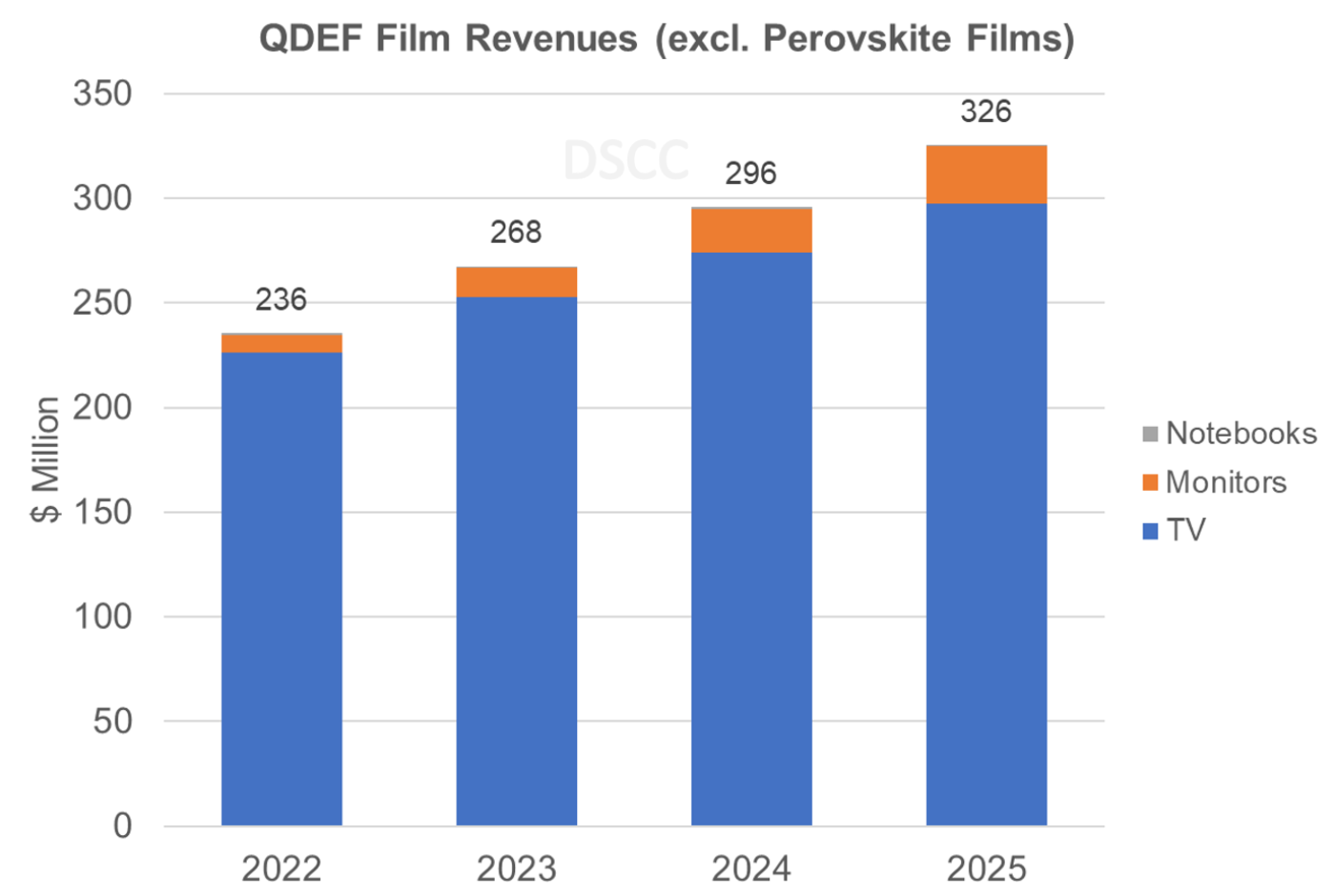

Last week DSCC released some interesting data and a forecast for the market of QDEF films for use in LCDs. It got me thinking. QDEF (Quantum Dot Enhancement Film) has been the main way QDs have been used in LCDs (or displays in general) although that could change going forward.

