It is that time of the year to review the display industry trend for next year. The outlook for 2022 is uncertain because of the new Covid variant, a slower global economy, fear of inflation, and the post-Covid impact on demand. In such times, product differentiation, newer technologies, higher performance and lower prices all help drive demand.

MiniLED Display: Strong Shipments Growth

MiniLED-based displays were introduced by top consumer brands such as Samsung, LGE, TCL, Apple and others in 2021 for TV, monitors, notebooks and tablets. By the use of multi zone blinking backlights, miniLED with QD (Quantum Dots) has enabled LCD to have higher brightness, very high contrast, excellent HDR, thin form-factor, superior power efficiency and display performance close to OLED.

- More suppliers are expected to enter in 2022, increasing competition, improving the supply chain, increasing volumes, improving yield and reducing cost.

- MiniLED-based products with QDs with higher picture quality, more competitive prices, higher product availability and brands focus (for product differentiation) will drive shipment growth in 2022.

MiniLED QD TVs

TCL introduced high performance and ultra-slim TVs based on its third generation miniLED backlight technology “OD zero” in 2021. Samsung’s introduction of “Neo QLED” miniLED backlight-based 8K and 4K TV models in various sizes helped to increase shipments. LGE also adopted QD miniLED technology with its QNED products (4K and 8K).

MiniLED QD Gaming Monitors

Samsung and LGE introduced TVs with gaming features (especially 4K gaming at 120Hz): with low response time, auto low latency mode and variable refresh rates. Asus and Acer have been shipping gaming monitors with miniLED and QDs.

MiniLED Notebooks and Tablets

High-end notebooks are increasing market share with Oxide, LTPS and OLED display technologies. Apple introduced 14.2″ and 16.2″ MacBook Pros, with miniLED backlight technology, after its first 12.9-inch miniLED iPad Pro in 2021. This will increase demand further. Apple’s adoption of MiniLED backlight technology in IT products will give a big boost to demand.

The adoption of miniLED technology by Samsung, LGE, TCL, Apple and others will have a very positive impact on the supply chain leading to strong growth in 2022. Success will depend on suppliers’ ability to reduce cost to drive demand.

Quantum Dot: Growth with Expanded Presence

Quantum Dot display technology is continuously evolving with new materials and new processes. It is enhancing LCD, OLED and MicroLED displays and is progressing towards next generation self-emissive display. The technology has evolved during the last few years to improve or eliminate many challenges, resulting in broader adoption of the technology. Nanosys’s new aerobically stable xQDEF is expected to lower costs and increase manufacturability enabling lower cost mainstream products at <$500 with QD.

Reinventing LCD

The first generation QD enhancement film (QDEF) enabled LCDs to have better color purity, wider color gamut, and offer a brighter and a more immersive HDR experience while maintaining power efficiency for TV applications. Samsung, Vizio, TCL, Hisense, Konka and Xiaomi were already offering QDEF-based LCD TVs with very competitive price that has helped to increase market shares and adoption rates.

QD-OLED: Entering the market

QD-OLED displays from Samsung Display are expected by the end of 2021 or early 2022. The industry is buzzing with news that Samsung Electronics is expected to show QD-OLED TVs at CES 2022. Sony is also expected to adopt it for TVs. QDOLED could combine the best of OLED and QD: very high contrast, perfect black, wider viewing angles with better color gamut and higher brightness.

Companies are still developing solution-printed QDs as the emitter material intending to make AM QLED displays. However there are still many challenges. Blue emitting materials still have efficiency and lifetime issues. Multiple layers of blue OLED can be used to reduce the problem.

