We tend not to respond instantly on display industry news in Display Daily. We usually like to stand back a bit and reflect and dig before we post. However today I’m reporting on a story that broke in the last 24 hours and that is the change of ownership of Cynora GmbH in Germany.

Bloomberg’s Mark Gurman, normally a specialist in covering Apple, reported (subscription needed) that Samsung Display Co (SDC) has purchased the company’s IP and technology for $300 million. The report said that Samsung had not bought the firm’s engineers and that the sale had been made as the firm was running short on cash and needed an exit for investors. The investors in the firm included Samsung itself, but also LG Display.

As it happens, I mentioned to some friends at the SID/DSCC Business Conference just last month that it was strange that Cynora was not present, given that two of its key competitors in developing high efficiency blue OLED materials, Kyulux and UDC were both presenting – as were others including Noctiluca. At the time, I had thought “Oh, they got bought by Samsung, didn’t they?”, but when I did some checking, I couldn’t see confirmation of that fact, so I forgot about it.

Anyway, the story has been widely reported on the internet in the West as well as in Korea, with no denials that I can see, so I think it’s true.

So Who are Cynora?

Cynora has been on my radar since 2013, when the subscription newsletter that I published then, Display Monitor, in Volume 20 #29, reported a project between Cynora, Novaled and the University of Regensburg to make printable OLEDs for use in lighting, with funds from the Germany government. My database on Novaled goes back to 2005 when the German firm issued a press release with Philips on the development of new White OLEDs for lighting. Novaled also developed electron transport materials for display applications and, by then, had investment from Samsung Ventures (in 2011).

Novaled started to supply Samsung with materials in 2012 and in 2013, Cheil Industries, then an affiliate of Samsung, together with Samsung Electronics and Samsung Venture bought the firm for a reported $300 million. Cheil then merged with Samsung SDI and Novaled GmbH is still listed as a subsidiary of SDI. The firm continues to operate in Germany and is one of the top four suppliers of OLED materials along with UDC (#1), Idemitsu Kosan and Merck according to DSCC.

I suspect that when I had the false memory that “Samsung had bought Cynora, the German OLED developer”, there was a lingering memory of “Samsung bought Novaled, the German OLED developer”.

Anyway, Gildas Sorin had been the CEO of Novaled AG (as it was then) from 2003 to 2014. He then, in 2015, became CEO of Cynora and I remember interviewing him when he explained that he had, effectively, been reluctantly dragged back into another start-up because of the great prospects for the TADF materials that Cynora was developing. The firm was pursuing the ‘holy grail’ of a blue that had the right colour, lifetime and efficiency for the display business and, like Kyulux, it was sure it could create it using TADF.

The Trifecta

Those three factors are key. An OLED specialist (I think it was Barry Young, but it was a long time ago) said to me many years ago, “Don’t believe what you hear about OLED materials unless you have the colour, the lifetime and the efficiency of the same material” and that has proved to be good advice. There have been plenty of developments with one or two elements there. In fact, I was catching up with an SID talk yesterday (Symposium paper 8.3) where a scientist from Sharp explained how the firm had some great EL quantum dots with deep blue and good efficiency. However, in the questions he had to admit that there was “Still a problem, still a great problem” with lifetime.

Cynora struggled (as everyone has, to be fair) to finalise its blue (it kept saying it would soon commercialise it, but the dates kept slipping). The blue was developing, the firm revealed at various display events, with good colour and efficiency. However, lifetime was ‘still an issue’. I remember a UDC executive pointing out how hard it is to get all three factors right at the same time and how Cynora might find extending lifetime harder than it expected. Of course, having a lot of R&D and scientists depletes your cash. In 2017, LG & Samsung invested €25 million in the firm.

A Pivot in Strategy

In 2019, the firm had to change its business strategy as TADF blue was obviously not close to being a revenue earner. It raised $25 million from investors again, but moved the development of the TADF blue from being the main target to being a ‘long term goal’, while it focused on the less technically tricky tasks of developing a business to supply TADF red and green materials. Sorin departed as CEO and Adam Kablanian took over.

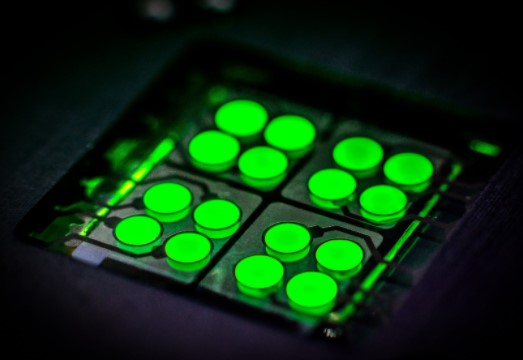

In 2020, Cynora annouced a fluorescent blue (not the TADF) and in 2021, Kablanian described his firm’s deep green material which by September was said to have 177 cd/A of output with 25% EQE. (TADF Is the Future of OLED, but the Future Comes Slowly) In his SID talk, he highlighted the AI technology that the firm had developed to find materials.

Cynora’s cyUltimateGreen TADF deep green device test kit, an industry first. (Photo: Harald Flugge)

Cynora’s cyUltimateGreen TADF deep green device test kit, an industry first. (Photo: Harald Flugge)

So Why the Acquisition?

So, what about the acquisition? Well, the logic of ‘the investors want a pay out and don’t want to put more in’ in the current challenging VC climate is not a surprise at all. Or, and this happens regularly in the VC/start-up world, maybe the VCs that were prepared to put more cash in wanted more of the company in return than other shareholders would stomach?

The acquisition of the IP alone by Samsung, and not the engineers, is significant, I think. The level of knowledge and skill of the Cynora group is likely to be very high and there must be a lot of experience and ‘know how’. Many businessmen have complained to me in the last year or two, that getting good specialist technical staff is significantly more difficult and much more expensive than it was. Why wouldn’t Samsung want to make the most of the opportunity to get such a team?

My guess (and it is just a speculative guess) is that Samsung doesn’t believe in the longer term trajectory of the Cynora technical approach. Samsung is also an investor in Kyulux, has a deep relationship with UDC and has its own research via Samsung Advanced Institute of Technology each of whom is developing better blue materials. Samsung Display may have (actually probably has) already decided which of those three has the winning position in next generation (phosphorescent, TADF or Hyperfluorescence).

Buying the ip from Cynora might just be to allow it to use the firm’s materials without an on-going licence cost, but if it wanted to use the materials in the long term, I think it would have taken the developers of that material too. After all, the display industry is a marathon, even if the current dash for next generation blue may feel like a sprint.

On the other hand, buying the IP stops it falling into the hands of a competitor. More particularly, it may have stopped the IP and materials being available to Chinese competitors. Even if Samsung had decided that Cynora wasn’t the best material option, it may still have been good enough to move one of the Chinese makers closer to being able to compete with Samsung as the clearly most advanced maker of OLEDs. That may have been a good enough reason for SDC to step in and block the possibility of a Chinese technology jump. After all, as was pointed out by Ross Young at the SID/DSCC Business Conference

“Chinese suppliers still account for less than a 20% share of the OLED market by revenue despite massive capex”.

Further, much of the investment in Chinese makers has been to boost GDP in China by building factories and supply chains. It might have been harder for Chinese companies to justify a big purchase of technology from Germany. Samsung will have had different hurdles to overcome to make the same decision. (BR)