SID Latin Display Conference – I’m currently in Brazil for the annual Latin Display conference – an SID event that is run to help to educate display users in Brazil, and give an opportunity for others in Latin America to meet and act as a focal point for the discussions about the Brazilian place in the display world.

SID Latin Display Conference – I’m currently in Brazil for the annual Latin Display conference – an SID event that is run to help to educate display users in Brazil, and give an opportunity for others in Latin America to meet and act as a focal point for the discussions about the Brazilian place in the display world.

Of course, I knew intellectually that Brazil is a big country, but just how big still makes you think when you are here! With a population of around 200 million, the country has the same order of magnitude of population as Europe or the US. The city of Sao Paulo alone has 18 million people.

That means that there is a huge consumption of displays in the country in TVs, mobile devices and in cars. However, the country’s involvement in the display side is somewhat limited. Brazil had a strong CRT business in the past, but “the lost 90s” as it was described at the conference here yesterday, saw the country miss out on a lot of opportunities to keep up and now the main display-related facility is a factory from Samsung. Samsung also has around 1,000 R&D staff in Brazil, but they are mainly working on software issues and localisation rather than core display technologies.

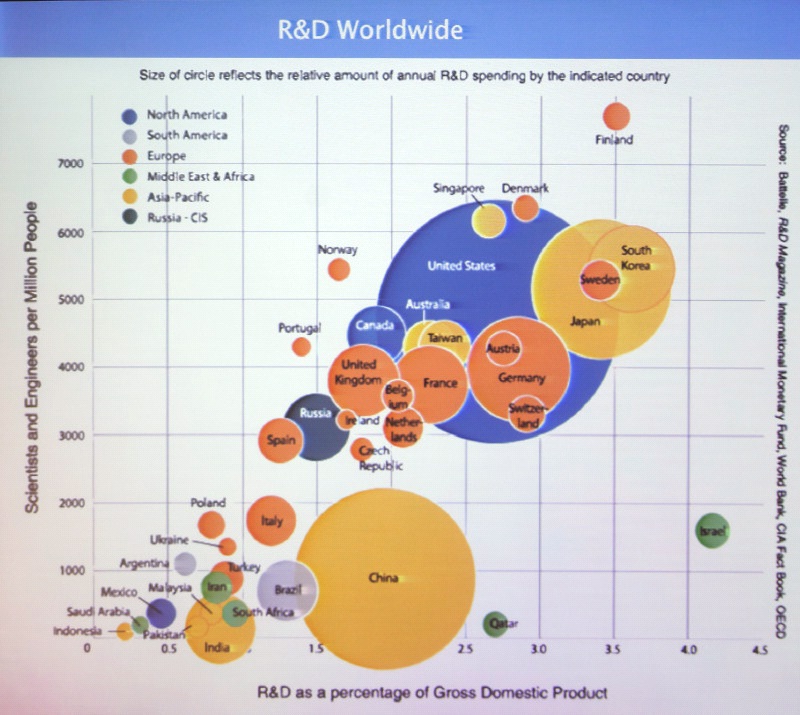

One of the speakers during the first day was Prof. Antonio Hélio Castro Neto (pictured), who is originally from Brazil. After working in the US for a number of years, he moved to Singapore to head up the activities in Singapore to develop graphene. The contrast in terms of the level of research expenditure in Singapore, a country of five million, compared to Brazilian activity was stark.

On the other hand, it’s not obvious, if you wanted to develop a display industry, how you would do it. Europe has many advantages over Brazil, but it still has only a limited display industry, these days. One of the strategies discussed was to pick a technology for the future based on some fundamental science and develop there. However, this has big risks, too. In Europe, Cambridge Display Technology and Novaled were successful companies in the growing OLED market, but both have been acquired in recent years by Sumitomo and Samsung, respectively.

Merck, of course, has a global LCD business based from Germany, but that business was started a very, very long time ago. Materials can be a profitable place to be, but often the right “bets” in terms of investment are only obvious with long hindsight. (Sri Peruvembra of Cambrios pointed out in his talk that, in his experience, you need at least 10 years and $100 million to build a successful display materials business.)

It’s also far from certain who will win in the race. I was struck by a comment during a discussion on touch by Jenny Colegrove of Touch Display Research that she is tracking 200 companies related to ITO replacement at the moment!

Anyway, if we look at the long term development of the main players in the display industry in Asia, it is clear that pure economics or employment opportunities were not the only drivers behind government support of their display industries.

Japan was in the market early to try to exploit its semiconductor technology and to enable its notebook business. Korea saw a chance to use aggressive investment to dominate an industry (although that dominance has not yet turned into the vast profits that must have been the dream). Taiwan wanted to reduce the vulnerability of its monitor and notebook businesses to a supply chain dominated by Korea, and China is keen to capture the value of its TV business locally and reduce its imports (LCDs are said to be the fourth largest imports by value into China).

Brazil doesn’t seem to have such a clear motivation, so it’s hard to see a major investment campaign being mounted. As Bruce Berkoff (then of LG.Philips LCD) used to say, “Engineering beats science, economics beats engineering, but politics beats economics”. Without a clear political rationale and political will, it’s hard, anywhere, to get the kind of momentum needed to succeed in the display business in a big way.

The US, with Corning, 3M, UDC and the up and coming quantum dot and ITO replacement companies, might have an argument to say that it’s simply best to leave investment decisions to the market (although the new companies, in particular, gain huge benefits from university research that is dependent on plenty of US government funds). But for the market to work, you need the kind of VC infrastructure and mentality that is much less prevalent outside the US. Nobody mentioned VCs during the round table discussion in Rio! – Bob Raikes

This chart shows the number of engineers and scientists relative to the population, against the amount of R&D spending. Brazil has slightly more spending than Italy and Spain, but fewer engineers.Spain, but fewer engineers