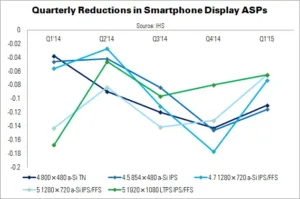

Panel manufacturers are being pressured to lower smartphone display module prices, even as resolution and average sizes continue to climb, says IHS. The firm believes that mobile phone display shipments reached 2 billion units last year, while smartphone display ASPs fell 14% YoY; from $22 per module to $19. The forecast for this year is another double-digit fall, to about $17.

Panel makers are promoting their products to Chinese vendors with aggressive pricing strategies. These vendors are able to use economies of scale, and their strong market positions, to negotiate even lower prices. Looking at the supply side, LTPS LCD capacity is rising in all regions. Additionally, Taiwanese panel makers are moving smartphone panel production to G5 fabs.

All of the above factors are combining to lower average prices. IHS’ data shows that 5″ LTPS-LCD smartphone panels, with IPS/FFS technology and 1920 x 1080 resolution, fell 30% YoY in 2014, from $30 in December 2013 to $21. A continued fall is expected in Q1’15 – traditionally a slow season for panel purchases.

In China, 5″ 1280 x 720 modules are the most popular smartphone display type, helping to boost these units to a market share of over 40% in the 5.x” space last year. The modules are key to many brands’ low-cost, high-spec smartphones, with costs in China’s open market falling to sub-$12 in December 2014. Prices for low-specification 5.x” panels is expected to fall to $11 by March, or below $10 for some particularly low-grade units.

IHS expects panel makers to continue to expand LTPS capacity, due to booming demand from China. “By the end of 2016, new fab investments by AUO, BOE, China Star, Tianma and Foxconn will result in at least five Gen 6 LTPS fabs running in China and Taiwan, which may induce more pressure to reduce smartphone ASPs in the future”, said IHS’ Terry Yu.

More pressure is coming from aggressive end-market pricing by Chinese smartphone brands. An increasing number of premium Android models are expected to use 2560 x 1440 resolution displays this year, driving 1920 x 1080 models down into the mid-range pricing segment.

In late December Meizu, a growing Chinese brand, introduced an especially low-cost smartphone with a large (5.5″) display and 1920 x 1080 resolution – the ‘No Blue Note’ costs just CNY1,000 ($160, inc VAT). IHS notes that several industry players have pointed to this phone as a warning for upcoming price competition in 2015.

“Facing ASP pressures, display cost reduction will be the top priority for the panel makers, especially through more effective production yield rate management and improvements in component performance”, said Yu.