In case you missed it, the latest numbers from display market research firm, Display Supply Chain Consultants (DSCC) is reporting that 2019 is the year that foldable (not just flexible) OLED displays will begin to ship. The research firm’s latest report includes tracking data for three form factors, rigid, flexible and foldable displays.

It’s the latter we are interested in, for as most readers of this blog know, both Samsung and LG are shipping high quality flexible OLEDs in mass quantities in both their respective brand smartphones, as well as Apple’s flagship iPhone X, yet all are encased in rigid glass and do not fold.

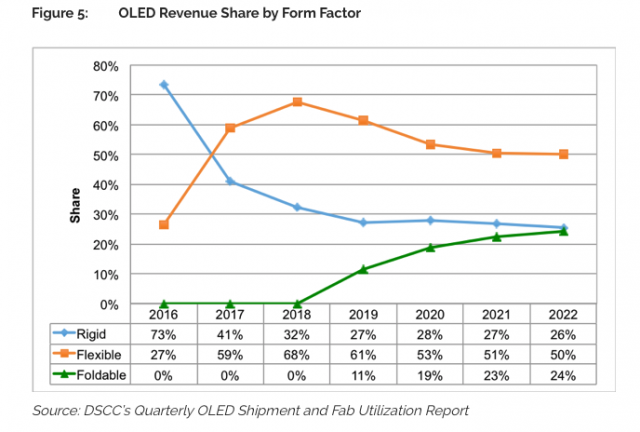

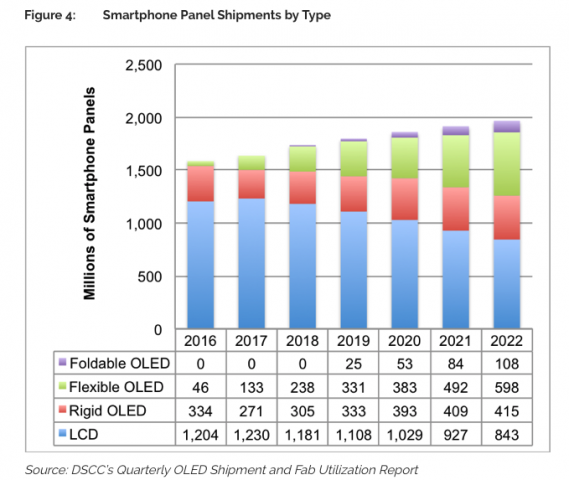

DSCC sees sales of the foldable OLEDs taking off next year and forecast to reach 25M smartphone panel shipments and capturing 11% of OLED revenue share by the end of next year (see charts.) In their award winning supply chain blog, DSCC founder Ross Young said by the end of the survey period in 2022, “we expect foldable OLEDs, with their significantly higher prices, to account for 24% of the OLED market with flexible at 50% and rigid at 26%. There is no question that a high percentage of the new capacity is going towards flexible and foldable which will push down prices and drive their growth. Flexible/foldable revenues are expected to grow at a 28% CAGR vs. rigid at an 11% CAGR and total OLED revenues at a 23% CAGR”. Look for the upcoming DSCC Foldable Display Technology and Market Report for more details.

While the news is encouraging, what has been the hold up in these foldable devices that have been promised for at least a decade? Foldable displays may be one thing, but getting the other components that make up the device stack to fold an equal number of times, with equal reliability is a real challenge. This was confirmed in a recent text exchange with DSCC president, Ross Young. He said,

“there are many challenges which have less to do with the TFT and frontplane process and more to do with the adhesive material (OCA), cover film, polarizer and touch sensor layers. Having those materials fold tens of thousands of times is resulting in the need for some new materials and alternative approaches.”

Beyond that, Young explained, encasing flexible OLED displays does nothing for the ODM (original device maker) to help differentiate a product, even though the cost of a flexible OLED can be much more costly. According to Young,

“The panels are in fixed devices and it is difficult for consumers to determine whether they are buying flexible or rigid OLEDs; smartphone brands are reluctant to pay high premiums for those panels. Brands say their products have OLEDs, but don’t say if they have flexible OLEDs. This, the lack of differentiation makes it difficult to justify a high premium as flexible OLED may be priced 3x higher than rigid OLEDs. A foldable display would create that differentiation.”

So, while the promise of decoupled device size from the size of the display has been floating around the halls of trade shows seemingly since the “bronze age” of technology, shipping devices still elude us. But if the crystal ball over on Ross Young’s desk keeps it’s luster, we may finally be on the verge of a foldable device future. — Stephen Sechrist

Visionox Shows 7.2″ Foldable OLED in China

ITRI Foldable OLED Is on YouTube

Huawei to Announce Foldable Smartphone Before the End of 2018?

Apple to Launch Foldable OLED Smartphone in 2020?

AGC To Show Glass for Flexible Displays at SID

Japanese Panel Makers Ramp Up Foldable OLED Development

Samsung Foldable Still On for 2018?

Fraunhofer FEP Has Co-Developed a Flexible OLED Bracelet

Huawei Mate RS Flexible OLED Display Came from LG

BOE to Open Third Flexible OLED Fab in Chongqing

Flexible AMOLED Market More Than Tripled to $12 Billion in 2017, IHS Markit Says

(Links are to our subscription website).