Gray is a very experienced analyst on the TV market so is always worth a listen. I often quote his opinions on the market. As HbbTV is a European standard, he focused on the European market.

He started by saying that demand for TVs has been ‘unprecedented’ as people have been locked up. This was not just in the developed world, but throughout developing regions, highlighting the key role that TV continues to play as a communication device. The supply chain was well run and ‘most of the people got most of the TVs most of the time”.

In terms of Europe, the West saw the best conditions for a decade although demand is starting to fade. Eastern Europe is different and is very affected by the Russian market which has never fully recovered from the Ruble devaluation in 2014.

People ordered take-aways and watched a video in most of Europe over the last couple of years and no delivery platform really lost out. Linear TV, Pay TV and online all grew but not dramatically in percentage terms. As he said, when you’re watching five hours of TV per day, it’s hard to double that and hold a job down! Online did do particularly well in percentage terms, including catch-up services using HbbTV.

Short form media grew, but there was a shift back to long form video and this probably reflected different commuting habits. Even short form seems to be looking more like long form.

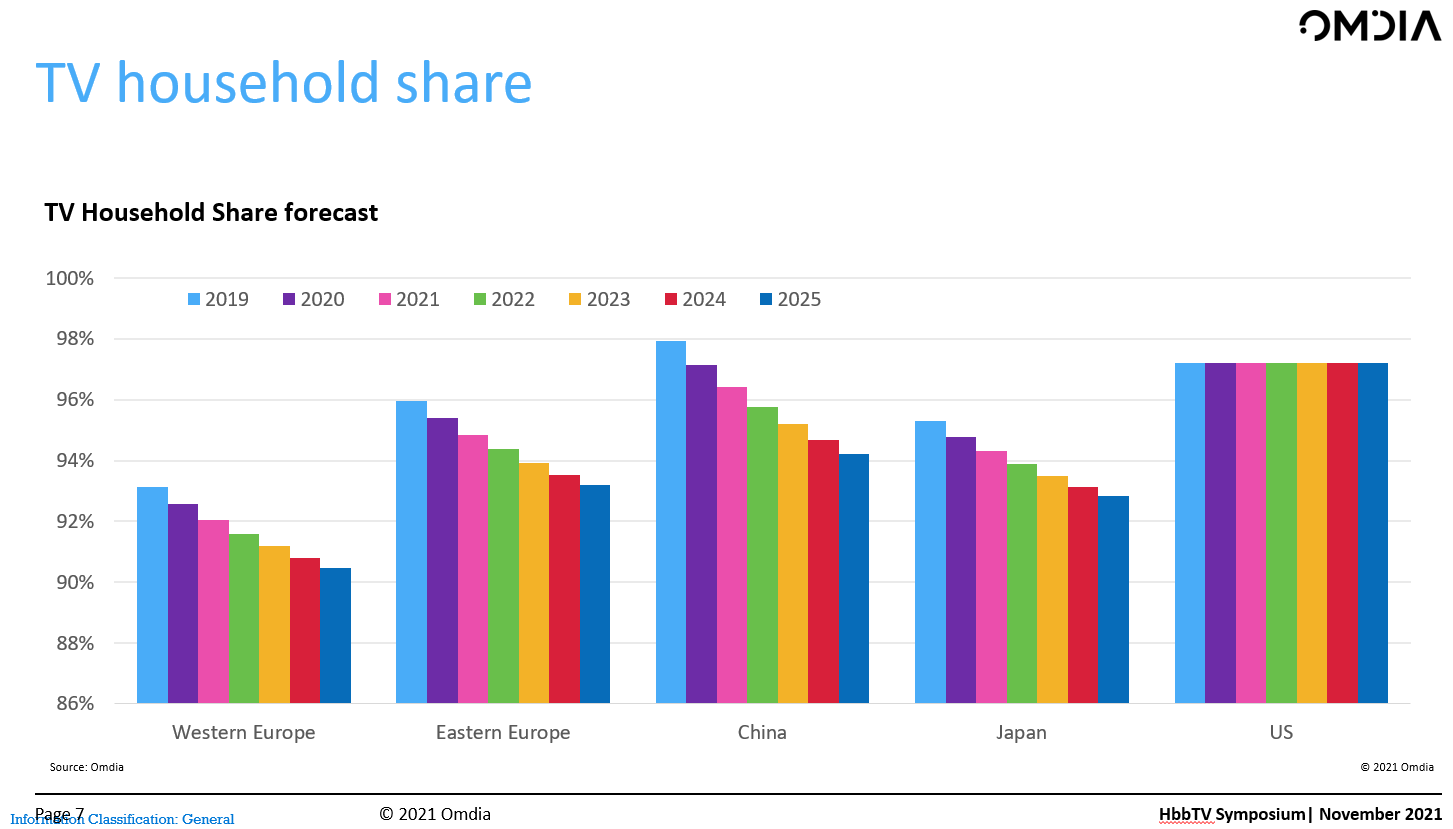

There has been talk over years that TV households are reducing, but it has been hard to get data. However, it is happening. In Germany and Sweden, TV-owning households are below 90% now. Japan and even China are seeing falling ownership – a trend that started in China in 2002 even before smartphones arrived. The US is flat. Later, in responding to questions, Gray said that TV in the US is often ‘video wallpaper’ whereas elsewhere there is more focussed watching of content.

