5G is coming, as I have said before. Currently, the main drive for 5G comes from the consumer segment, especially the consumer love of streaming video to show on their mobile devices, computer monitors and TVs. In the long run, however, it may be the enterprise market that drives the need for 5G networks – and the financing of those networks.

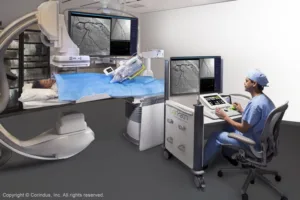

5G Handset sales and market penetration (Credit: CTA)

5G Handset sales and market penetration (Credit: CTA)

Consumers are being presented with an increasing variety of 5G handsets. The Consumer Technology Association (CTA) market research shows that by 2023, about 95% of all handsets sold will be 5G-capable. (IDC may not agree with that forecast, according to a confusing press release. Part of the confusion may be the difference between 5G mmWave and 5G NR.) Yet the consumer is expecting cellular bills to decrease, data limits to be higher or be eliminated altogether and is pushing back against high smartphone prices, providing cellular network providers little cash to invest in these 5G networks.

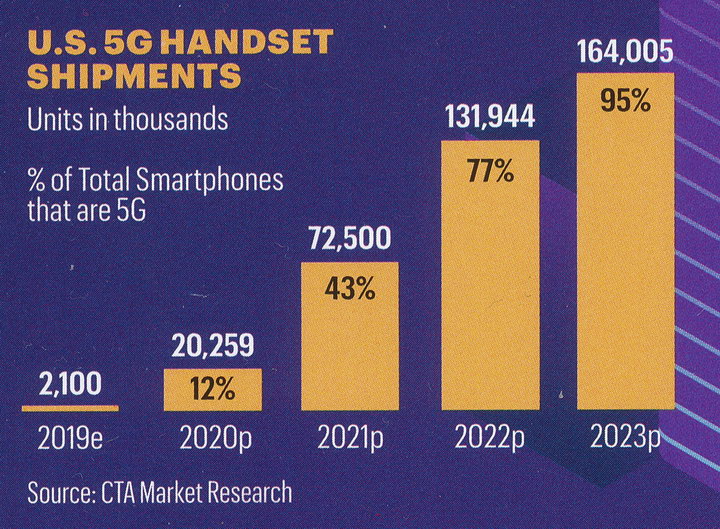

The CTA believes 5G will be led by the enterprise markets. (Credit: CTA)

The CTA believes 5G will be led by the enterprise markets. (Credit: CTA)

This, perhaps, will be less of a problem than many people fear. The drive to complete the installation of 5G networks, as opposed to the sale of handsets to be used in the few locations with 5G mmWave coverage, is likely to come from enterprises, not consumers. The CTA, which seems to be focusing on all technology, not just consumer technology, puts the enterprise market along a spectrum that depends on which features of 5G technology are needed.

At one end of the CTA IoT spectrum are Massive IoT installations that require low cost and low energy technology. Individual sensors reporting their data over their network, likely to be 5G going forward, may have relatively modest data requirements. For example, a sensor in a smart building may report a room’s temperature, humidity and the status of its lights to allow a central system to control a building’s energy use. This is only a few dozen bytes of data (including the sensor’s ID number) and only needs to be reported every 15 minutes or so. However, these sensors should be in every room in the building so in a large building that can be a lot of sensors. Realistically, sensors like this need to be battery powered, not line powered, to avoid massive installation costs. 4G LTE has the ability to support a few thousand users per square kilometer, which is plenty if it is only human end users and their handsets. 5G can support millions of users per square kilometer, which should be enough for even the largest, densest office complexes.

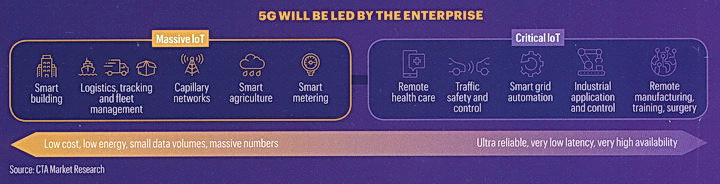

Smart gas (left) and electric (right) meters from Consolidated Edison. (Credit: M. Brennesholtz)

Smart gas (left) and electric (right) meters from Consolidated Edison. (Credit: M. Brennesholtz)

On a more human scale, Consolidated Edison recently updated my gas meter and had done the electric meter a year or so ago. The new IoT module for the gas meter is highlighted by the red rectangle. The basic mechanical gas meter was installed in 1985 or before. Previously, the gas meter had been wireless but required a Con Ed truck to drive past our house to read it. With the update, they can read all gas and electric meters from a remote location. Presumably this is done over the existing 4G LTE network, since our neighborhood does not have 5G yet. In denser neighborhoods than our suburban town, this might crowd the capabilities of a 4G LTE network.

