MiniLED display technology can enable LCD to achieve high brightness, very high contrast, better HDR (High Dynamic Range), thinner form factor and higher power efficiency to compete directly with OLED. MiniLED-based displays were introduced in 2018, but trade issues in 2019, and global pandemic in 2020 have delayed suppliers’ expansion plans and product introductions. Suppliers are now starting to increase capacities and investments.

The supply chain is evolving. Top consumer brands such as Apple are expected to introduce miniLED-based products by the end of 2020 and in 2021 for multiple applications. Cost is still the biggest challenge.

MiniLED: Different from microLED

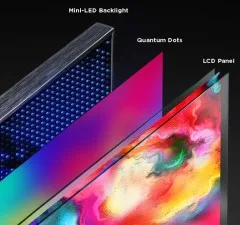

MiniLEDs are very different from microLEDs in terms of manufacturing process and their application markets. MicroLED can be considered as a revolutionary technology that will enable creation of a new self-emissive displays. MiniLED is a more evolutionary technology that can empower LCD backlights by helping in a reinvention process for most applications (high-end tablet, notebooks, monitors, TV, auto display, VR and others). It can also be used as a direct lit RGB LED for commercial applications like digital signage or control rooms.

MicroLED display still needs a technology breakthrough in mass transfer, higher manufacturing yield and significant capital investments to commercialize as reported earlier “MicroLED Display: Progressing Towards Commercialization“. However, miniLEDs can use existing fabs without major investments.

MiniLED: Enables Higher Display Performance

MiniLED-based display products were first introduced in 2018. Compared to microLED, this technology has higher manufacturing yield and is easier to mass-produce.

- In terms of LED size, miniLED lies between traditional LED and microLED. According to the current general consensus I have heard, microLEDs are mostly <50 microns in size; miniLEDs are generally 100 to 200 microns; and traditional LEDs are generally higher than 300 microns.

- By the use of multi zone blinking backlights (>10,000 zones), miniLED can enable LCD to have higher brightness (>1000nits), very high contrast (>10,000:1), excellent HDR, better color rendering, ultra thin form factor, superior power efficiency and display performance close to OLED.

- Due to miniLED’s small size, it can enable curved form factors and narrow bezels.

OLED can have a true black state and excellent contrast being an emissive display, but to achieve >1000nits it requires relatively high current which can impact lifetime. LCD can achieve >1000 nit brightness by increasing the number of LEDs but contrast ratio is very limited. MiniLED can resolve these issues. For HDR, pixel level dimming is best which is possible with microLED technology. MiniLED with multi zone blinking backlight can work as an alternative for higher HDR with >100000:1 contrast ratio and higher peak brightness. HDR is expected to be an essential feature for next generation display products.

ASUS ROG Swift PG27UQX G-SYNC ULTIMATE 4K 144Hz Mini LED HDR gaming monitor – source:Nvidia.com

ASUS ROG Swift PG27UQX G-SYNC ULTIMATE 4K 144Hz Mini LED HDR gaming monitor – source:Nvidia.com

MiniLED: Increasing Capacity

Major LED chip companies such as Epistar (Taiwan) and Sanan (China) are increasing capital expenditure to increase capacity. They are installing equipment for high-speed transfer, die testing and sorting to improve manufacturing yield.

Equipment suppliers such as Kulicke & Soffa and AMSPT are focusing on high-speed transfer and bonding while suppliers such as FitTech, Saultech are providing sorting and testing equipment. K&S and Rohinni have co-developed miniLED placement solutions. The development of tools that can increase throughput efficiently and handle smaller dies (<100 micron), can reduce manufacturing costs.

As miniLED technology uses a large number of small size LEDs, the process of testing and repairing is very important to reduce repair costs and improve yield. Testing and sorting companies are starting to report strong growth in demand from Taiwan and China. Driver IC companies such as Taiwan’s Macroblock are focusing on miniLED products this year. Most of the miniLED capacity is expected to come by the end of 2020 and in 2021.

MiniLED: Evolving Supply Chain

There are currently more collaborations among suppliers within the miniLED supply chain: substrate, LED epitaxial wafer, packaging, driver ICs, display suppliers and even consumer electronic companies. Panel suppliers are collaborating with their LED subsidiaries: AUO with Lextar and Innolux with AOT and other companies.

Epistar and Lextar announced a recent partnership to reduce overlapping investments and share production capacity for micro and miniLEDs. LED chip company Sanan is working with Samsung, while BOE has joint venture with Rohinni.

MiniLED supply chain companies such as BOE, China Star, AUO, Innolux, Epistar, Sanan, Lextar, Macroblock, ASM Pacific Technology, Nationstar, Refond, Yenrich, and many others are all working to develop better solutions. Consumer electronics companies are also joining in the collaboration and development.

