In my years of Display Weeks, I have attended all of the Business Conference Days, I think. They really are a great chance to get a snapshot of the key business and economic factors and this year, DSCC put together a very strong panel of speakers with only one taking the chance just to make a company pitch – which is a waste of time, I think.

I particularly enjoyed the session on the TV business which was called ‘Is this what maturity looks like?”. Bob O’Brien started the session with an overview of the dynamics of the market. LCD TV will remain the key technology for volume because of the big investments in Chinese G10.5 fabs and that capacity growth will continue to bring prices down. OLED will grow with CAGR of 40%, but sales will be restrained by capacity limits.

One of the topics that he covered was the tariff situation between the USA and China and at the end of that section, he said that he thought that ‘Things will get worse before they get better’. Given the news today that President Trump is planning to impose tariffs of up to 25% on imports from Mexico, that looks like a very good call! Panels from China already have 25% duty, but most TVs sold in the US are made in Mexico, so if the plan goes ahead, it will have a significant impact on TV set pricing in the US.

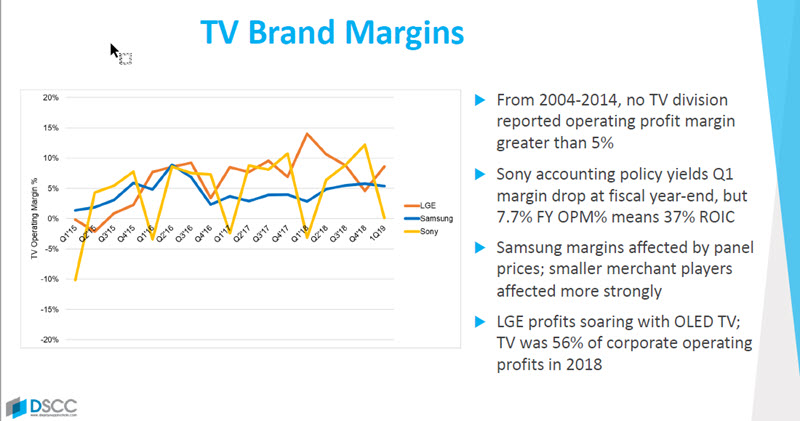

Looking at the TV brands,O’Brien said that the big three are Samsung, LG and Sony and although combined revenues have declined by 5% since 2015 (Samsung is down by 11%, LG by 4%, but Sony is up 8%), the slightly surprising fact is that their TV businesses have become surprisingly profitable, and with historically high margins. O’Brien said that although Sony’s margin is just 7.7%, that represents a 37% return on capital because the TV set business is, these days, so asset light. In the past, I have written editorials that have talked about the apparent lack of profit in the TV market, but that despite the lack of profit, everybody wanted to be in it – in that way it might be like large parts of the airline business.

It might just be a historical quirk that profit is being made now, but I also remember going to a talk about the hard disk business that pointed out that there were decades of profitless battles, until the industry reached full maturity and finally made some profits. A big factor in this is what impact the Chinese brands such as TCL have on the premium end of the market, where most of the profit is.

