture ratios). There are some additional benefits, such as some of the capabilities to replicate driving and multiplexing functionality in the borders of the display and reduce the needed semiconductor ICs. Oxides also have low leakage current. However, there has not been quite enough performance to be a possible LTPS replacement or superior backplane for emissive technologies).

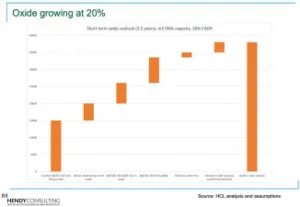

Up to now the oxide semiconductor has been found in WOLED TVs (at LGD) with almost 13 million m² of capacity (2022) and then in pockets of applications. For example, it has been used for higher resolution iPads. The oxide market is perhaps around 15-20 million m² or a pretty distant third place for oxide behind the leader amorphous silicon (>250 million m²) and low temperature polysilicon, LTPS (30 million m²).

However, the demand trajectory for a mid-performance semiconductor is now moving upwards, with two additional applications. And as “demand” increases, then the industry will look for new sources of high-performance oxide at a technology level.

Two New Drivers – from Samsung

The new drivers of demand are both from Samsung. The first is the long announced QD OLED technology for TV and monitors which is beginning to ramp as we speak from November 2021 and was shown privately at CES 2022. This new technology plans to compete alongside WOLED TV but is based on fluorescent blue emitters (a 3-layer blue stack), and potentially 6 million m² (or 90k/month Gen 8 within a fairly short horizon and the potential for a Gen 10 later). This QD OLED technology needs an oxide backplane. Large panel emissive displays can have narrower borders and higher frame rates with better performing oxide.

