As LCD makers looked to differentiate their product by offering LCDs with miniLED backlights with greater contrast ratio and higher luminance, they, in effect, opened more of the 270m unit notebook market to OLEDs, which in the past have been limited to 50% of 1.35 billion smartphones and 8 million of the 20 million TV panels 50” and greater.

The rest of the display market is generally untouched by OLEDs with the exception of 50m <2” panels smart watches, ~1m panels for automotive and the recent introduction of the Nintendo Switch. The irony is that without MiniLEDs, there would be only a limited value proposition for OLEDs. But MiniLEDs has proved to the notebook and tablet set makers that the market would accept a differentiated product with a higher end display at a higher price point. Enter the OLED tablets and notebooks, which already compete with MiniLED displays much as they do in the Advanced TV market

OLED technology is not well suited for monitors, where much of the usage model is relative constant images with lots of white space. There is a small segment of the 200 million unit market (less than 3%) for gaming, where OLEDs are considered the ‘go to’ product, because of fast switching, high contrast, VRR and wide viewing angle requirement in multi-person game playing.

In the notebook market, OLED displays were used sparingly for niche products, but there have been several announcements that indicate the category will be a larger target for OLEDs.

- Apple expects to produce at least 1 MacBook Pro model with an OLED and is also designing in OLEDs for their high-end tablets. Apple’s IT design criteria includes brightness at ~2,000 nits and lifetimes of over five years, which has been viewed as meaning a need for a dual stack of OLED materials and an LTPO backplane.

- Asus announced that all future notebooks would have OLED displays or at least an OLED option

- Samsung expects to ship 10m OLED notebooks in 2022

- LGD is allocating some of their limited Gen 6 capacity to notebooks and tablets

- SDC is building a Gen 8.5 fab with 30,000 substrate/month capacity that will initially be dedicated to IT applications and will use some of its excess Gen 6 capacity for IT

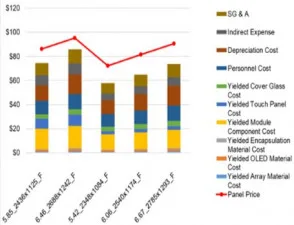

Gen 6 OLED fabs tend to be optimized for the smartphone size and are not very productively sized for the larger notebook models. In the table below, the cost of a 5.42” flexible panel is compared with a 15.6” rigid panel cost and the revenue per substrate is calculated. At yield of 80%, the 5.42” panel generates ~$25K in revenue/substrate with a $4000 gross profit. To achieve the same revenue, for 15.6” 4K panels, the price would have to rise to a non-competitive $610 as the # of panels per substrate is 40 compared to 336 for the 5.42” model. LCDs at 15.6” in volume have a market price in the $47 range and MiniLED LCDs are priced in the range of $60 to $75. Selling at below $150 per panel would generate ¼ the revenue of the typical smartphone panel and produce zero profits.

Table 1: 5.42” vs. 15.6” Revenue Generation Potential on Gen 6 Fab – Source: OLED-A, DSCC

Table 1: 5.42” vs. 15.6” Revenue Generation Potential on Gen 6 Fab – Source: OLED-A, DSCC

By using a Gen 8.5 Fab vs. a Gen 6 Fab the number of 15.6” panels/substrates grow from 40 to 84/substrate and the cost is down to ~$70 for a single stack and $75 for a dual stack depending on yields and utilization. The use of idle (under-utilized) Gen 6 capacity for IT is a win as for each 10% increase in utilization, smartphone panels, cost is reduced by ~2%. Samsung’s Gen 8.5 for IT reflects a commitment to expanding the OLED market and protecting their leadership position from the inevitable challenge of the Chinese, while LGD dips its toe in the IT water, as an accommodation to its best customer, Apple. The ironic part is that without MiniLED LCDs, there would be no place for OLEDs in notebooks.

