A few years ago, when the flat TV market was new and lots of companies saw this as an opportunity to disrupt the CRT TV market and jump into the scene (it didn’t work out like that), I was in the Taipei Hilton trying to explain to an executive that wanted to enter the European TV market, why it was difficult. “It’s like the Alps”, I said.

The inspiration came from a wall next to our table that was carved from solid stone. “If you look at a map of Europe, bang in the middle you will see the Alps. Look at the postcards and it looks very attractive. However, get close up and it’s cold and you need a lot of preparation and provisions”. The executive had hoped to emulate the success of Vizio in the US, but I had to explain that the conditions that Vizio had enjoyed in the US simply didn’t apply in Europe (and still don’t).

The view from one of my favourite places to stay in the Alps – it looks very attractive in the summer, but the winter is a different proposition! Image:Bob Raikes

The view from one of my favourite places to stay in the Alps – it looks very attractive in the summer, but the winter is a different proposition! Image:Bob Raikes

I was reminded of this yesterday at the DVB World event in Dublin. 200 executives from the TV industry in Europe had gathered for an annual get-together to look at technology and market developments. Two of the speakers highlighted points I made all those years ago, that the European TV market is, in fact, a large collection of individual national markets, not a single market in any way.

The first speaker was Mathias Coinchon of Radio Television Suisse (RTS/RSI/RTR/SRF/SWI – lots of acronyms because of the number of languages!) in Switzerland. He explained that although Switzerland is only a small country in area, (with much of the country covered by mountains, which are more or less, uninhabited) it has four distinct language zones that means that its broadcasting has to meet the needs of the different communities, in Swiss-German, French, Italian and Romansch.

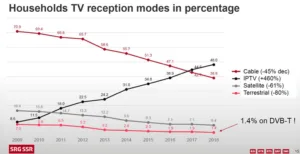

The country has a range of different TV delivery systems using satellite, cable and IPTV as well as an ageing DVB-T system. Last year, there was a referendum that reviewed the funding of broadcasting via a licence fee. Although the broadcaster won the vote and has continued to be funded by a fee, it had its budget substantially cut.

The DVB-T system was national, but was based on old technology (DVB_T/MPEG-2) and was started in 2003 with analogue switch-off in 2006. Channels have 2.7Mbps avr and there are 220 transmitters across the country. If the service was to support future requirements in higher resolutions, it needed upgrading. Because of the budget pressures, the decision was made, instead, to close the DVB-T network to save the cost as it was used now by just 1.4% of viewers.

The rise of IPTV has been inexorable and is now the main distribution system in SwitzerlandA support service has been set up to help consumers with the change and in extreme cases, there has even been some support for customers by providing some help in getting alternative services – usually satellite. The network will close at the end of 2019 with FM radio shutting down by the end of 2024, to be replaced by DAB+

Satellite coverage is very good and RTS has seven free-to-air (FTA) HD channels using MPEG-4 at 10.5Mbps avg and 26 radio channels in MPEG-2. The signal is encrypted to meet the territorial requirements of content owners. There is also a cable service via UPC Cablecom (although it has just been purchased by Sunrise, a large local telco).

IP is supported by a law on universal service that mandates at least 3Mbps access for all.

RTS highlighted that, increasingly, national broadcasters are less and less involved in the distribution, with more and more outsourced or provided by platform suppliers, and increasingly just suppliers of AV content.

France is Quite Different

The position in France, next door to Switzerland and with plenty of French-speaking Swiss citizens watching its content, is quite different. In France, the DVB-T system was originally launched and based on DVB-T with MPEG-2 in 2005. By 2011, 97% of the country had coverage and analogue was switched off. The broadcast technology switched to DVB-T with the H.264 codec for HD in April 2016 which meant new STBs.

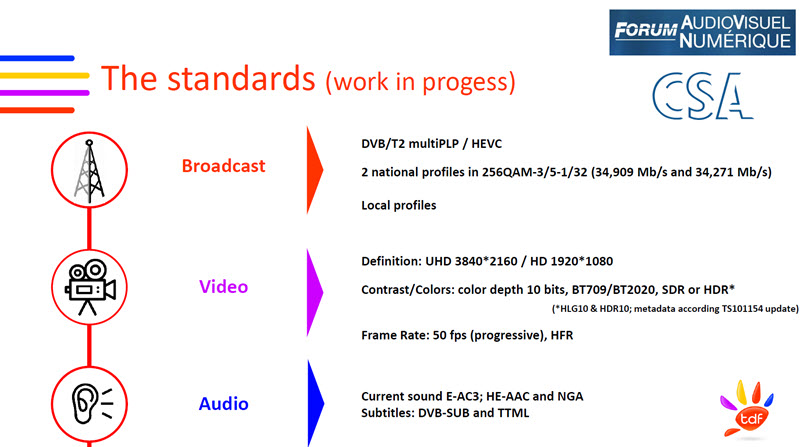

Unlike Switzerland, the French use DTT on their main sets with 68% using DTT on their main TVs today. The CSA, which supervises French broadcast, decided that the technology is too important to be abandoned, so a process was started to review a revised technology to support HD and even UltraHD with 8 or 10 bit support and HDR support via HLG or HDR10. Frame rate is planned to be 50fps.

Paris will be the host city for the 2024 Olympics, so that was chosen as a time when the new system needed to be in place. The plan calls for upgrades to STBs in 2023 to support the new standard.

A review of technology around a year ago decided that H.265 should be the codec (it’s about 50% more efficient than H.264). The transmission standard, naturally, was adopted as DVB-T2. Three UHD channels can be stat-muxed on a single 33 Mbps transmitter.

The specification for the next generation of DVB-T in France has been set.

The specification for the next generation of DVB-T in France has been set.

Testing for the new technology is being done in Paris, Nantes and Toulouse and the final specification is being published so that set makers can review and respond to the proposals.

The Moral

The difference between these two adjacent countries, that partly share a language, shows the complication of the European TV market. Every country is different and the development of a variety of digital technologies have actually made life even more complicated because of the range of different broadcast standards and codecs has increased, allowing more and more permutations. That’s what makes it so complicated to set up a TV business in Europe. It also makes the market defensible by those large companies that have invested for the long term in supporting the range of technologies and standards and makes it very hard for new entrants. (BR)