Just before IFA, Xperi announced its new Tivo OS for TV and revealed that Vestel was its first partner. Both companies were at the show and I was able to talk to both of them about the deal which was genuinely exciting Vestel (which already supports several OSes).

Anyway, Xperi is what used to be Rovi, a specialist in TV content and EPGs and discovery (which was originally built on the Macrovision EPG technology for those of you with long memories.). Rovi has added a number of other companies and technologies to its technologies including Tivo and, most recently, Vewd (which used to be Opera’s TV business). The company in the last few years seems to have bought up almost any company with four or five letters in the TV space!

Now, from the outside, this may look a bit confusing and some of us might think that all these acquisitions and developments were opportunistic, but when I spoke to Xperi, they explained that this was all based on a ‘master plan’ (well, not quite those words) that they had had for years. So the fact that Vewd went bust is a bit lucky really!

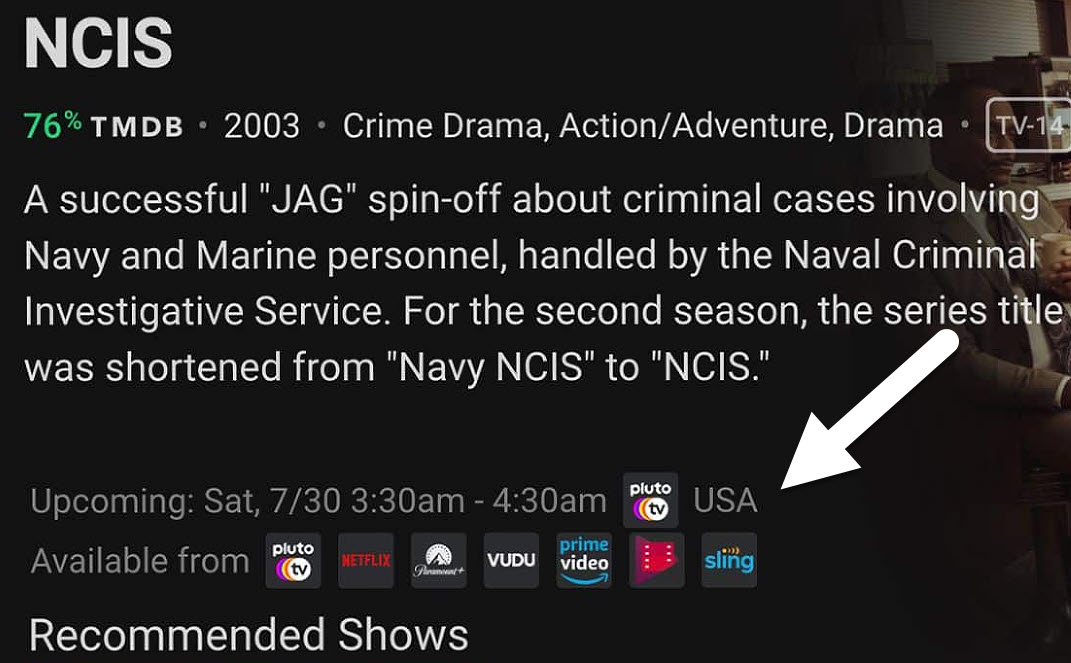

Anyway if we ignore my cynicism about how they got to where they are, the fact is that the agglomeration of all these elements makes a lot of sense. The EPG and content discovery was always key to Rovi and Tivo had a great interface for content discovery. Combining those makes both better. The demonstration that I saw at IFA was particularly impressive in the way that it integrated streamed and broadcast content into a single interface. It was compelling.

Tivo aggregates the different content sources very nicely.

Tivo aggregates the different content sources very nicely.

So those user interface technologies (+ voice and some other technologies) allowed the development of STBs and PVRs. However, TV sets are a different business with different hardware limitations and, these days, no disk drives. On the other hand, not only did Vewd have TV set makers as customers, but they were also based in Europe. The European TV market is of byzantine complexity. I’d like to say sophistication, but it has been, for many years, a mess. It’s one of the reasons that there have been no Vizio-like new TV brands in Europe in the last few years. To succeed you have to have a lot of engineers and management patience.

Europe is Tricky

You need people who know their way around that mess if you want a TV business in Europe. Europe is a big market globally, especially for revenue and for more advanced sets, so if you want to be a global player, you probably want to be able to address it.

(as an aside – I was once in the Taipei Hilton talking to a potential TV supplier about Europe. We were next to a stone wall. I said that the European TV market is like the Alps – from a distance it looks attractive and beautiful, but if you want to spend time there, you’d better be prepared and plan well, or it can be dangerous!)

Choosing an OS for a TV

Now, choosing an operating system for a TV is not simple. If you are big enough, and Samsung is, and LG may be, you can ‘roll your own’ OS. However even LG is trying to find partners for its WebOS to try to spread the development and maintenance cost spread as widely as possible. For a brand that is new in a market or region or is relatively small, a recognised brand such as Google TV or Android or Roku might be appealing as it signals to the consumer something that they recognise. But Google TV and Android do not have a great reputation with set makers for flexibility or being responsive and there are always questions for the consumer and the set maker about who gets what data.

Roku, like Tivo, has a well developed interface and TCL, for example, has done really well with it in the US. However, if you are successful, you really want to have your own brand to try to differentiate yourself from other ‘Roku TVs’. That’s where TivoOS comes in, as it is being promoted as a ‘white box’ solution. So, you can take advantage of a really great interface and content discovery mechanism (including Rovi’s voice technology). There could be a concern that the OS might be a bit heavy for smaller brands, who often find it very difficult to compete in the premium segment. It seems that the understanding from Vewd has got this covered and the OS can run on sets with a mid- to low-tier BOM cost. The whole OS has been re-engineered to run on Linux, rather than on Android.

Vestel is the First Partner

The ability to run on mainstream volume sets is highlighted by the fact that Vestel of Turkey is the first partner. Vestel, for those that don’t know the company, makes around 10 million TV sets a year under lots of brand names including its own. It licenses brands including Toshiba for TV but also makes for a lot of OEMs in the mid- and lower tiers.

I was able to catch Vestel and talk to them about the opportunity and it is fair to say that they are genuinely excited about the opportunity. Press releases always highlight how executives are excited by developments, but on the Vestel booth I got the real smell of enthusiasm. There were three key reasons for this (apart from the ones already mentioned)

- Vestel will be able to offer a top class interface that their brands and their customers’ brands can sell under their own names. (It already has Android, Google et al)

- Vewd understands Europe and the regions around which is Vestel’s happy hunting ground

- Vestel believes that it will be able to support many more native languages with voice controls and operations. That’s a big advantage, especially when you get into smaller countries in the East of Europe and MEA.

The TivoOS brand can also be included if the brand decides to do this as it is in the picture below.

Many of the mergers and acquisitions that I see don’t seem to make much sense. Analysts will tell you that most don’t achieve what they hoped to or what the CEOs said they would. This one, though, seems remarkably and genuinely synergistic. Could there really have been a master plan all along? (BR)