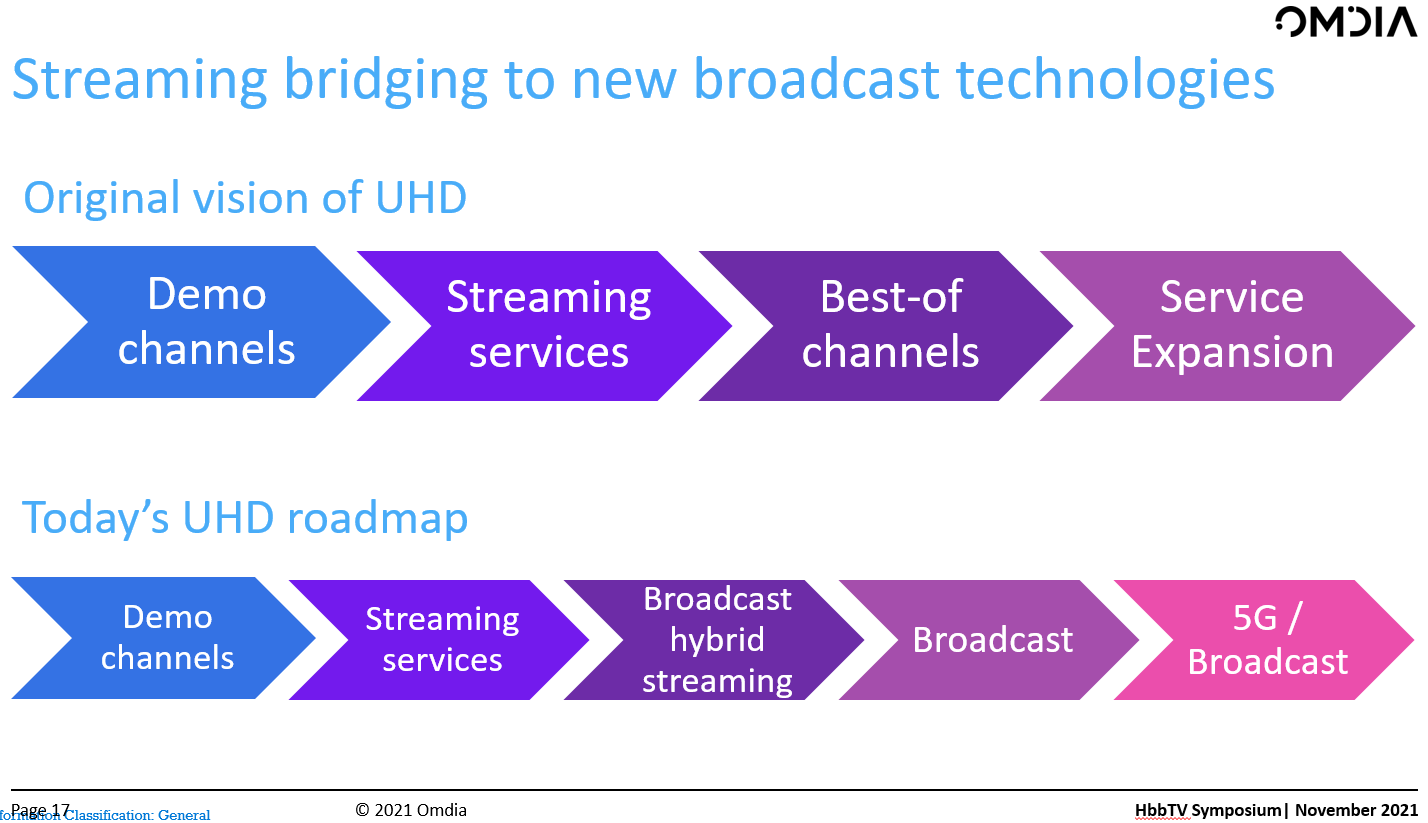

Pay TV and free to air (FTA) TV are well established in Europe but online has really increased. Streaming is likely to be a key enabler for UltraHD technologies. Gray is less sure now that UltraHD will be the next big broadcast platform, although he saw this as the likely outcome previously.