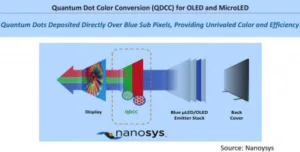

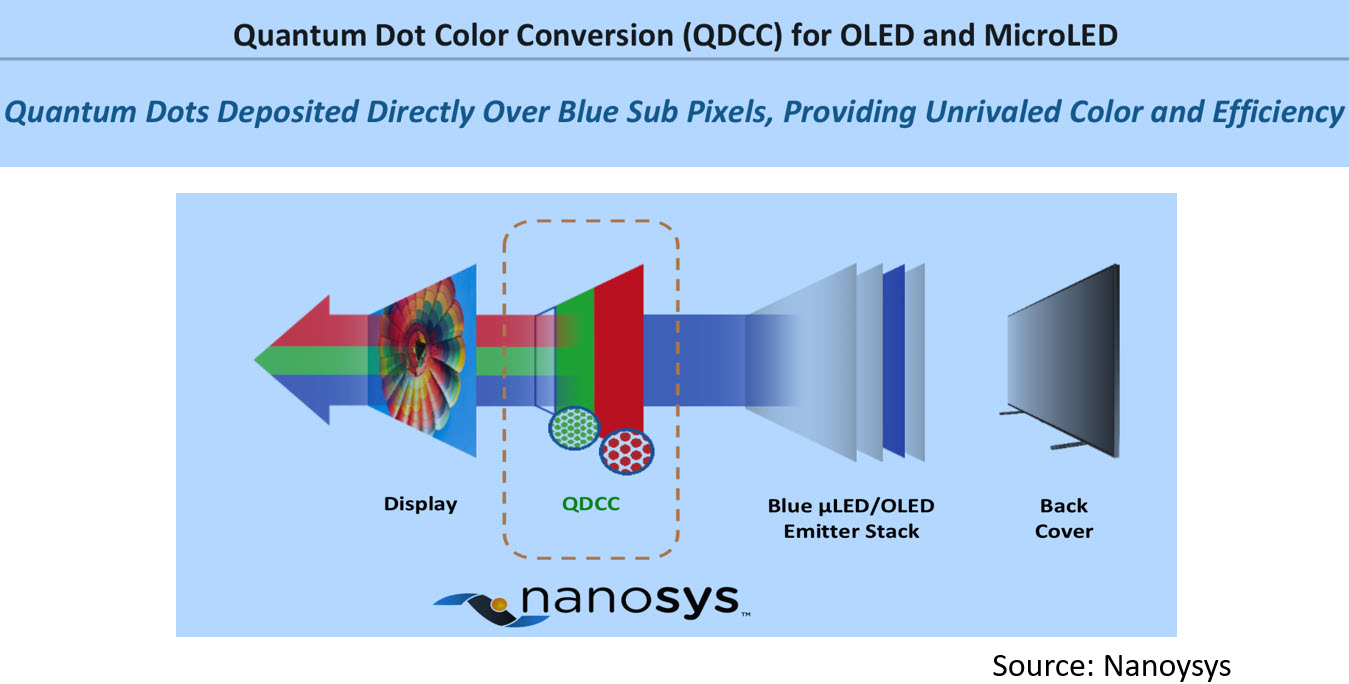

QD-MicroLED: Coming in Future

The mass transfer process that requires bonding RGB (Red Green Blue) MicroLED to the display backplane accurately and efficiently is very challenging. Using single-color (blue) MicroLED chips and color converting them with QD layers can help in the manufacturing process. There have been many announcements and prototypes but no mass production yet. MicroLED display needs a mature supply chain for high volume production. Nanosys has acquired the microLED company “gl?” to improve the supply chain and accelerate product development and adoption. QD microLED is expected to be available in 2023/24.

OLED: Growth with Higher Performance and New Form Factors

Technology developments, improvements in materials, advances in inkjet printing combined with capacity expansion and higher competition will help OLED displays to gain a higher share in 2022. New form factors (foldable, rollable, stretchable) combined with better materials, process and designs will create new application opportunities for OLED in future. At CES this year suppliers such as LG Electronics and TCL/CSOT showcased rollable screens that can roll from smartphone to tablet.

WOLED TV: Higher Performance & Higher Supply

LG Display introduced a new material to improve efficiency by 20% enabling higher brightness. LG Electronics used a special panel for its premium TV: it’s called OLED ”evo” and has higher brightness and better picture quality. LGD also used higher efficiency MMG (multi model glass) to produce 83″ and 48″ OLED TV panels in its 8.5 Gen fab in China. WOLED TV increased its share in 2021 with expanded production and a narrower price premium gap with LCD. LGD is planning more sizes of WOLED TV panels and higher production in 2022. (and there are strong rumours that Samsung Electronics may adopt WOLED with supply of panels by LGD – editor)

OLED IT: growth with new product and capacity

OLED displays can compete with miniLED in the high-end notebook market and in tablets. RGB OLED capacity is expected to increase for IT applications. Samsung Display is reported to be planning an 8.5 Gen AMOLED fab for notebook and tablet market. (Real Decisions Over OLED To Guide Industry to 2026)

OLED: Flexible – Increasing Shares

Flexible OLED form factors are likely to shift from foldable to rollable and scrollable. The introduction of 5G-based products needing slimmer displays to accommodate 5G-enabling components will increase flexible OLED demand. The integration of new technology such as under panel camera (UPC), fingerprint under display, touch display, power saving, variable refresh rates, and other features to reduce border & increased screen-to-body-ratio will make flexible OLED more critical for 2022 products. Flexible AMOLEDs will continue to gain significant share in the smartphone market with new features and faster 5G adoptions by handset makers.

