LCD TV panel shipments are set to decline by 6% in 2021 according to the latest research from Omdia. LCD TV display makers are expected to ship 256M units of LCD TV panel in 2021. Chinese TV display panel makers are expected to increase their dominance of global shipments with their share of market set to increase by 10% YoY to 64% in 2021.

There has also been a change in focus for many LCD TV Panel makers. The new capacity from Gen 8.6 and Gen 10.5 fabs, panel makers want to stop focusing the 43-inch panel production to focus on the 65-/75-inch panel production at Gen 10.5 fabs, more Gen 8.5 fabs capacity will be shifted to IT panel production, components supply constraint. However, while the LCD TV panel supply is shrunk, Omdia observes that the TV makers are more aggressive in planning their 2021 business.

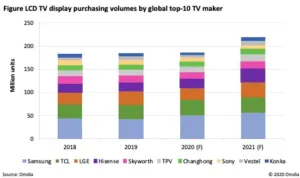

Omdia’s research has found that the global top 15 TV brands’ intented to grow their LCD TV shipments to new highs, up 9% YoY, if they are able to secure the panel supply. Top 10 TV manufacturers – Samsung, LG, TCL, Hisense, and Skyworth are planning to purchase 200 million units of LCD TV panels in 2021, occupying for 86% of global supply, an increase from 70% in 2020 or 64% in 2018 according to the latest Omdia TV Display and OEM intelligence Service.

While there are dynamic changes on worldwide TV makers’ shipments targets for 2020 amid the COVID-19 pandemic, TV makers are proposing TV business plans for 2021 and the aggressive growth scenario will be adopted for the time being to negotiate the competitive panel supply resources and secure their market positions, which are expected to have some drastic changes from 2020 onwards when the panel supply continues to be an issue in 2021.

Top tier TV makers, Samsung, LGE, TCL, Hisense and Skyworth are jointly asking for 10–15% more of panel supply for 2021 as they are expecting a strong recovery post COVID-19.

Supply Chain Issues

Currently these growth plans are beyond panel makers’ supply availability. Panel makers are prioritizing their panel supply to their strategic or preferred top tier TV makers who can sell TVs with advanced features at a higher premium, rather than to the low-tier TV makers whose TVs are priced at low value in the market.

This focus on the premium market will cause an industry shakeout in TV makers the value of the entire TV supply chain will be improved accordingly.

Deborah Yang, supply chain research director in Omdia, commented: “TV display Supply chain relationships have been reshaped drastically in 2020-2021 due to the impact of the CVOID-19 and the Korea LCD makers’ reduced supply along with the newly increased supply from China.

“From 2021, Chinese panel makers have the clear leadership in all aspects, which means panel supply will be decided by fewer but much stronger panel makers in 2021. This will worry some TV makers who used to enjoy supply chain bargaining.

“When the panel supply falls short of the demand that comes with the skyrocketed panel prices in the second half of 2020, it will naturally pressure some low-tier TV makers. Strengthening business relationships with certain panel makers to secure the competitive supply base will be the key success factor for TV makers. “

About Omdia

Omdia is a global technology research powerhouse, established following the merger of the research division of Informa Tech and the acquired IHS Markit technology research portfolio, Ovum, Heavy Reading, and Tractica.

We combine the expertise of more than 400 analysts across the entire technology spectrum covering 150 markets and publish over 3,000 research reports annually, reaching over 14,000 subscribers, and covering thousands of technology, media, and telecommunications companies. Our exhaustive intelligence and deep technology expertise allow us to uncover actionable insights that help our customers connect the dots in today’s constantly evolving technology environment and empower them to improve their businesses – today and tomorrow.