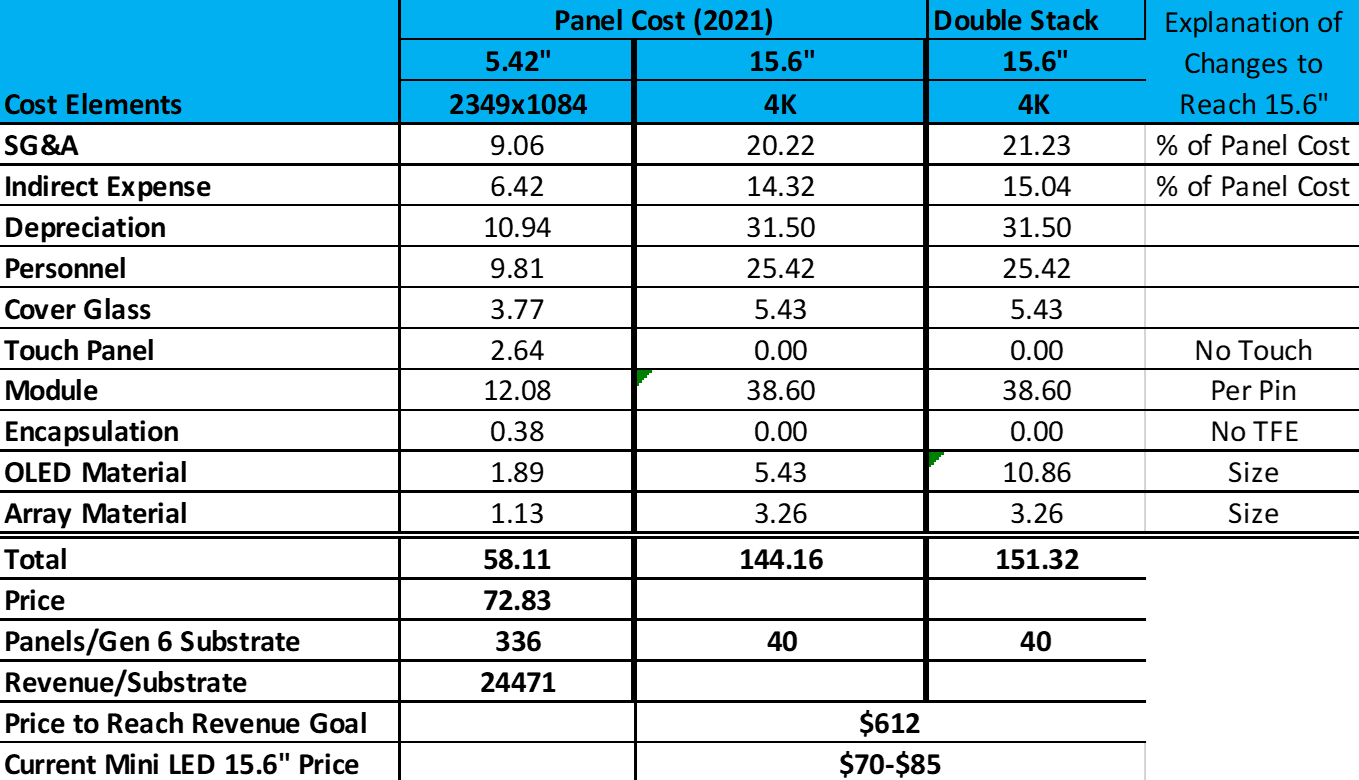

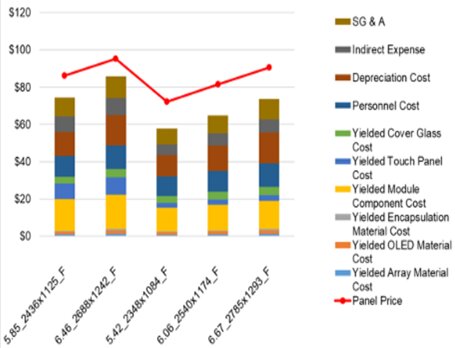

In developing the 5.42” and 15.6” OLED costs in Korea, the following baseline chart from DSCC was used.

Figure 1: OLED Panel Costs in Korea (circa 2020). Source:DSCC

Figure 1: OLED Panel Costs in Korea (circa 2020). Source:DSCC

Samsung’s decision to build a Gen 8.5 for IT reflects a commitment to expanding the OLED market and protecting their leadership position from the inevitable challenge by the Chinese, while LGD dips its toe in the IT water, as an accommodation to its best customer, Apple. (BY)

Barry Young is the CEO of the OLED Association