A couple of weeks ago, LG Chem finalised a deal with DuPont to buy its intellectual property related to its soluble OLED materials, paying $175 million, according to reports. We’ve been reporting on DuPont’s interest in this technology and OLED deposition for a long time.

Meko’s Display Monitor subscription newsletter (now merged with the DSCC Weekly Review) has been reporting on DuPont OLED plans and developments since SID in 1998 – that’s twenty one years. It shows what a long term view you have had to have to be in OLEDs! Here are some of the events over the time:

- In 1998, Cambridge Display Technology (CDT) said that it had entered into a two year deal with DuPont to license its Light-emitting polymer (LEP) materials and technology for use in large area flexible displays. The quote below was given at the time. (Chapchal didn’t last that long!). DuPont was not so optimistic, expecting high volumes of flexible OLEDs within three years. Oops.

CDT’s CEO Danny Chapchal added “Over the next 18 months, a major goal will be achieving large volume, flexible, low information products. Ultimately, we anticipate large scale manufacture of flexible substrates developed with DuPont and leading electronics companies to create high information content products such as the flexible electronic newspaper”.

- We ran an article after SID 2001 that set out the developments and reported on investments by DuPont i Ritek of Taiwan to make OLEDs. The company established DuPont Displays to develop its technology and it told us about deals with a number of companies including Vitex (for encapsulation) and Covion an OLED material supplier, established by Hoechst and Avecia (which was later bought by Merck). It was still working with CDT (which was, itself, later bought by Sumitomo) and extended the license with the firm later in 2001 and set up collaboration between Uniax (a DuPont Displays subsidiary) and CDT.

- In 2003, CDT agreed to supply details of its inkjet printing OLED deposition process to DuPont. In the same year, it announced a brand ‘Olight’ for its OLED products. By then, it had developed a relationship with UDC for its ‘short molecule’ materials, rather than the ‘long molecule’ materials which it had been developing (and were the focus of CDT).

- At SID in 2005, DuPont showed a 14.1″ 1280 x 768 format OLED made from polymer materials and using a substrate from Samsung. Brightness was 200 cd/m² and power consumption was 5W. The company said that it had made it by printing, but wouldn’t say how.