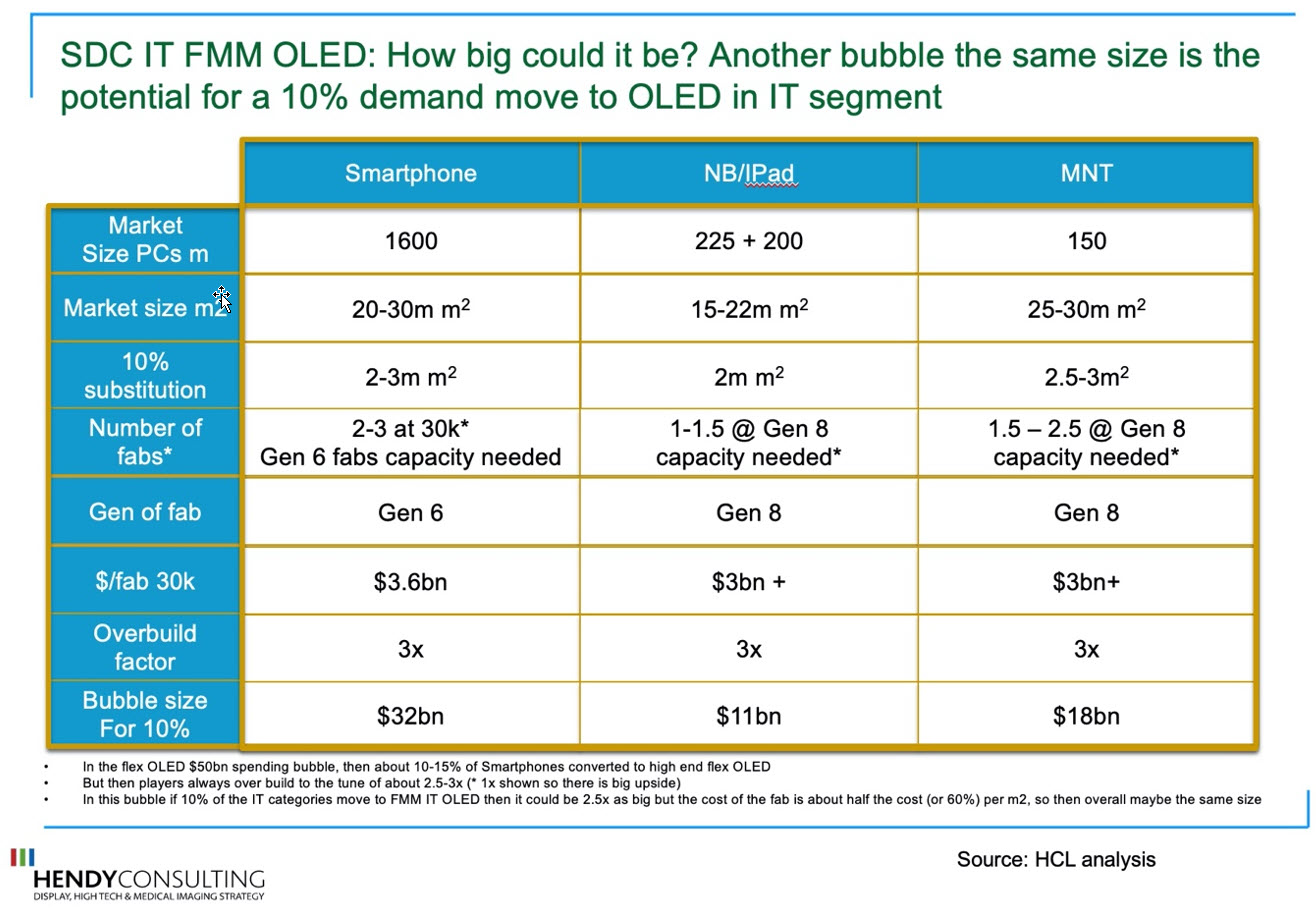

The second is the extension of Samsung’s mobile approach to OLED, including Fine Metal Mask (FMM) but to IT panels at Gen 8. The notion of trying to use current FMM OLED approaches to IT panels is not new, but despite years of equipment R&D it has proved elusive: getting the ability to do fine metal mask over a 2m+ length for Gen 8 Scale is tricky. It looks like now Ulvac has cracked this and perhaps other equipment makers too. And my own analysis has suggested that the capital bubble from a 10% demand switch towards OLED in IT spaces, could give the same level of capital spending as the 2016-2020 investment into flex OLED (assuming the same level of competitive overbuilding), at over $30 billion in new fabs and up to 15 million m² of new capacity.

For now, DSCC is talking about demand changes nearer to the 5% level over the near term but this is still roughly $15 billion+ in capital and 7.5 million m² in new oxide backplanes (based on typical over building assumptions) being installed.

The supply of oxide then could rapidly move from about 15 million m² today to more than 38 million m² (20% CAGR) and more as producers prove out the role of IT OLED panels based on a lower cost backplane than today’s LTPS and Samsung tries to compete with LGD WOLED. BOE and LGD will also aim to grow the space.

And as a really exciting thought experiment, should IT panels eventually mirror today’s smartphone and move to say 50% of units as OLED then this could be 5x as big taking oxide into the > 100 million m² range in terms of installed capacity.