According to Con Ed, “Between now and 2022, we will be installing nearly 5 million smart meters. They’ll provide you with more information about your energy use so you can make better energy decisions.” The Con Ed website says that the smart electric meters they have been installing are read every 15 minutes. Reading 5 million meters every 15 minutes will mean 480 million messages a day between the smart meters and the Con Ed computer system. I would say this counts as “Massive IoT.”

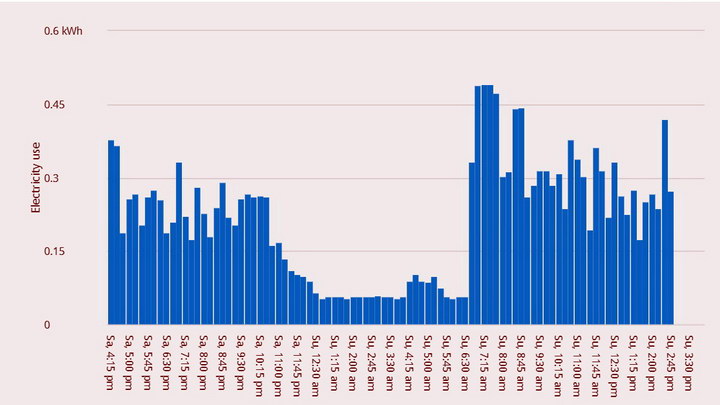

Usage of electricity over a 24 hour period. (Credit: Con Ed)

Usage of electricity over a 24 hour period. (Credit: Con Ed)

Smart meters benefit both the consumer and the utility company. As a consumer, I can see when my high-usage times are. For example, my furnace thermostat is set to warm up the house starting at 6:45AM and the surge of electric use to run the two large electric motors in the furnace is clearly visible. The more modest surge in the middle of the night could have been the refrigerator, my Windows 10 computer updating itself or something else I wasn’t aware of because I was asleep. Note the baseline overnight load of about 0.05 kWh. This represents things like computers, televisions and radios on standby, night lights, phones recharging, electric clocks, etc.

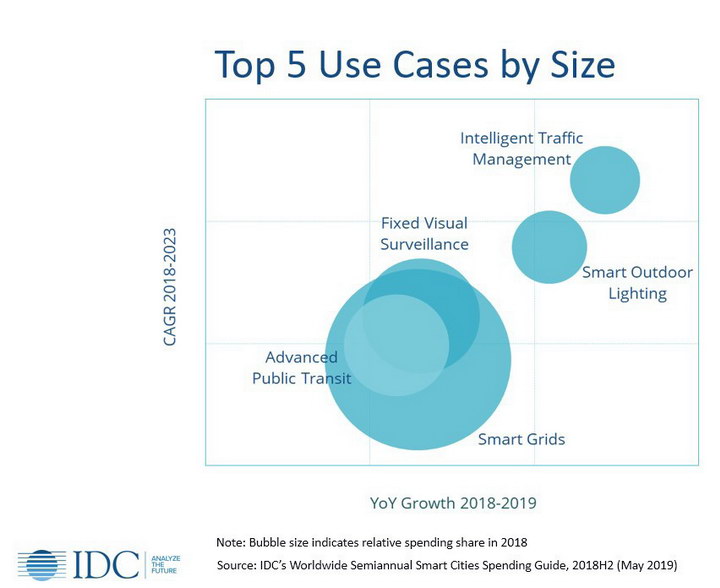

Top five “Smart City” IoT applications. (Credit: IDC via the CTA)

Top five “Smart City” IoT applications. (Credit: IDC via the CTA)

The utility company also benefits from smart meters. On the simplest level, they no longer need to send meter readers into the basement or even down the street, saving money. Probably more importantly in the long run, however, this allows the utility to monitor and control its power grid in a smart city application. This overall grid control, as opposed to simple metering, is listed by the CTA as a Critical IoT application. With the addition of power sources like wind and solar power that are not as predictable as traditional sources like coal, hydropower and nuclear energy, control and rapid response to inputs like minute-by-minute electrical load in the city is more important than ever.

