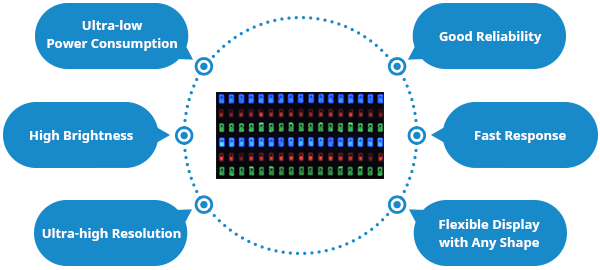

microLED is considered to be a next generation display technology. It provides the best features of both LCD and OLED display. It has the potential to outperform both the technologies in terms of color reproducibility, brightness, reliability and low power consumption.

Many working prototypes have been introduced, but it is not in volume production yet due to manufacturing challenges, cost issues and the need for supply chain establishment. Technology developments and new solutions are coming, leading to steady progress towards commercialization.

Display Suppliers: Increasing Activities

According to recent press release from Yole Development,

“..analysts estimated that cumulated effort in microLED to date reaches close to $4.8Billion, with Apple alone close to $1.8 billion, factoring in both the Luxvue acquisition and internal developments”.

They identified and selected about 5500 microLED related patents filed by more than 350 organizations. Tjhe ress release reported that 40% of the patents were filed in 2019 alone. China and display makers are driving this exponential growth. BOE now leads in volume with close to 150 new patent families in 2019.

Currently the display industry is going through a great transition. Samsung Display and LG Display (Korea) have decided to stop LCD production due to low profitability. Suppliers from China are dominating the LCD market with their massive 10.5 Gen capacity. Samsung (the dominant OLED supplier) and LGD are focusing on OLED and next generation technology (Quantum dot, microLED). China suppliers are also starting to build OLED fab capacity. AUO and Innolux (Taiwan) are focusing more on microLED as they didn’t invest in OLED capacity. Major display suppliers – Samsung, LGD, AUO, Innolux, BOE, Tianma, CEC Panda, Visionox and others are all increasing their activities in microLED display which will help to establish the supply chain for volume production.

microLED Suppliers: Bringing in Prototypes

According to industry estimates, more than 130 companies are working in the microLED display supply chain. Besides panel suppliers, many startup companies and component suppliers as well as top brand manufacturers are exploring solutions for microLED products including Apple (LuxVue), Facebook/Oculus (mLED, InfiniLED), eLux (integrated with Foxconn group), Aledia (Intel), Lumens, Lumiode, Jade Bird Display, Mikro Mesa, Play Nitride, Plessey, Glo (Google), VueReal, X-celeprint (X-Display), Rohinni, Sony, Visionox and others.

Here are some of the microLED display prototypes announced in the 2019/2020 timeframe.

- AUO & PlayNitride – announced a 9.4″ (228PPI) flexible display (PI LTPS) for automobile application. AUO also introduced a 12.1″ (169PPI) panel in 2019 (LTPS glass)

- RiTdisplay & PlayNitrite – introduced a 1.25″ display with glass substrate and 0.9-inch flexible display based on thin film (both 228ppi resolutions, scheduled mass production 2020). According to industry news sources, both companies may be in talks with Apple to produce a next generation watch/wearable display.

- Samsung – showcased “The Wall” large format TV products at CES 2020 in 292″, 150″, 110″, 93″, and 88″ using larger size chips. It also showed a 75″ (4K) microLED TV based on smaller size chips from PlayNitride.

- Glo – has a 1.6″ (JDI) and 1.8″ (Kyocera) full color microLED display (LTPS backplane) and showed a full color RGB LED display for AR/VR.

- Plessey – demonstrated a 1080p microLED near eye display solution for AR/MR

- Jade Bird Display – has shown a 0.31″ monochrome green micro-display for AR/VR (3 million nits, 5,000 PPI) and a 0.3″ monochrome blue micro-display (150,000 nits, 10,000 PPI)

- PlayNitride & Tianma – have shown a 7.56″ RGB full color transparent display with LTPS backplane (114PPI, >600nits, 60% transparent). The have also shown an extremely thin (28um) flexible display and a 1.25″ 458dpi wearable display.

- CSOT – showed a full color 3.5″ transparent display (IGZO glass backplane).

- X-Display – exhibited a 5.1″ (70PPI) display

- VueReal – announced a 30K PPI, 100K nits MicrolED microdisplay in May 2019

Technology development prototypes with lab scale productions are very different to commercialized products. To compete with TFT LCD and OLED in the consumer market microLED products need to have zero defects, high performance, high uniformity, high consistency, high volume scalability and cost competitive manufacturing. Products sometimes take years to shift from prototype to commercialization and some never even make it to the market.

