Growth in worldwide and European* AR/VR spend will decline in 2020 compared to the pre-COVID-19 forecast scenario according to the June release of the International Data Corporation (IDC) Worldwide Augmented Reality (AR) and Virtual Reality (VR) Spending Guide. Marked reductions in IT spend and an economic downturn due to the pandemic will slow worldwide AR/VR spend to $10.7 billion — a tempered 35.3% growth from the $7.9 billion spent in 2019.

But the long-term outlook remains strongly positive — IDC estimates a five-year compound annual growth rate (CAGR) in AR/VR spending of 76.9% worldwide in 2019–2024 to reach $136.9 billion by 2024.

“The latest release of the AR/VR Spending Guide was adjusted for the impact of COVID-19,” said Marcus Torchia, research director, IDC Customer Insights & Analysis. “Supply chain disruptions, store closures, and delayed enterprise implementations cast shadows on the short-term outlook for the coming quarters into 2021. However, the longer-term growth opportunities for AR/VR may emerge even stronger. Remote working requirements, contactless business processes, augmented meeting places, and virtual social togetherness portend an updraft in expected demand for the enabling of AR and VR technologies.”

Europe accounts for roughly 15% of worldwide AR/VR spend, with European spending forecast to be $1.6 billion in 2020. Europe is among the regions hardest hit by the pandemic, showing a 58 percentage point reduction in 2020 AR/VR spending compared to the pre-COVID scenario, against a 43 percentage point worldwide average decline.

“The pandemic and containment measures are heavily impacting the European economy, with GDP expected to decrease 8% in 2020, before bouncing back in 2021,” said Giulia Carosella, senior research analyst, IDC European Customer Insights & Analysis. “In verticals that have been highly impacted, such as retail, the strong focus on cash preservation has led to the pushing back of some large AR/VR deployments until the return to growth. But elsewhere the shift in priorities, with a greater focus on ROI optimization and productivity and efficiency gains, will continue to ramp up interest in AR and VR led by the ‘remote everything’ digital trajectory.”

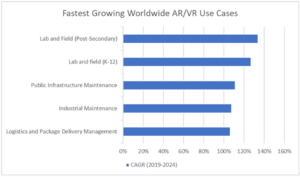

The impact of the pandemic and related spending reduction varies across industries. Commercial use cases will account for nearly half of all AR/VR spending in 2020, led by training ($1.3 billion) for virtual reality and industrial maintenance ($375.7 million) for augmented reality. The AR/VR use cases forecast to see the fastest spending growth in 2019–2024 are lab and field (post-secondary, 133.9% CAGR), lab and field (K-12, 127.0% CAGR), and public infrastructure maintenance (111.4% CAGR). On the consumer side, spend will be led by two large use cases: VR games ($3.0 billion) and VR feature viewing ($1.2 billion).

Source: IDC’s Worldwide Semiannual Augmented and Virtual Reality Spending Guide 2020, June (V1, 2020)

“The COVID-19 pandemic has created a shift in mindset. With so many employees working remotely, augmented and virtual reality are being considered as necessary tools to engage with consumers and drive business processes within and across organizations,” said Stacey Soohoo, research manager, IDC Customer Insights & Analysis. “Unsurprisingly, face-to-face industries such as retail are expected to be the most negatively impacted due to the pandemic, along with education, discrete manufacturing, and process manufacturing. Despite a moderate decline in growth, there is an uptick in demand for innovative technologies as retailers shift their focus from selling the product to creating a personalized, immersive customer experience. In other industries, enterprises are focusing on knowledge capture and transfer initiatives, enabling front-line workers to be more efficient and collaborative while keeping safety in mind.”

Though commercial AR/VR spending is expected to surpass consumer spend next year in Europe, the latter will still lead the market in 2020. Virtual reality games and video/feature viewing (VR) together will account for more than half of all AR/VR spending in this segment. On the AR side, the most severe contraction is expected to be seen in retail and media, but also in the finance sector. Healthcare and government are expected to be the most resilient in 2020, showing interesting pockets of growth related to monitoring of social distance compliance, anatomy diagnostics, and emergency response. Due to the expected high demand of industrial AR/VR solutions, industrial maintenance will be the fastest growing use case in terms of CAGR over the forecast (2019-2024). On the VR side, consumer spending will be the most resilient in 2020, driven by demand for at-home entertainment. Remote training and collaboration will also sustain demand in the commercial space. Training and industrial maintenance will be the main AR/VR commercial applications in Europe, and together will garner around 46.3% market share.

Spending in VR solutions will be greater than that for AR solutions initially. However, strong growth in AR hardware, software, and services spending (184.5% CAGR) will push overall AR spending well ahead of VR by the end of the forecast. Hardware will account for nearly three-quarters of all AR/VR spending throughout the forecast, followed by software and services.

In Europe, hardware is expected to be the largest technology category in 2020, with more than 60% market share. Software spending will maintain its second largest share. AR/VR services-related spending will stay with the lowest share in the following years at under 10%, but will see the fastest growth, registering a CAGR of 126.2%, driven mainly by consulting services and system integration.

From a reality type perspective, VR solutions will have the largest portion of spending in 2020, achieving more than 70% share, but AR spending will overtake it by the end of the forecast due to increased demand and strong growth in all AR technologies (176.8% CAGR).

“AR and VR investments have slowed due to the pandemic, which has required companies to review their road maps,” said Lubomir Dimitrov, senior research analyst, IDC European Customer Insights & Analysis. “However, as companies progress along their road to recovery, spending on AR/VR will accelerate quickly, with a focus on targeted investments that can bring European companies clear benefits, including the ability to address many of the challenges associated with COVID-19.”

The IDC Worldwide Augmented and Virtual Reality Spending Guide examines the augmented reality and virtual reality (AR/VR) opportunity and provides insights into this rapidly growing market and how it will develop over the next five years. Revenue data is available for nine regions, 20 industries, 47 use cases, and 6 technology categories and two reality types. Unlike any other research in the industry, the comprehensive spending guide was created to help IT decision makers to clearly understand the industry-specific scope and direction of AR/VR expenditures today and in the future.

For more information on the IDC Worldwide Augmented and Virtual Reality Spending Guide, please contact Marcus Torchia [email protected] or Stacey Soohoo [email protected]. For more information on the IDC European Augmented and Virtual Reality Spending Guide, please contact Giulia Carosella [email protected] or Lubomir Dimitrov [email protected].

*Note: Western Europe and Central & Eastern Europe