President Han Jong-hee at Samsung Electronics (Visual Display) recently agreed to use QD-OLED panels in their TVs, after almost a year of claiming the technology was inconsistent with their current strategy of using LCDs with LED backlights for the low end, LCDs with QD enhanced LED backlights for the mid-range, QD enhanced Mini LED LCDs for the upper range and MicroLED TVs for the ‘one percenters’. This week Samsung Visual introduced their MicroLED Consumer TV, a 110” 4K device for $155,000.

To get Samsung Visual to take their QD-OLED panels, which no other TV brand has yet to do, SDC is extending its schedule to close its remaining LCD fabs from March until the end of this year. Apparently, it was President Han who made a proposition first.

SDC has a Gen 8.5 production line (Q1) with 30,000 substrates/month capacity in Asan and it has conducted pilot operations since December last year. SDC expects to have prototypes by mid-2021 and to begin mass production in 2022. Samsung Visual staff had expressed concern about the high unit cost, and the difficulty of incorporating yet another new technology into the TV range.

Samsung Visual’s new interest in QD-OLEDs was driven by changes in the supply chain for TV panels that goes back to the beginning of 2019, when TV panel capacity was rising faster than demand causing SDC and LGD to both sell TV panel capacity in China and plan to either shutter old LCD fabs in Korea or convert them to OLEDs. Then the pandemic hit and the work at home phenomena increased demand for notebooks and monitors causing panel makers to shift production from TVs to notebooks and monitors where the revenue per sq. m is higher. The shift caused a shortage of TV panels and prices rose 50% to 70% over the last 8 months. SDC and LGD delayed their LCD phase-out plans.

