Reuters reported this week that Foxconn is in discussions to appoint banks to find a buyer for its LCD factory that is being built in Guangzhou. While Foxconn replied in a written statement that “As a matter of company policy, Foxconn does not respond to market rumors or speculation,” Reuters reported that multiple contacts within Foxconn were involved in the discussion. If true, the sale of such a new plant would be unprecedented in the flat panel display industry.

Reuters reported this week that Foxconn is in discussions to appoint banks to find a buyer for its LCD factory that is being built in Guangzhou. While Foxconn replied in a written statement that “As a matter of company policy, Foxconn does not respond to market rumors or speculation,” Reuters reported that multiple contacts within Foxconn were involved in the discussion. If true, the sale of such a new plant would be unprecedented in the flat panel display industry.

Reuters reported that Foxconn is reviewing its businesses in light of the US-China trade war, which is disrupting global supply chains. While Reuters referred to “slowing demand for large-screen televisions and monitors”, DSCC would characterize the situation as a growing oversupply that has far outstripped demand growth. Foxconn questioned the need for the Guangzhou plant: “Existing plants are already not running at full capacity … why need another one?”

The Guangzhou fab is expected to start mass production in late September or early October, and celebrated a lighting up ceremony on July 31st and already rolled out its first 65”panel according to Digitimes. The plant is a joint venture between the Guangzhou government and Sakai Display Products (SDP), which owns the Gen 10 LCD plant in Sakai City, Japan, built by Sharp. In its years of financial distress in before being taken over by Foxconn in 2016, Sharp sold portions of the SDP business to some suppliers and to Foxconn founder Terry Gou. Sharp and Gou remain minority owners of SDP, but Foxconn does not directly have a stake except through its majority share of Sharp.

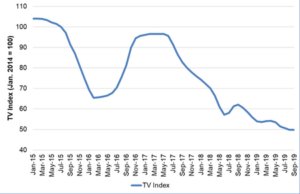

As originally envisioned, the Guangzhou Gen 10.5 was targeted to manufacture 65” and 75” TV panels and expected to generate an annual revenue of CNY 92 billion ($US 13 billion) from an investment of CNY 61 billion (US$ 8.7 billion). However, such a revenue projection was unrealistic to begin with, and appears fantastic given the recent trend. TV panel prices have fallen by 50% since the project was originally conceived, and at current prices the annual revenues from the plant, selling 65” panels at 90% yield and utilization, would amount to only $1.3 billion.

TV Panel Pricing, 2015-2019. Average of Six Sizes, Indexed to January 2014

The prospects for large-screen TV may be further diminished by the 10% tariffs to be imposed by the US on China imports. While most high-end TVs sold in the US are manufactured in Mexico, many lower-priced TVs are imported from China, both from China-based brands like TCL and Hisense and white box brands. The tariffs will likely lead to increased prices for TVs, and lower volume.

Chinese TV brands have been losing money for the last 2-3 years, and without continuing government subsidies would find it difficult to survive. Our sources in China say that there will be no more new investments in large-gen LCD fabs in China, and that pending projects, including a Gen 10.5 fab announced by HKC, will face delays or cancellation.

If it really wants to try to sell the Gen 10.5 plant in Guangzhou, Foxconn may have difficulty finding a buyer, given the current dynamics of the industry. The only prospects are among Chinese panel makers. CEC might be able to raise funds with an equity offering, as the company’s stock price has increased 44% this year. Other options include HKC, CSOT or BOE. Regardless of the buyer, Foxconn will have a tremendous challenge to recoup its investment.

The possible sale by Foxconn of its Guangzhou Gen 10.5 fab has no direct impact on Foxconn’s plans to build an LCD plant in the US state of Wisconsin. Foxconn has repeatedly said that it is committed to creating 13,000 jobs in Wisconsin, and has recently started construction of a manufacturing facility there. However, if Foxconn can put a huge investment like Guangzhou up for sale even before it starts mass production, one has to wonder if any investment by the company is safe. (BoB)

The author of this article was Bob O’Brien

This article was originally published on the Display Supply Chain Consultants’ blog and is republished with permission.