Korean panel makers’ exit from LCD TV production expected to create a supply bottleneck. From 2013 through 2020 worldwide flat panel display (FPD) capacity grew almost 50 percent, expanding to 335 million square meters per year, up from 225 million.

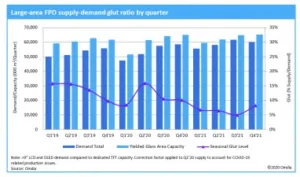

The continuous build-out of new factories in China, including multiple enormous Gen 10.5 lines, drove the FPD industry to an unusually high average capacity glut of 13.6 percent in 2019. This in turn caused liquid crystal display (LCD) TV panel prices to decline throughout the year to record lows.

The coronavirus crisis is now impacting FPD demand and creating considerable business uncertainty. Challenged to maintain profitability in this environment, South Korean suppliers have accelerated plans to completely exit LCD TV panel production in Korea in 2020. These factory closures will remove 57 million square meters of capacity between 2019 and 2021. With 17 percent of total capacity now expected to be shuttered by next year, the glut level is modeled to shift from being excessively loose in 2019 to an extremely tight 6.5 percent average in 2021.

In the first quarter of 2020, the FPD supply chain was significantly restricted as COVID-19 hindered logistics, caused material and component shortages, and prevented factory workers from assembling modules in China. This helped to balance the large-panel market and caused prices to rise through much of the quarter. By early April, Chinese FPD factories had mainly returned to near-normal capacity. Now as the coronavirus spreads globally, the bottom is falling out of TV demand. The glut level is again surging to high levels and second-quarter TV panel prices are now expected to plunge back below cash costs.

On a unit basis, 2020 demand is currently estimated to decline by about 10 percent compared to 2019 as a result of COVID-19. The IT market—particularly notebooks and tablets—is the one segment of the display industry now enjoying healthy demand as much of the world has rapidly had to pivot to working, playing and teaching children at home.

Even so, Omdia currently assumes this surge in IT will be short-lived and will mainly pull in demand from the second half of the year. The rise in IT spending will not be sustainable as corporate IT and education systems’ budgets are likely to be curtailed as the economic impacts of the pandemic increase. At this time, Omdia forecasts unit demand will start to recover from 2021 but will take two to three years to approach 2019 levels. However, on an area basis, 2021 large-panel demand is expected to exceed 2019’s level by 11 percent due to projected growth in LCD TV weighted average panel size from 45.4-inch to 49.2-inch.

Over the same 2019 to 2021 timeframe, capacity is forecast to grow by only 2 percent. From a total industry supply perspective, the Korean LCD TV factory shutdowns negate much of the capacity expansions and new factories now being built in China.

Ramp-up plans are being delayed in the first half of 2020 for multiple new Chinese Gen 8.6 and Gen 10.5 LCD factories. This is mainly due to interruptions to equipment set-up plans caused by travel restrictions on engineers. The companies are working through set-up issues with local Chinese engineering staff in most cases. However, for some process-critical machines, such as photolithography tools, set-up is starting to fall behind previous plans by two to four months.

The year 2020 was previously expected to be a time of substantial change for the FPD industry. However, now with COVID-19 and Korean panel makers withdrawing from LCD TV panel production faster and more abruptly than even the most aggressive scenarios, it now looks like this year will suffer from more disruption than anyone imagined only a few months ago. Of course, how quickly the global economy recovers from the coronavirus will affect the FPD industry as well. If a V-shaped recovery in LCD TV demand can be realized, the combination of larger average sizes and minimal capacity growth are expected to push the large-area FPD supply glut to a very low level of 5 percent in the third quarter of 2021. That is a positive leading indicator for improved pricing and better financial performance for panel makers in 2021 and beyond. – Charles Annis

This article was originally published on the Omdia (previously IHS Markit Technology) blog and is reproduced with kind permission. The data is from the AMOLED and LCD Supply Demand & Equipment Intelligence Service.

Charles Annis, a leading expert in flat-panel displays. In his previous role at DisplaySearch and its sister company Solarbuzz, Charles served in the dual roles of senior analyst and vice president of manufacturing research. He was the key specialist at DisplaySearch for emerging technologies; for tracking and forecasting investments in the flat-panel display space; and for researching equipment, materials, and process trends.

Charles has a master’s degree in business law from Ryukoku University, a privately held institution in Kyoto, Japan; and a bachelor’s degree from Pomona College in Claremont, California. He is based in Japan.