As can be seen in the data from IDC, smart grids like this are the biggest spenders of the top-five smart city technologies. The other top five systems today are advanced public transit, fixed visual surveillance, smart outdoor lighting and intelligent traffic management. These top five items are expected to be about 50% of the total smart city market through 2023, when IDC expects the market to total about $190 billion dollars. Singapore is currently the top investor in smart city initiatives, followed by New York City, Tokyo, and London. Note that “Smart City” programs are not necessarily paid for by the city itself: smart meters and smart grids are paid for by the electric company.

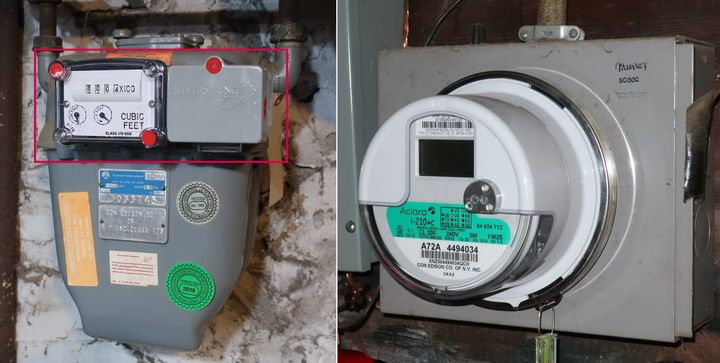

Physician running Corindus Vascular Robotics CorPath GRX system from the remote control station. (Credit: Corindus)

At the other end of the CTA enterprise spectrum are Critical IoT applications that require the low latency and reliability that 5G is expected to bring to cellular networks. Some of these applications require much higher volumes of data per IoT user. For example, remote health care presumably includes two-way video. Certainly, remote surgery will not only require a high resolution, high frame rate and high bit depth video connection but that connection must have very low latency and very high reliability.

It would be unacceptable for a surgeon to be cut off from his patient in the middle of an operation. In 2019, the physician operating a “remote” surgery system will not, in fact, be remote for these and other reasons. He will be in the operating room, as pictured in the Corindus robotic surgery image, looking at a high resolution medical display, not the patient. This display will be repeated in the operating room for the others not shown in this picture such as the anesthesiologist and the surgical nurses who will be working directly with the patient. These medical applications, when and if they ever do go fully remote, are expected to be relatively few in number, certainly not the 5 million or more IoT connections for smart meters in the New York area needed by Con Ed alone, which doesn’t even cover the entire New York area.

Other applications such as traffic safety and control for a smart city also require video connections. An individual surveillance camera is unlikely to consume the bandwidth consumed by remote surgery, nor will they need the ultra-high reliability and low latency needed for surgery. On the other hand, there are far more surveillance cameras in a modern city than there are surgeons doing remote surgery.

The Mercedes-Benz entry into the e-scooter market, to be launched in early 2020. (Credit: Daimler AG)

The Mercedes-Benz entry into the e-scooter market, to be launched in early 2020. (Credit: Daimler AG)

Another smart city application is the control and inventory of shared personal transportation devices such as shared bikes and electric scooters. Some cities, like New York, these shared bikes must be returned to an approved location. In other cities, the bike or scooter can be left wherever the user finishes his ride. To the passerby, it may look like these bikes or scooters are scattered at random but every one of them has reported its location and the state of its battery charge to the system controller via the local cellular network.