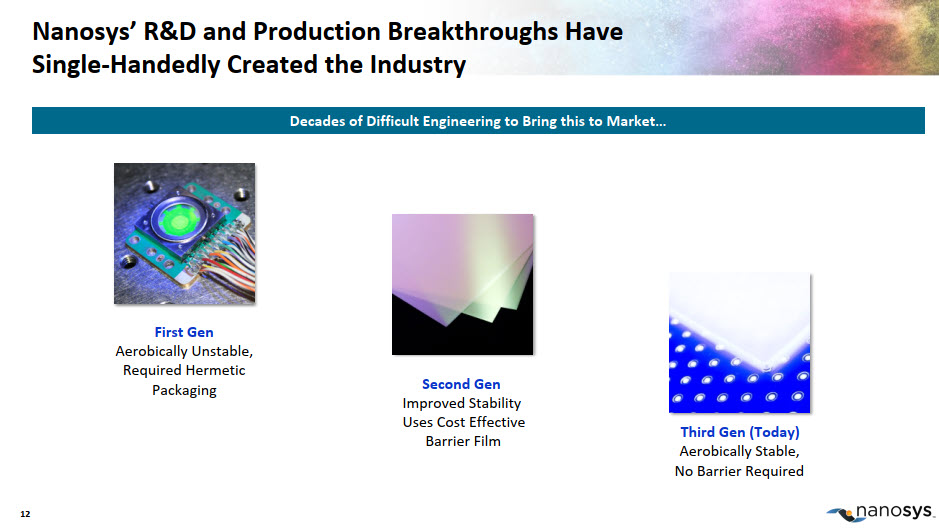

Quantum dots are amazing materials, but they have (or, maybe, had) a big weakness. They are very sensitive to oxygen and, to a lesser extent, water so early implementations (from QD Vision et al) put them in a sealed glass tube to be laid alongside blue LEDs in the side lights that were used on nearly all LCDs when they were introduced. That should have been simple but I remember hearing from a monitor engineer at the time that it was harder in practice than expected. I had (and may even still have somewhere in the loft) a Philips monitor that used this system, but the brightness uniformity was very poor. So QDs in a tube didn’t last. Samsung bought QD Vision’s IP.

One of the early adopters of quantum dots for use in displays was 3M which had a big division selling films (reflective films and DBEFs etc) into LCD makers. I used to run a lot of training courses on LCD technology ‘back in the day’ and delegates were always amazed at how many different sheets of film there were in an LCD module. So, naturally, 3M developed a film to exploit the wider gamut and purer colours available with QDs. To avoid having an extra layer, the QDs were embedded in the diffuser film that was already being used inside the LCD, between the backlight and the LCD cell. Unlike the ‘side tubes’, the engineering was relatively simple and basically just meant replacing the diffuser with a QDEF film.

The film, though, needed encapsulation layers on the top and bottom to protect the QDs, and that added to the cost considerably and meaning that the cost of QD-equipped sets were limited to the premium end of the TV market. Eventually, 3M exited the QDEF business, but others have continued and nearly all of the QD TVs and monitors shipped in recent years have used QDEF, although not all film makers had suitable encapsulation technology, which has limited the supply chain.

QDs Have Advantages

QDEF has a particular advantage. If you try to use QDs to convert to ‘pure’ colours (as Samsung does in its new QD OLED technology and the way that LCD makers tried to replace the filters with QDs), you run into trouble as some of the blue light leaks through and reduces the purity of the red and green. (That problem is avoided by Applied Materials in its latest microLED idea by using UV LEDs which do not produce visible light Applied Materials Overcomes Some Challenges in MicroLED for VR). Blue leakage through the red and green pixels makes it very hard to achieve the wide colour gamuts that QDs are designed to deliver.

To ensure that all the blue light is absorbed by red and green QDs, you need quite a lot of QDs in a (relatively) thick layer and they are expensive. That’s not a problem with QDEF because the light coming out is expected to be a mixture of red, green and blue and the colours are separated later in the filter. A further complication of using separate red & green subpixels is that there is a certain amount of self-absorption by QDs which gets worse as the layers get thicker. (WCG Heavyweights Slug it Out at Display Week)