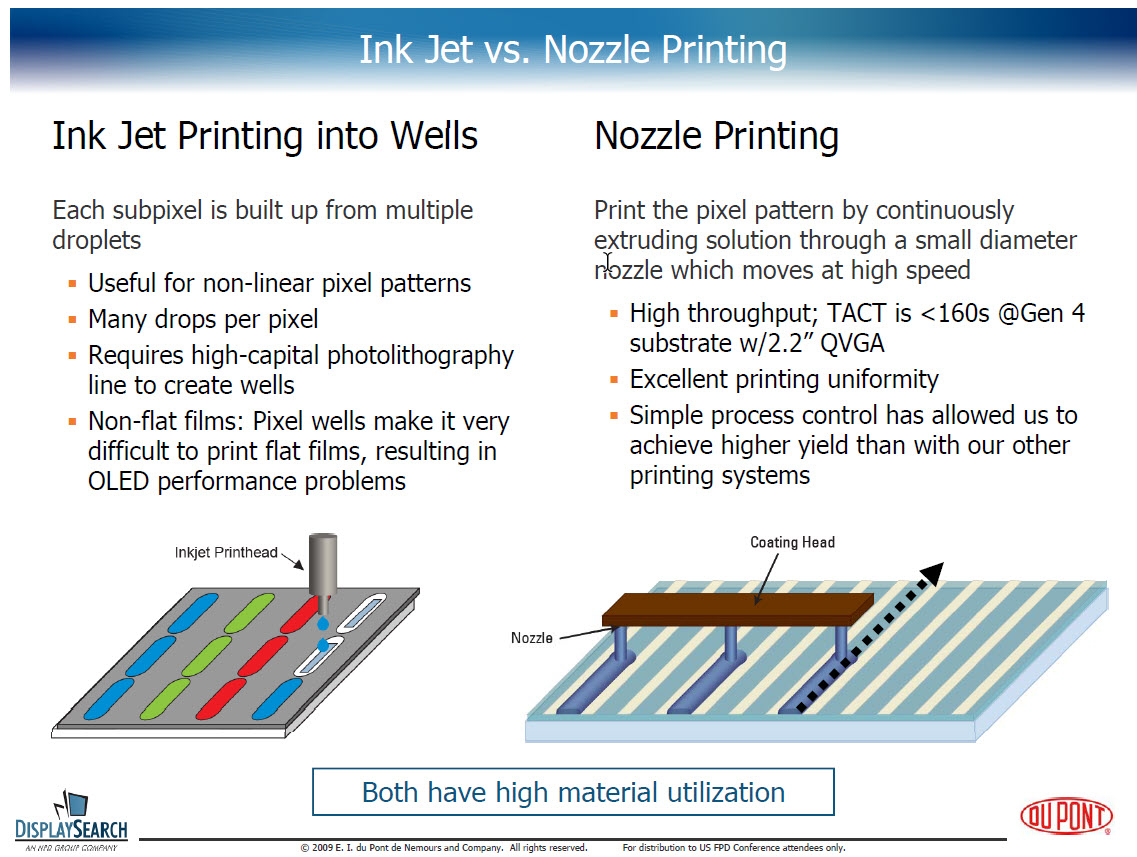

- There was then a period when DuPont really promoted its technology and we had dozens of articles (including a deal with Dainippon Screen on printing) and at the DisplaySearch US FPD conference in 2009, DuPont emphasised its nozzle printing system for OLED manufacture. This was not able to make really small pixels for smartphone displays, but was being looked at for making TV panels (it was limited to around 180 pixels per inch). In the same year, at SID the headline after our briefing said “DuPont Nearly There with Big OLED Bet”. To be fair, the company was mainly promoting its materials.

- In 2010, the company told us at SID that it had a nozzle printing pilot line and that it could deposit the materials for a 50″ display in just two minutes. (in the same year, Samsung said at the US FPD Conference) that it was pressing on with large OLED development and patterning was ‘still an issue to be solved’ although it identified the DuPont approach as ‘good work’.

DuPont showed this slide on its nozzle printed OLEDs at the US FPD conference in 2009.

DuPont showed this slide on its nozzle printed OLEDs at the US FPD conference in 2009.

So why did DuPont continue trying to develop printing for so long? Well, very simply, OLED materials are very expensive and most of the materials currently used are deposited using vapour deposition and a shadow mask. That means that a huge proportion of the material is wasted in the chamber. It would be much better to deposit the materials directly and inkjet printing was the first candidate technology. I covered some of the long history of inkjet printing of OLEDs a couple of years ago. So far, to the best of my knowledge, nobody is yet in mass production of inkjet printed OLEDs. (Well, JOLED is in some kind of volume in manufacture, but I would be surprised if this was in the tens of thousands per year, yet)

DuPont showed this printed OLED in 2010.

DuPont showed this printed OLED in 2010.

However, Samsung, LG and BOE (and others) have pilot lines and are still trying to make a success of the technology. Kateeva, which makes industrial inkjet printers for, among other things, the encapsulation of OLEDs, has announced equipment for inkjet production. There is a “smell in the air” that we might, finally be getting close.

On the other hand, if the technology is very close to a breakthrough, why would DuPont sell its ip? The answer to that question is beyond my pay grade but the OLED Association has said that the company had invested ‘several hundred million dollars with no return’, so I suspect that it was just a case of cutting its losses.

However, LG Display’s OLED TV panel business is largely based on the technology that it acquired when it bought IP from Kodak, so the company has some track record in successfully exploiting the IP of others. Of course, acquiring the IP also keeps it away from Samsung, BOE and others. LG Chem, of course, will get a potential entry into some parts of the OLED materials market that it has not, so far, had products in. (BR)