According to published industry news, Apple is reportedly investing over $300 million to produce miniLED and microLED in Taiwan in conjunction with Epistar and AUO. The industry is buzzing with expectations about the possibility of a Apple 12.9” miniLED-based iPad Pro product introduction by end of 2020 or in 2021. Apple is reportedly planning to release six miniLED products by the end of 2021 including 14-inch and 16-inch MacBook Pro models, a 27-inch iMac Pro, a 10.2-inch iPad and a 7.9-inch iPad mini, including a 12.9-inch iPad Pro. Apple’s adoption of miniLED technology will have a very positive impact on the supply chain and growth potential.

MiniLED: Cost Challenge

Cost is a big challenge for miniLED. Cost reduction can be realized through advance chip production and higher throughput for the transfer and assembly process and PCB and driver IC enhancements. Chip production can be improved through reductions in chip size, improvements in uniformity and boosting luminous efficiency.

Epistar is changing the beam angle of LED chips using proprietary reflectors leading to a reduction in the number of chips used. Upgrading transfer and assembly efficiency and accuracy can also improve manufacturing yield. Panel suppliers are switching backlight connection backplanes to use glass with active driving solutions to reduce costs.

Most of the suppliers in the miniLED backplane market are also paying attention to microLED. Some suggest that processes such as faster bonding, faster transfer, precise backplane that are being developed in next few years for microLED can also help miniLED to reduce costs. That could enable miniLEDs to shift from incremental cost reductions to substantial cost reductions. Panel suppliers and component suppliers are expected to focus more on cost reductions in 2021 to support brands’ product introduction of miniLED-based displays to drive growth and expansion plans.

According to the LEDinside research division of TrendForce,

“the manufacturing cost of Mini LED backlight displays is currently higher than that of traditional LCD and OLED displays. However, as manufacturers continue to make improvements in process technology and yield rate, the cost of Mini LED backlight displays is expected to undergo 15-20% YoY deceases and to potentially be lower than the cost of OLED displays by 2022, making Mini LED a cost competitive option in the market. “

Quantum Contrast is made of approximately 1,000 control zones – more zones, improves performance and minimizes unwanted artifacts, such as “halos,” associated with other LED-LCD TVs. Source TCLUSA.com

Quantum Contrast is made of approximately 1,000 control zones – more zones, improves performance and minimizes unwanted artifacts, such as “halos,” associated with other LED-LCD TVs. Source TCLUSA.com

MiniLED: Application Market

MiniLED-based products are already being shipped for high-end monitors and TV. Display panel suppliers have shown many prototypes of miniLED-based products at DisplayWeek 2019:

- Tianma (HDR LTPS LCD smartphone)

- CSOT (5.99” LTPS LCD smartphone)(15.6” LTPS notebook) (12.3” curved LTPS LCD auto display)(65”, TV 2000 nits, BT2020 color gamut)

- AUO (17.3”, 4K, HDR, notebook) (12.3”, curved auto display) (2.9”, LTPS LCD, 1688PPI for VR)

- BOE (15.6, oxide LCD, 240Hz, HDR notebook).

- TCL was first to introduce miniLED backlight based QD TV in 65”(<$2000) and 75”(<$3000) in 2019.

- At CES 2020 consumer brands showcased: Acer and Asus (QDLED 4K G-Sync gaming monitor BT 2020).

- Vizio unveiled a miniLED backlight-based 8K LCD TV

- MSI announced first 17” 4K laptop with miniLED display

- TCL showcased Vidrian 8K TV by directly infusing miniLEDs into glass substrate greatly increasing performance.

TCL 65″ Class 8-Series 4K QLED Dolby Vision HDR Roku SmartTV – 65Q825- 65inch-MiniLED backlight- $2999 – Source:TCLUSA.com

TCL 65″ Class 8-Series 4K QLED Dolby Vision HDR Roku SmartTV – 65Q825- 65inch-MiniLED backlight- $2999 – Source:TCLUSA.com

MiniLED costs have gone down recently due to increased efficiency and lower chip costs. It still faces cost challenges to become competitive. With Apple’s introduction in tablet and IT products more brands are expected to follow. In the near term, suppliers are focusing more on value-based applications such as high-end tablet, notebook, gaming monitor, TV, automotive and VR.

MiniLED-based products can open up new opportunities for the display market. It can enable LCDs with higher performance, thinner form factors and lower power consumption to compete with OLED and drive replacement demand with higher specs. MiniLED-based products are poised for expanded market presence. Success will depend on its ability to reduce cost to drive demand. (SD)

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insights.com