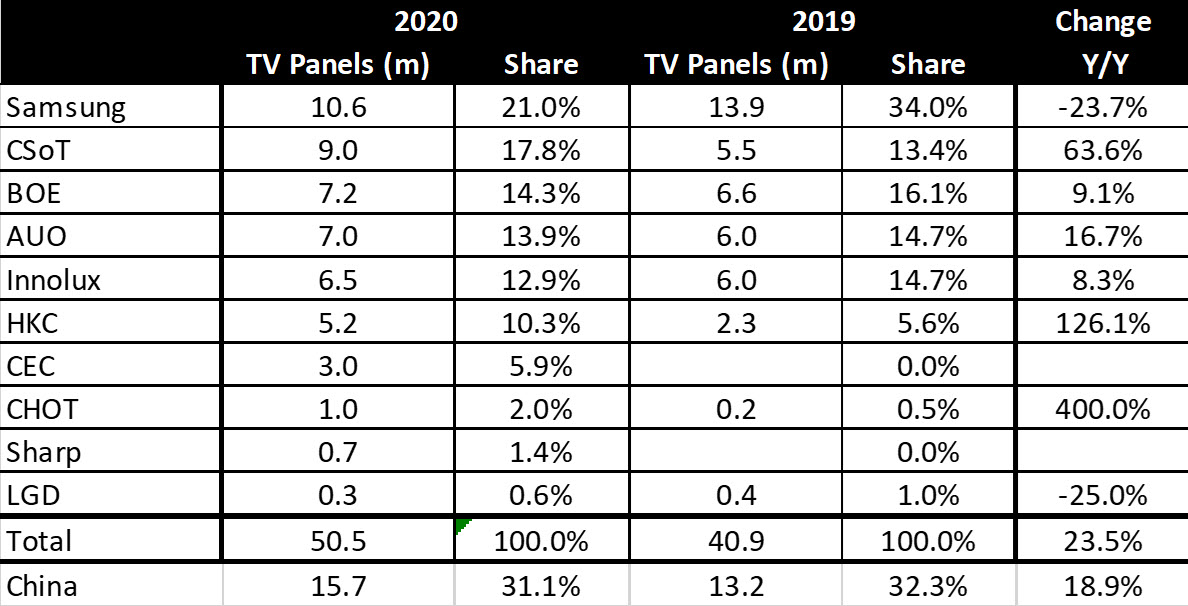

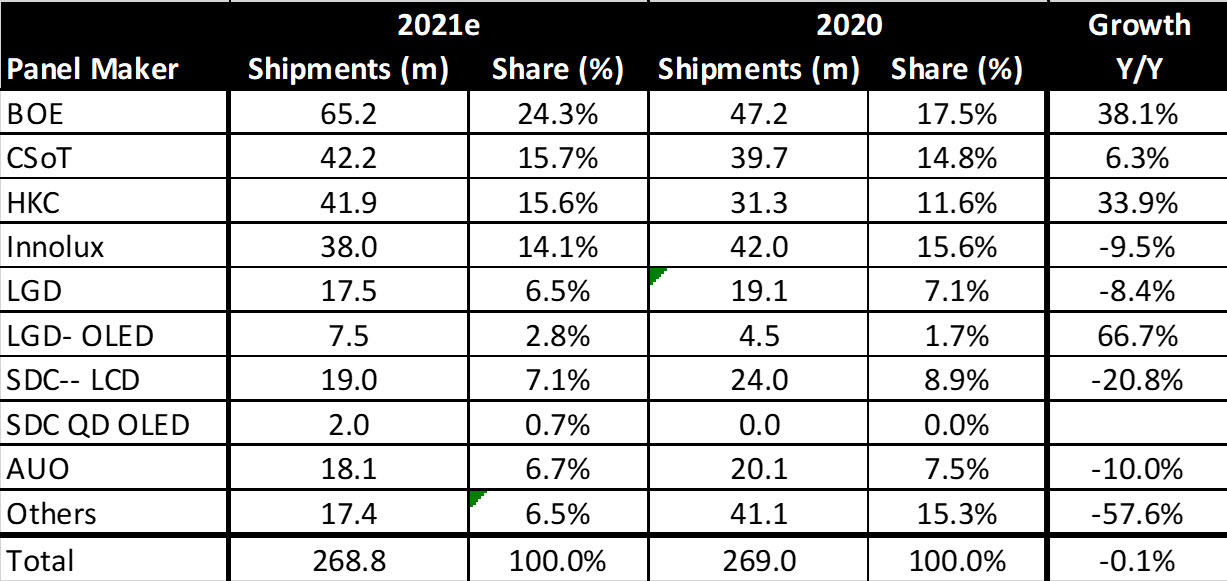

However, Gen 10.5 capacity in China is rising, notebook and monitor growth is relaxing, and TV panel prices are expected to start decreasing in the 2nd half of 2021, which would enable SDC and LGD to revert back to their LCD exit strategies. The next two tables demonstrate the nature of Samsung Visual’s supply issues. In 2019 and 2020, China provided 32% and 31% of Samsung TV panels, but SDC was a declining source. In 2021, SDC’s LCD panel capacity could drop by 20% making Samsung Visual even more dependent on Chinese panel makers. If SDC were to close their LCD fabs, China’s share would increase by 10m panels, rising to over 50% of Samsung Visual’s TV business. Any overt or covert action by the Chinese to reduce sales to Samsung would be devastating to the business.

Table 1: Samsung Visual’s LCD Panel Suppliers, Share, Change Source:Omdia

Table 1: Samsung Visual’s LCD Panel Suppliers, Share, Change Source:Omdia

TV Panel Production Share Growth. Source:Trendforce

TV Panel Production Share Growth. Source:Trendforce

Samsung Visual’s strategy of concentrating on Advanced TVs (as defined by DSCC) is also threatened by the Chinese because the primary source of 65” TV panels is the collection of Gen 10.5 fabs in China and the Chinese goal is to dominate the profitable Advanced TV market where Samsung has a 50% share, and which generates ~$20 billion in annual revenue. Enter SDC, which still operated LCD fabs but is investing $12 billion in QD-OLEDs, despite lacking commitments from any TV brands. Samsung Visual proposed that Samsung Display extend its LCD production until at least the end of this year and promised to use QD-OLED display panels. Samsung Display agreed to the extension as it has been desperately looking to secure customers for its QD-OLED panels and will continue mass-producing LCDs at its 8-2 LCD production line in Asan until at least the end 2021.