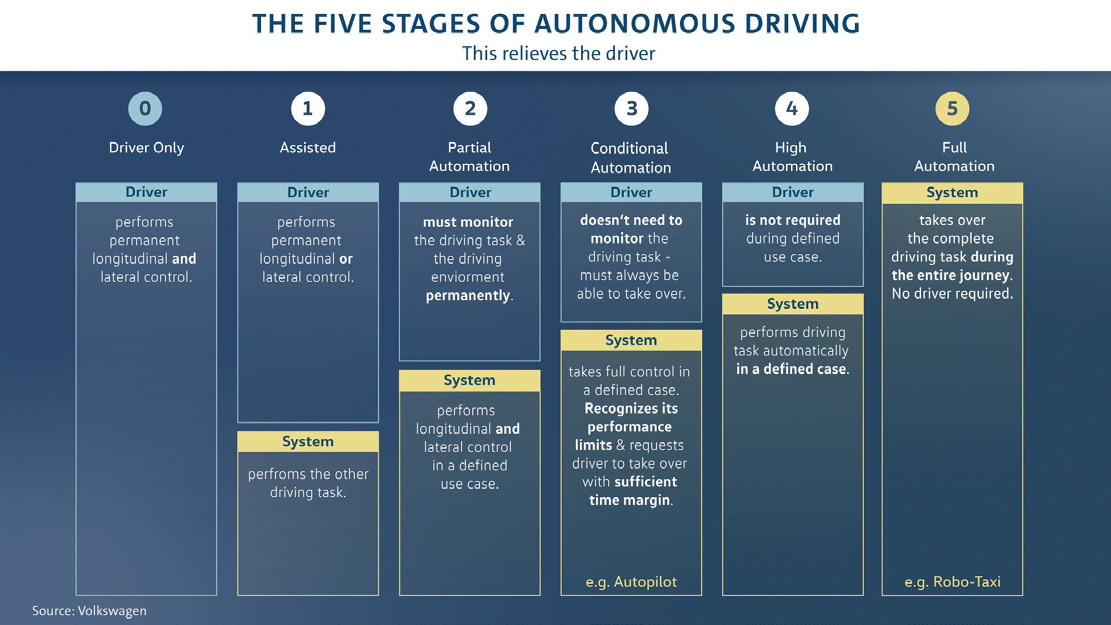

The five stages of autonomous driving. (Credit: Volkswagen via the IoT Consortium)

The five stages of autonomous driving. (Credit: Volkswagen via the IoT Consortium)

While autonomous driving is not listed among the CTA’s critical IoT 5G applications, it is certainly a smart city innovation and will be heavily dependent on its communication network which is likely to be 5G cellular systems. Besides convenience for the consumer, autonomous driving offers several significant advantages over human driving.

First, the smart city will know were every car is at all times. If there is a traffic problem, the traffic can be routed around the hot spot, whether it is an accident, a presidential motorcade or just volume related. Second, it is likely to be safer than human driving. Every time there is a fatal autonomous driving accident, it hits the headlines nationwide. If every one of the 36,750 people were killed in the U.S. in traffic crashes in 2018 with human drivers in charge were reported by a front page headline, there would be about 100 deaths reported on the front page of your newspaper every day of the year. And every day next year and the year after, too. A lot of these fatal accidents are attributed to distracted driving, drunk driving or excessive speed. None of these problems are likely to be associated with autonomous driving systems.

Nuro autonomous delivery vehicle on the street. (Credit: Nuro)

Nuro autonomous delivery vehicle on the street. (Credit: Nuro)

Unfortunately, fully autonomous driving is a very, very difficult task. The research firm ResearchAndMarkets believes that full autonomous driving systems, Level 4 and Level 5 in the chart, are unlikely to fully enter the market before 2030. One of the many difficulties to be overcome is the question of cybersecurity. Here, the enhanced security of 5G networks compared to 4G networks will be a help. Other autonomous systems in simpler situations are already in use.

In December, 2018, “Nuro launched the first-ever unmanned delivery service for the general public. People in Scottsdale, Arizona can now have their groceries delivered by the R1, a self-driving, unmanned on-road vehicle. We are incredibly proud of our team and our partners for reaching this milestone together.” You can watch a Nuro delivery van on the streets of Scottsdale, Arizona here.

Clearly, both public and private enterprises see the need for more communication. The sorts of communications needed cannot be hard-wired and, given time, are likely to overwhelm the capabilities of 4G LTE networks. While in the short term, consumer video is going to be the dominant traffic over cellular data networks, in time this data traffic is likely to be significantly increased by the video and other data needs of data-driven enterprises. And today, what enterprise isn’t data-driven? – Matthew Brennesholtz