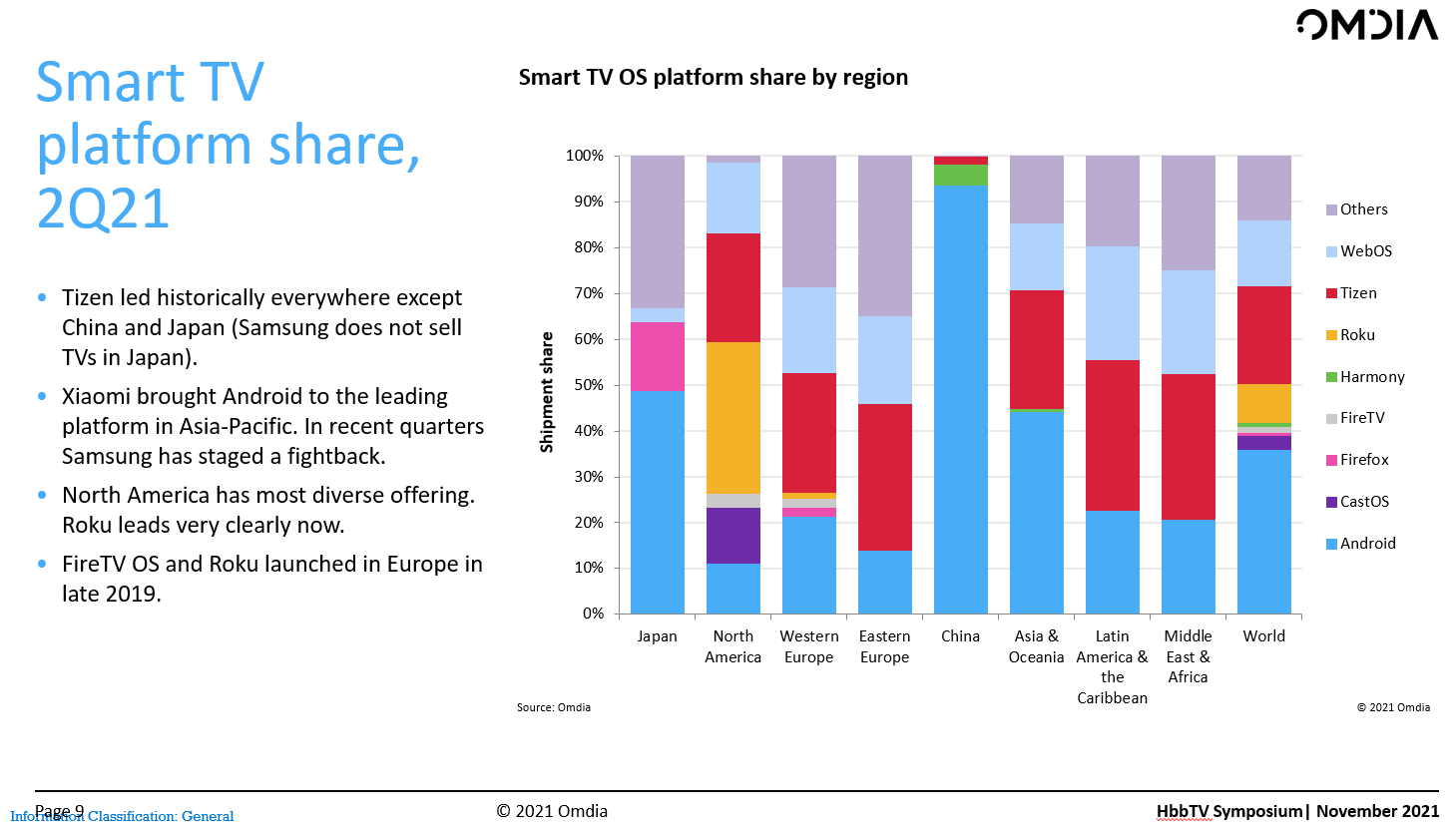

Turning to SmartTV and the platforms, there are big regional differences with the US very competitive and with diverse platforms, whereas in China, it is nearly all Android although every brand has its own ‘fork’ of the platform because of the limits to Google’s operation in the country. Apps will normally load across sets from different brands. “Others’ in Europe are big because the integrated HbbTV functionality is good enough for many viewers.

Gray focussed then on “the new TV battleground”. If you are a streaming service provider, it’s tough. Omdia tracks 5,349 different on-demand streaming platforms globally. It is very hard for services to get noticed. One way is to have TVs and Sky has launched its Glass TV (when is a tv) in the UK and Amazon has the FireTV that is also optimised for streaming.

The battle in the past was always to be the first channel on the tuner, then it was to have the widest number of apps on a SmartTV, but it turned out viewers just wanted ‘TV’, so there was a battle to become the first app on the SmartTV. Channels became apps and the new phase is ‘who controls the TV’. This is a ‘playing field that some are trying to tilt’ and there are interesting issues around platform neutrality.