Image:TianmaComplex Manufacturing Issues

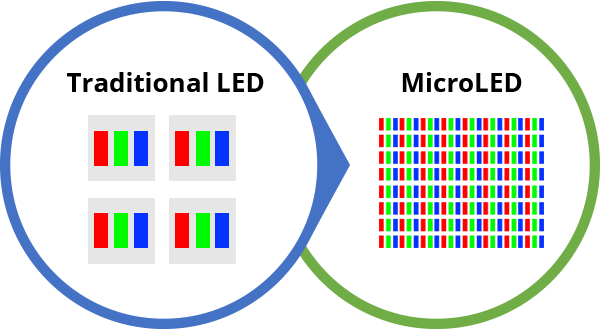

microLED is a self-emitting display technology consisting of arrays of microscopic LEDs each forming a pixel. It is simple in structure compared to OLED and LCD but has a complex manufacturing process. The microLED supply chain consists of the following steps.

- GaN epiwafer preparation

- Processing of thin film LEDs on the wafer

- Mass transfer of the chips to the display backplane

- Inspection and repair processes

Display integration of microLED can be generally of two types. One is heterogeneous integration, where microLED arrays use pick and place process, and chips are transferred from an epiwafer or carriers to the display backplane (LTPS or Oxide TFT in glass or flexible PI substrate). The other one is monolithic integration where process involves microLED arrays and backplane hybridization.

Mass transfer – of microLED devices is a critical enabler for cost competitiveness with TFT-LCD and OLED. Companies such as eLux are offering technology that moves microLED from the wafer to a substrate in a fluidic process where the microLED get dispersed in liquid and wells built on the substrate create a self-assembly system. The target of the tool is to work on Gen 6 LTPS substrates in the future. Collaborations of PlayNitride, Unimicron Corp (PCB backplane), and Macroblock (driver ICs) have shown the use of mass transfer of microLEDs into printed circuit board backplanes, which can reduce production costs. Startup company VueReal has developed micro printing technology that can make different sizes and different resolutions high density microLED micro-display.

Yield – Manufacturing and yield problems can become an issue in epitaxy, chip, mass transfer, bonding, driving technology, backplane, inspection and repair. Integration of in-process testing, redundancy and repair are used to improve yield. The industry is working to resolve these issues.

Uniformity – microLED chips need wavelength uniformity and thickness uniformity for display applications. Solutions from MOCVD suppliers such as Aixtron, Veeco and others are helping to resolve such issues. For example Veeco is collaborating with Allos (provider of GaN epiwafer technology) to achieve extremely good emission wavelength uniformity. The Aixtron MOCVD solution AIX G5+C and Planetary® technology is enabling high volume manufacturing of products with high-level wavelength uniformity and low defects that can help to increase yield and lower costs.

Testing – microLED companies also need to use mass testing and repair methods to reduce the cost and time of assembly. Companies such as Toray are working on equipment for microLED wafer inspection, repair and transfer. Laser repair equipment can remove defective microLEDs and then selectively transfer good microLEDs to complete the repair process.

Color Conversion – The mass transfer process that performs the bonding of RGB (Red Green Blue) microLEDs to the display backplane accurately and efficiently is very challenging. Also different colors of LED need slightly different voltage and drive currents. Color conversion by quantum dots or by phosphor provides another alternative. Using single-color (blue) microLED chips and color converting them with quantum dot layers can help in the manufacturing process. Nanosys has demonstrated a photo lithography-patterned cadmium free color conversion layer for microLED.

Source:PlayNitride

Source:PlayNitride

Supply Chain Development

microLED still faces many challenges in terms of mass transfer, mass inspections/repair, and supply chain establishment.

- There is no standard manufacturing solution for commercialization.

- Startup companies are mostly fabless with licensing capabilities, but they need partnership for manufacturing. Large established companies are reluctant to depend on single startup for their supply.

- Suppliers with LTPS-TFT capacity for backplane or other manufacturing capabilities need to invest capital for transfer, inspection/testing, and create path to mass market.

- Panel suppliers and set suppliers need to be confident about profit margins for business. Current market condition makes it difficult for display suppliers to invest capital in this new technology.

- Set makers are currently driving microLED chip decision strategy to improve product performance.

More partnership and collaborations among panel makers, set makers and microLED chip makers are required.

Application Market

microLED display have a strong potential to outperform TFTLCD and OLED as they offer high contrast, fast response time and wide viewing angles. The technology can also provide wider color gamut, very high brightness, higher readability, long lifetime, environment stability, high resolution, ultra low power consumption for mobile devices and options of using a flexible backplane. It also allows the integration of sensors and circuits, enabling thin displays with embedded sensing capabilities such as fingerprint identification and gesture control.

Companies are initially targeting wearable, AR/VR, digital signage, public display and automotive (HUD) applications. High-speed transfer, assembly technologies, yield and defect management need to improve before large volume commercialization in consumer products such as smartphones or TV.

Source:PlayNitride

Source:PlayNitride

Road to Commercialization

microLED display technology is making steady progress towards commercialization. However the technology faces several challenges, which will take more time to resolve. In the meantime, suppliers will test the market with higher priced, lower volume, value-based products. Samsung plans to commercialize a 75″ microLED TV based on PlayNitride chips by 2021. Apple may be also introducing microLED based wearables by next year.

Success in commercialization and mass production will depend on the ability to scale up for volume production with competitive price performance – SD

Sweta Dash, President, Dash-Insights

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insight.com