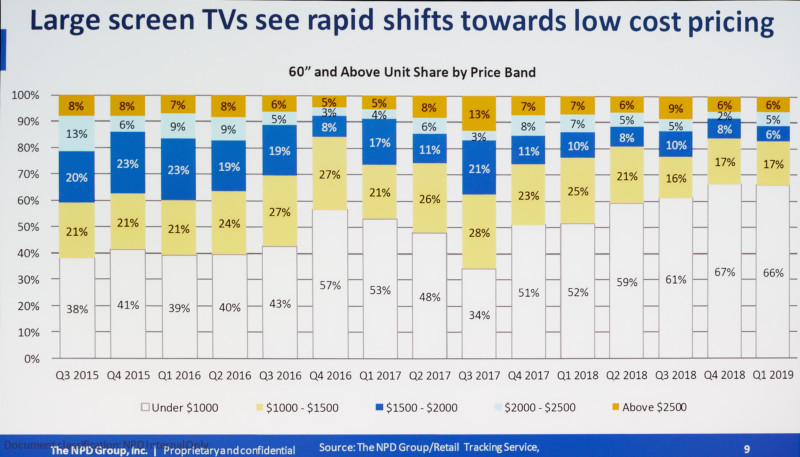

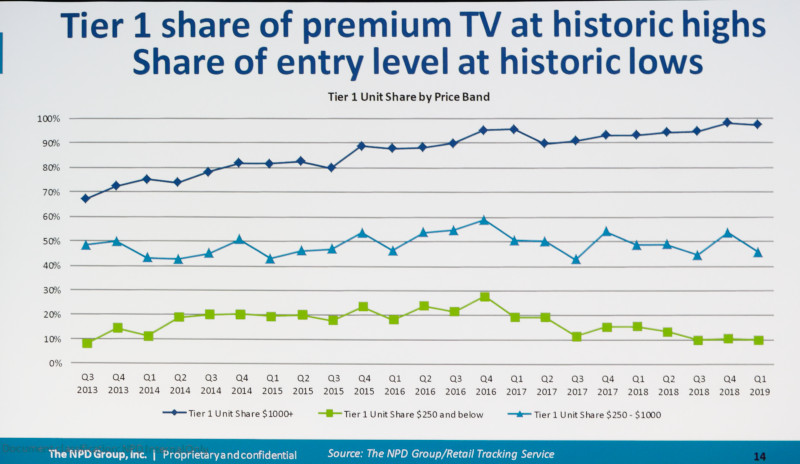

Stephen Baker is from NPD and was introduced as ‘the authority on US TV Retail’. He pointed out that in almost all mature electronics businesses in the US, ASPs are rising to deal with this. That doesn’t apply, though to TV, where set prices continue to fall. He said that the ‘Holiday season’ in 2019 was already a ‘lost cause’ and he expects to see someone with a $299 65″ LCD TV at some point later this year (although the recent news on tariffs may impact that prediction, of course) . There’s no unit growth and ASPs have come down in the last year by 20%. One in three of US TV sales in Q1 2019 were 55″ and above and 32″ is replacing 19″ and 28″ at the entry level.

As he has pointed out many times, only 6% of the total market is priced above $1,000 and the market above $2,500 is ‘essentially flat’. On the positive side, the big three are holding their prices and have 98% of the highest segments of the market, while they now get ‘little or nothing’ from small size set sales.

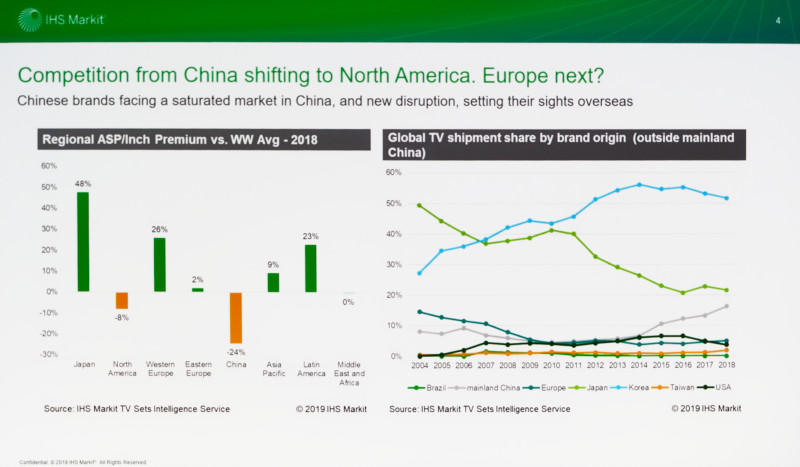

Paul Gagnon is from IHS Markit although since the event, IHS has said that it has traded its technology group, so this is probably the last time that the name may be seen at the event. He completed the panel on the market and talked about the period of profitless proprosperity in the TV market globally. Chinese brands are now starting to see saturation in their domestic markets and will, increasingly, look abroad to find growth, initially in the US, but also in Europe later. He said that he expects the result from TCL in Q1 to cause some shock around the industry.

Looking at the global competition between LCD and OLED, he sees the key parameter as the cost difference between the two technologies. He expects direct competition between 8K 65″ LCDs and 4K 55″ OLEDs.

TV demand is all about pricing. Prices have to be below $1,000 to drive volume and if you want volume, you have to attack the Chinese and US markets which dominate the volume. At three times the price of LCD, OLED struggles, but at double it does well, especially in Europe and Japan.

Gagnon does see opportunities for value growth by boosting ‘smart’ functions and by developing new form factors, such as rollable sets. (BR)