I’m at CES, in the middle of the press day and I did think about writing about the first impressions, but I’ll leave that for later in the week. In the meantime, there was an interesting item of news in early December that I have been meaning to write about. The news was that AT&T is ‘done with new satellites’ for future broadcasting.

Now, the fantastically high bandwidth at relatively low cost of satellite broadcast has been a key enabler of quality improvements in TV all around the world. Without satellite, even FullHD would have taken much, much longer to penetrate, let alone UltraHD.

One of the key drivers for FullHD was that the US satellite broadcaster, DirecTV, which was built on direct-to-home satellite (as opposed to satellite broadcast to cable or other head ends for local distribution), made a huge contribution to the push to HD by adopting it very strongly, even though when it started there were relatively few sets out in the market. The company took the risk and really promoted the technology. The result was that early adopters, the wealthier consumers started to shift to FullHD and to DirecTV as a service provider.

The consequence of that success was that other broadcasters saw a decline in their audiences of the consumers that advertisers most wanted to address. That gave them no choice but to meet the compete in order to keep their viewers. After all, once you get used to HD, you really don’t want to go back to SD.

This was different to the situation in Europe. Public broadcasters do not have the same imperative to keep particular groups of viewers, they really want the maximum possible audience because their funding is usually politically driven. Pay TV providers such as Sky did have a good reason to go HD relatively quickly as they could charge a premium, but the rest of the market has continued to lag in Europe.

The same logic applied for UltraHD/4K and pay TV operators such as Sky in the UK and Germany have worked hard with satellite providers, especially SES which, in Europe, has been a big promoter of higher quality (and therefore higher broadcast bandwidth). Of course, high dynamic range (HDR), wide colour gamut (WCG) and high frame rates (HFR) also need more bits to work well, which suits the satellite operators.

However, at the end of November, I saw news reports that AT&T, which now owns DirecTV in the US, had said in an analyst presentation that “We’ve launched our last satellite”. John Donovan, CEO of AT&T Communications who supervises most of AT&T’s cable-based and internet-based video services. The key reason is that although satellite is a very low cost way to multicast video (sending the same content to many people at the same time), the trend is towards unicast systems as consumers increasingly want to watch their content when its convenient.

This trend has seen the market for geostationary satellites drop from an average of 20 per year in the past to just five, according to SpaceNews. Around the time of the AT&T story, Inside Satellite TV reported that Deutsche Bank was warning of head winds for Eutelsat, a major European satellite provider, which has not diversified away from video as a revenue source as much as rivals, SES. There are other uses for satellites such as provision of internet (for ships, planes and others that cannot simply connect to a fibre).

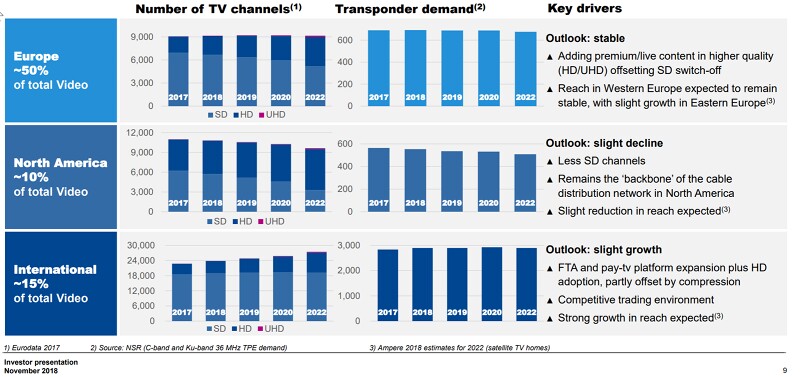

(SD remains a mainstay even of satellite broadcasts – at IBC, SES told us that it was transmitting 7,900 video channels in total with 2,700 in HD and just 50 in UltraHD. It was over 8,000 by the end of the year).

Of course, getting video over the internet with consistently high quality and at low cost has been a challenge, but that challenge is being met and Inside Satellite TV has also quoted Cisco forecasts that 85% of all internet traffic will be video by 2022. (Having said that, as I am writing this, I have been listening to some streamed CES press conferences, which have often been interrupted.) I have also heard that a number of streamed live events in Germany have seen a lot complaints about quality.

In Japan, satellite distribution has been essential in enabling the start of 8K content delivery and it’s hard to see that content being available in other ways very quickly, although there are those that believe that 5G is the answer (although I have a lot of nervousness about the business case as I wrote recently How Will 5G Roll Out?). However, 8K live broadcast content looks a few years away outside Japan, and by then we’ll have better Codecs and will need less bandwidth. Further, more development progress may have been made on better multicasting of live internet video. – BR

Video market dynamics – shown by SES in its financial presentation in November 2018. Satellite video drops in the US, is flat in Europe, but continues to grow elsewhere. Image:SES – click for higher resolution

Video market dynamics – shown by SES in its financial presentation in November 2018. Satellite video drops in the US, is flat in Europe, but continues to grow elsewhere. Image:SES – click for higher resolution