Reducing the Costs

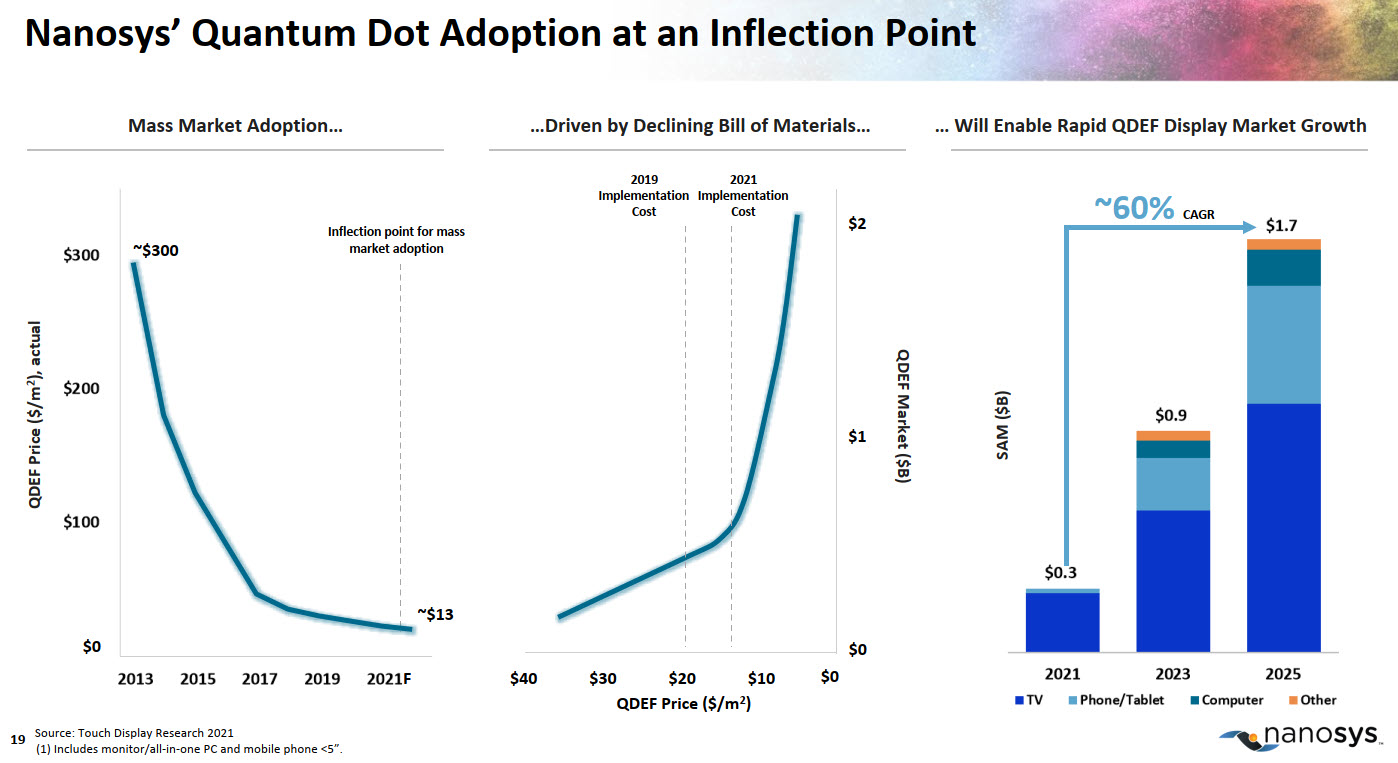

Nanosys wanted to reduce the cost of implementing QDs, to help push them from the premium end of the market to the mainstream, so has done a lot of work to make their QDs less sensitive to the environment. At Display Week last year, the firm announced that it had new QDs that did not need expensive encapsulants and are ‘air stable’ so they could be directly embedded into the plastic diffuser plates that are used as light guides (LGPs) for LCDs. Jason Hartlove of Nanosys said that it was using this xQDEF idea to significantly reduce the overall cost of including QDs into TVs. Light guides are used in LCDs where the LEDs are around the edge (which is still most of them) to distribute the light across the whole panel and to get it to be directed out of the front of the display. In backlit displays they are used to help diffuse the light from individual LEDs to create an even white.

As well as creating better colours, Nanosys says that the xQDEF plates, are actually better diffusers than traditional components. The improved diffusion means that the LEDs can be put closer to the back of the LGP, reducing the thickness of TVs. The xQDEF concept has been adopted by CYD, a Chinese maker of LGPs and by Hisesense, Skyworth and TCL. (Breakthrough “Air Stable” Quantum Dot Component Enters Mass Production) The air-stable QDs can also be used in films that are coated with PET without needing expensive barrier layers.

Looking at the DSCC data, there is almost no presence of QDs in the forecast in the notebook application. I checked with the firm that its data for QDEF includes the xQDEF technology.

Challenges in Notebooks

There seem to have been two distinct challenges for QDEF in notebook. One is that, although QDs are efficient at light conversion, there is some light loss. That means more power consumption than for other approaches, which makes the technology less attractive to notebook makers. QDEF has traditionally been thicker than other films, and adding thickness to notebook LCDs is another factor that makes the idea less attractive. DSCC told us that it expects perovskite films to be more significant than QDEF in this application because of wider gamuts and better efficiency (and that’s probably a topic for another day!). GE has talked a lot about the use of its KSF phosphors combined with perovskite films to create green. (WCG Heavyweights Slug it Out at Display Week)

Looking at the numbers, DSCC clearly doesn’t think that there will be a major impact from the development of xQDEF.

Of course, DSCC is not the only forecaster and at Display Week, Jason Hartlove quoted a forecast for QDEF that is very different from the cautious DSCC numbers. The forecast quoted by him showed the QDEF market growing from around $300 million this year, but up to $1.7 billion by 2025! That is very different and is based on the concept that the cost of QDEF has come down from as much as $300/m² in 2013 to just $13/m² in 2021 and falling further to under $5/m² in the future.

So, as the saying has it, in terms of forecasts ‘You pay your money and you take your choice’*. If you are GE or a perovskite maker or simply not convinced by the idea of xQDEF, buy the DSCC report. If you are Nanosys, you clearly need the Touch Display Research forecast. Personally, my gut feel is that if the cost figures for implementation of xQDEF are accurate, the result might be nearer Touch Display Research than DSCC. A factor is that QDs have been widely marketed as a premium solution (and will be, even more, with QD OLED sets hitting the market) and so will be recognisable as ‘better’ by consumers. The same cannot currently be said for ‘remote green perovskites with KSF phosphor’! (BR)

* and as my friend Jon Peddie says ‘if you use a crystal ball, every now and then you have to be prepared to eat glass’.