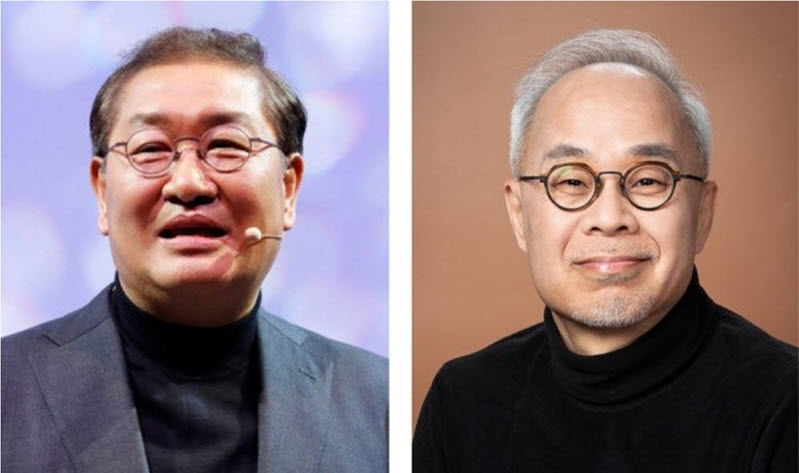

Figure 1: President Han Jong-hee (left) at Samsung Electronics and President Choi Joo-seon of Samsung Display. Source:ETNews

Figure 1: President Han Jong-hee (left) at Samsung Electronics and President Choi Joo-seon of Samsung Display. Source:ETNews

A New Story

But the new cooperation is not the end of the story. On the heels of this QD-OLED announcement is an unconfirmed report from Korea’s MTN that Samsung Visual and LGD had inked a conditional deal for Samsung to buy up to 1 million OLED panels in the second half of 2021 and up to 4m panels in 2022. Samsung Visual vaguely denied the report (there was an interview with the President of the VD division by the IT Chosun who said it was ‘just rumours’ – editor) but Samsung Visual and LGD have been meeting periodically for over a year negotiating the purchase of OLED panels by Samsung Visual, with the final hang-up being marketing strategy. For years, Samsung has criticized LG OLEDs for their aging issues and lower luminance, while LG has countered with the poorer contrast, color quality and response times of Samsung’s version of LCDs. The companies couldn’t agree on how these market ploys would be walked back.

Given LGD’s current capacity, adding a 4m panel demand would exceed their production for LGE, Sony and Samsung by ~30%, not to mention the needs of the remaining 15 brands. From LGD’s perspective it would help justify the 30,000 substrate/month addition to the Gen 8.5 fab in Paju and outfitting the empty Gen 10.5 building in Paju. Complicating the timing is LGD’s progress in testing their inkjet printing (IJP) tool (possibly from Tokyo Electron) that might further delay equipment purchases.

For SDC, this action by Samsung Visual can be looked at positively as a way to kick start Samsung Visual’s entry into the OLED TV market while they await the results of the QD-OLED experiment. Alternatively, it could be seen as Samsung Visual’s doubting the SDC strategy, because QD-OLEDs are both behind schedule and more expensive than LGD’s OLED panels and would be even less costly if LGD has a Gen 10.5 fab with IJP.

Samsung VD Needs to Break Free from China

For Samsung Visual, breaking free from China’s stranglehold on LCD capacity is paramount and based on the current state-of-the art of MicroLEDs, it will be years before the technology can get down to the $2,000 to $4,000 price range needed to compete for the high end consumer TV market (if ever). If it takes until 2025 to get a consumer competitive price for a consumer 65” TV at $4,000, and 8K would be the target resolution, and the MicroLEDs are 80% of the panel cost, the percentage reduction for the emitters over the next 4 years would have to exceed 99% of today’s MicroLED cost. Clearly, Samsung Visual needs a back-up plan! (BY)

Barry Young is the CEO of the OLED Association