Amorphyx getting close on new high performance solution

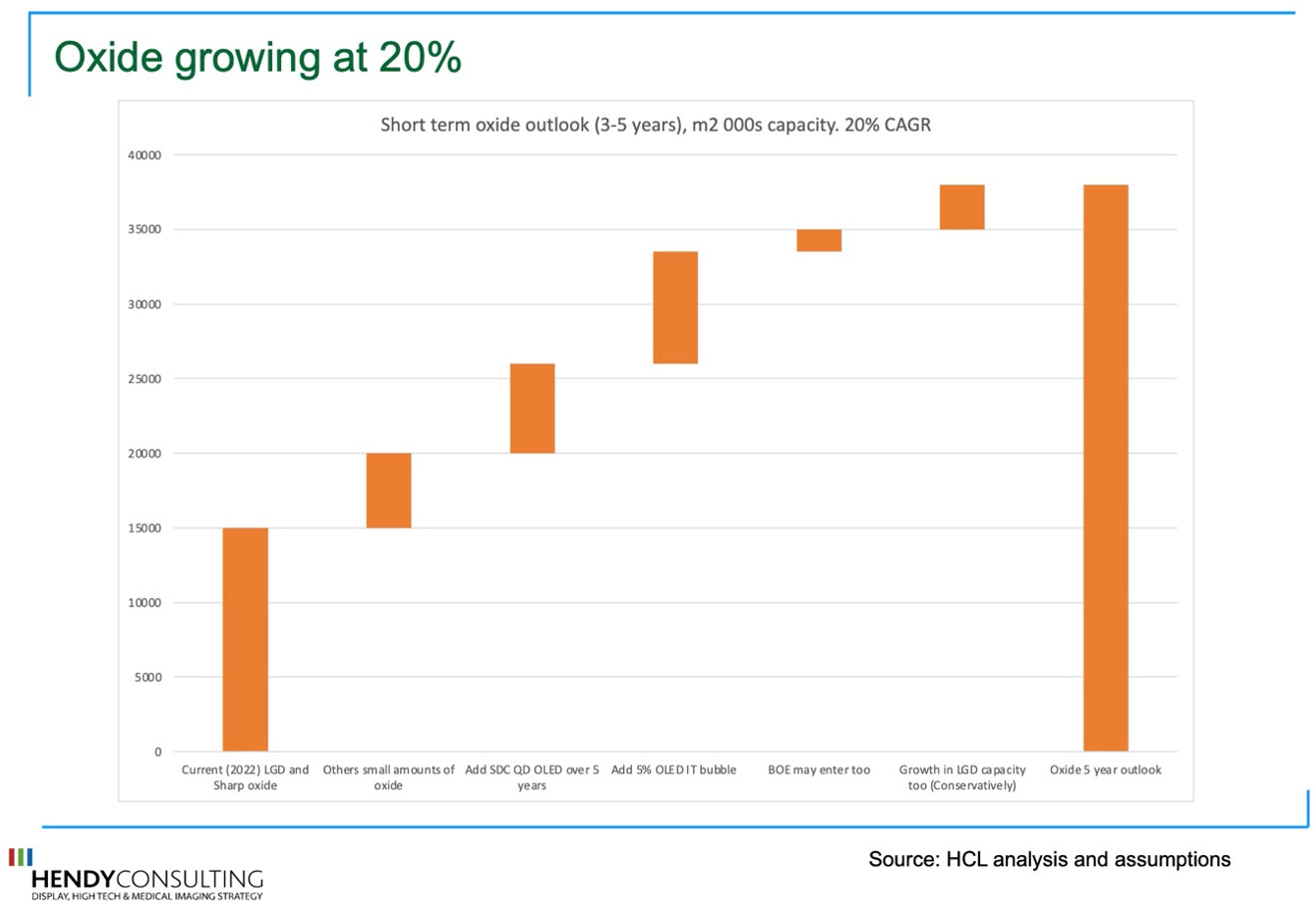

It is clear that players would like the performance of LTPS type levels (>60 cm²/Vs) but without the cost and complexity of laser annealing and doping and the high number of process steps.

Amorphyx has been working on its own approach to high performance oxide, with mobility in excess of 60 cm²/Vs and a path to higher. Its technology is based on a proprietary amorphous metal gate with a thin high-k dielectric gate insulator. The only process change is a slight increase in PVD in the line and the use of reactive sputter. Their process can work with any player to transfer the technology.

They have been working on this for the last 24 months and have brought all of the specifications for use to within expected targets, save for the PBTS reliability spec which is getting really close (the aim is < 1V drift based on 30V applied for 7200 secs positive bias). They are working hard to close this remaining gap and believe they can do so early in 2022.

This is a new adder to the oxide manufacturing and we believe is largely additive to other approaches that players may use to try to augment oxide mobility. Amorphyx believe that the interest in oxide development will spread around the industry and players will look for ways to be competitive.

Summary

Overall, this is the time for oxide to climb the rankings in importance in the display industry. If oxide does become well entrenched into FMM OLED for Gen 8, then will this then be proof enough that it can play in Gen 6 mobile applications too and displace LTPS. These are interesting times for oxide developments. (IH)

Ian Hendy is a Display Strategy Consultant based in London, UK. Hendy Consulting provides growth strategy, technology strategy and deal/M&A assessments for players throughout the display value chain. Amorphyx is a client of Hendy Consulting and has liberated this article from the Display Daily paywall.