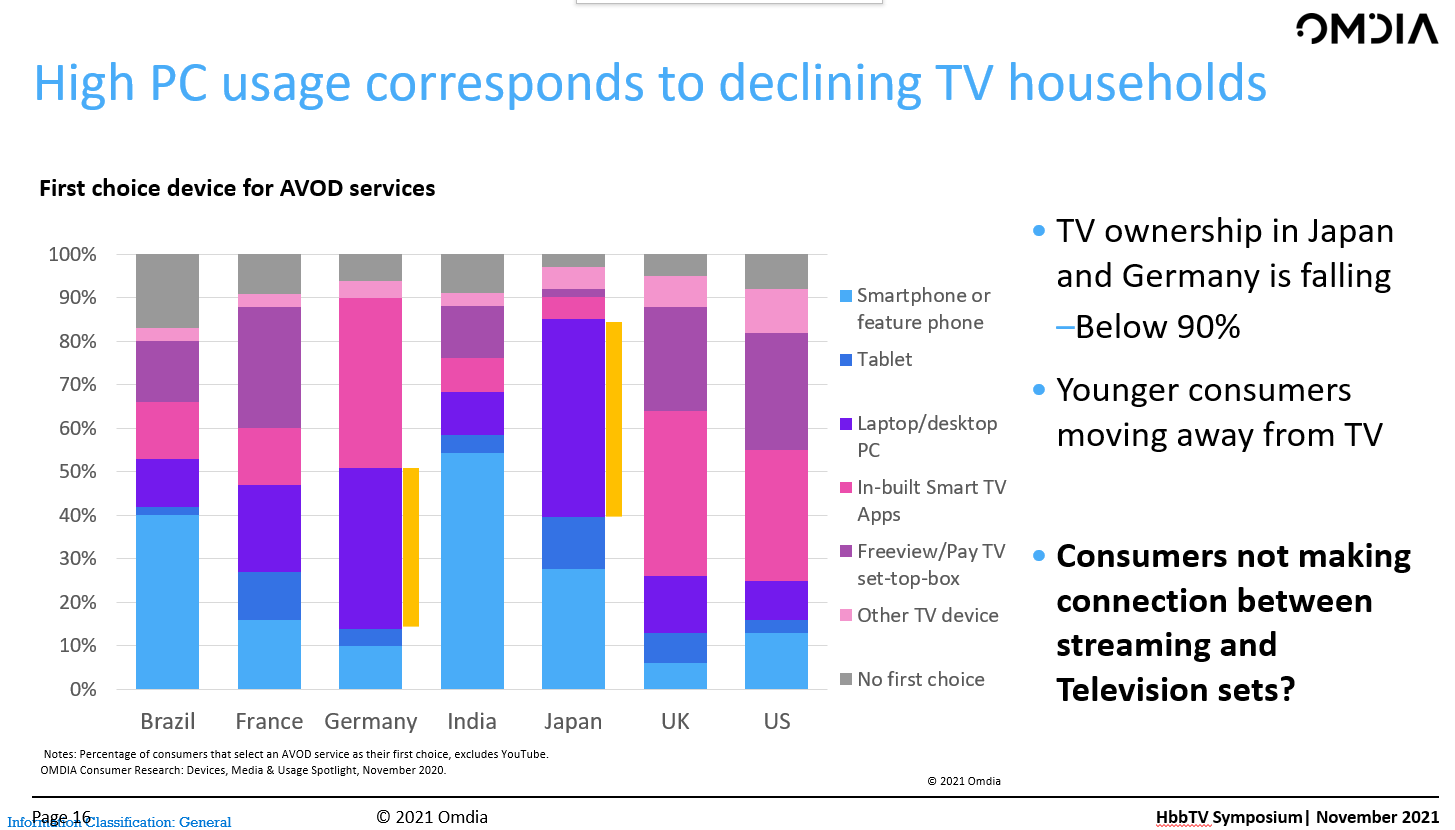

What do consumers want out of all this? Omdia did some research with consumers in several countries on how they wanted to get video. What is surprising is how different the countries are. In Germany and Japan where there are more households without TV and more single person households, there is much more use of PCs for watching video. It’s not clear why this is the case – it may just be that younger consumers have not bought a TV because they rent.

The original model for UltraHD is not going to happen and in the Olympics there were only three channels that offered live UHD services that were not streamed. In the future, 5G hybrid broadcast will mean that consumers are unaware of how the content is getting to them with dynamic switching. There are good environmental reasons to switch off powerful broadcast transmitters at night when few are watching. Gray repeated, in questions, his long held view that the key technology for UHD is HDR rather than ‘more pixels’.

In conclusion:

- All growth lies in streaming. Consumers want 3-5 hours of TV per day and linear TV is not going away, but consumers want choice.

- The battle has become one for attention. Ten years ago we went from 5-10 channels to 50 or 100. Now the amount of choice will increase again by a factor of 10 or more.

- HbbTV has to play a role in helping those that want to get more attention.

In response to a question about the forecast for PayTV, Gray said that his forecast is flat because Europeans typically pay a lot less than they do in North America, so there is less financial benefit from cancellation. US consumers, on the other hand, are still spending as much on TV services, with an average of 7 SVOD services each.

Responding to a question about gaming and eSports, Gray said that games and other long form content need to be considered together. TV has got more like film and gaming is becoming a third area of content. (BR)