Samsung Display is focusing on LTPO (LTPS + Oxide TFT) that enables variable refresh rates and lower power consumption (LTPO is a Hot Technology – but What Is It?). The Galaxy S21 Ultra is already using LTPO-based flexible OLED panel. Apple has adopted LTPO in its iPhone 13. Samsung Display has developed new material whose luminous efficiency has improved dramatically. Samsung Display has also developed on-cell touch Y-OCTA (Youm On-Cell Touch AMOLED) for flexible OLED technology enabling thinner flexible OLED displays. Apple and Samsung are both using it in their products. LG Display, BOE, Tianma, and Visionox are all developing their own processes for on-cell touch integration to reduce the layers and increase performance.

OLED: Foldable – Growing

Samsung’s aggressive pricing for its Zflip3 ($999) and Zfold3 ($1799) and better features have helped the growth of foldable phones in 2021. According to industry news Samsung Display is planning to more than double its foldable OLED panel production capacity in 2022. The company is also increasing its UTG (ultra thin glass) processing capacity. Companies such as Honor, Huawei, Oppo, Vivo and Xiaomi are also expected to introduce new foldable device in 2022 (although Google’s plans seem to be on hold – editor). Higher capacity, lower price and more products with differentiated features and form factors will drive growth in 2022.

MicroLED: Progressing Towards Commercialization

MicroLED display technology is making steady progress towards commercialization. The technology still faces several complex-manufacturing challenges, which will take time to resolve. The success of commercialization and mass production will depend on the ability to scale up for volume production with competitive price performance.

- There are many different options and processes to resolve microLED manufacturing issues for commercialization.

- Major display suppliers – Samsung, LGD, AUO, Innolux, BOE, Tianma, CEC Panda, Visionox and others are all increasing their activities in microLED display, which will help to establish supply chains for volume production.

- There are already many microLED demonstrations in different applications, such as large-size TV, automotive transparent display, flexible display, wearable devices and as AR/HUD display source.

MicroLED’s very high brightness, high reliability (inorganic LED display) and ability to create ultra compact form factors will have major advantages for the see-through AR market. Many companies including Vuzix, Snap, Xiomi, TCL and Meta are introducing microLED display-based AR/VR headsets. Vuzix’s next gen smart glass uses Jade Bird Display’s (JBD) microLED. Waveoptics (Snap) announced a developmental kit and projector using a JBD display and Kopin has announced collaboration with JBD to develop monochrome microLED displays. Xiaomi and TCL both introduced microLED-based smartglass prototypes in 2021. More product introductions are expected in 2022. High-speed mass transfer, assembly technologies, yield and defect management need to improve and supply chains need to be established before large volume commercialization in consumer products can be successful. In the meantime, suppliers will focus on markets with higher priced, lower volume, and value-based products.

LCD: Losing Share, Still the Dominant Technology

Large LCD panels saw dramatic increases in prices in the first half of 2021 due to unprecedentedly tight supply that was impacted by component shortages. Tight supply and extremely high prices have resulted in LCD TV set price increases. Softness in demand (due to higher set prices and changes in the COVID 19 situation globally) combined with supply expansion lead to sharp panel price reductions in the second half of 2021. BOE, CSOT (China Star) and HKC have been expanding their production capacity and increasing market share.

The LCD panel market has reached a “down-cycle”. With prices declining, panel buyers are delaying purchases and are already holding higher cost inventory, resulting in a further reduction in demand. The market is expected to come back to balance in the first quarter of 2022. Panel price reductions in the second half of 2021 can help to offer more aggressively priced TV products in the first half of 2022 with increasing demand. Very low panel price will also force suppliers to adjust utilization rates and delay expansion plans. LCD has been losing share to OLED. MiniLED backlight with Quantum Dot has enabled LCD to bring higher performance differentiated products to compete with OLED.

In the year 2022, when market outlook is uncertain product differentiation, newer technology, higher performance and high value products will help to drive demand. (SD)

Sweta Dash, President, Dash-Insights

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insights.com