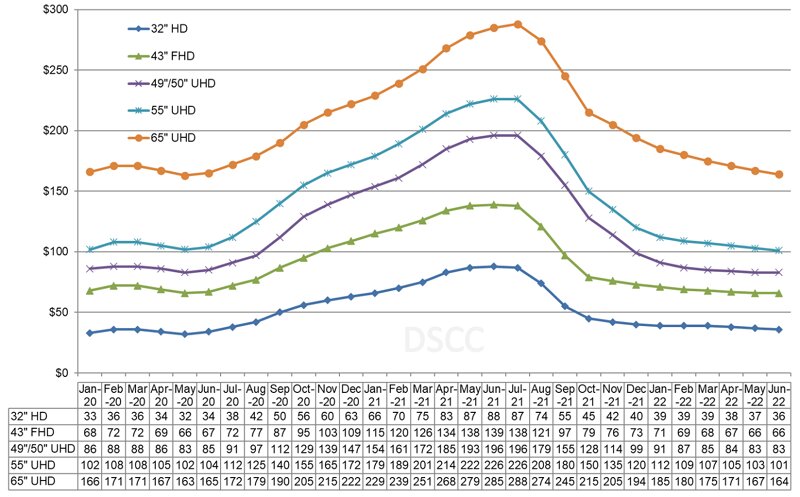

Well, the idea (hope?), expressed at the the Display Week Business Conference last year, that we might finally be coming to the end of the topsy-turvy Crystal Cycle, did not come to pass. From a huge boost to pricing from Display Week 2020 to July 2021, the industry has seen a dramatic drop in pricing over the last few months.

Prices of LCD panels fell dramatically from July 21 to the beginning of 2022. Since then, they have been falling still, especially in 55″ and 65″, but much more slowly as pricing gets towards the cash cost. At that point, unless you are ramping up a new fab and need to get your panel making processes stabilised, it’s going to cost you money for the privilege of making panels.

DSCC Published this chart in its analysis of panel pricing on its blog (registration required)

DSCC Published this chart in its analysis of panel pricing on its blog (registration required)

The Koreans have been cutting their capacity by closing and converting facilities and Samsung will be out of the TV LCD panel making business by this summer. LG will continue for a while yet, partly because it will be supplying LCDs for Samsung’s TV business.

Given the impact of the Russian war on Ukraine on the global economic outlook and relatively weak demand for consumer electronics as households look to try to balance their budgets in the face of rising food and energy costs, it’s not obvious when the pendulum will swing back towards higher demand which could lift prices again. History shows that this does happen, but at the moment it’s really unclear when this would happen.

And talking of pendulums and clocks, looking back on the site, it seems to be five years since I made reference to the famous Bavarian cuckoo clock that forecasts the weather. The man comes out of the chalet or the lady does, but never both at the same time. In the panel industry, the panel makers and the set makers are in the same kind of balance. When one is up, the other is down and vice versa. In the same way, the TV makers (and monitor and notebook makers) and panel makers are rarely at the same level of happiness at the same time. Usually, when supply is tight, the panel makers are happy and charging high prices, so the set makers have squeezed margins. When there is plenty of supply, as there is at the moment, the prices of panels drop and set makers can increase their margins.

And talking of pendulums and clocks, looking back on the site, it seems to be five years since I made reference to the famous Bavarian cuckoo clock that forecasts the weather. The man comes out of the chalet or the lady does, but never both at the same time. In the panel industry, the panel makers and the set makers are in the same kind of balance. When one is up, the other is down and vice versa. In the same way, the TV makers (and monitor and notebook makers) and panel makers are rarely at the same level of happiness at the same time. Usually, when supply is tight, the panel makers are happy and charging high prices, so the set makers have squeezed margins. When there is plenty of supply, as there is at the moment, the prices of panels drop and set makers can increase their margins.

Samsung issued its TV pricing for 2022 a month or so ago and I compared it to last year’s pricing. Despite the significant drop in panel pricing from last year, more of the firm’s TV prices went up than went down, especially in Europe (full details here (Samsung Reveals US and EU pricing for 2022 “Neo QLED” LCD TVs) with Display Insider subscription). So, that should mean bigger margins for Samsung’s TV business, although some of that will have been offset by higher semiconductor costs as shortages in that segment continue for the moment. That, of course, is one of the big strengths of Samsung’s historically very vertically integrated business model, with glass for the panels from Samsung Corning, LCDs from Samsung Display, chips from Samsung Semiconductor. If one part of the business was down, it probably meant that another was up!

That model is breaking down at the moment, as Samsung’s exit from the TV LCD business means it has to buy its panels. On the other hand, it will be processing bare cells from other makers and integrating its miniLED backlights and other technologies to add value to that cell and trying to minimise how much of the value of the set goes outside the company.

Still, with weak demand, I expect to see huge pressure on TV brands over the next year or two to bring prices down further. It’s not clear to me at the moment, though, that the kind of price drops we are likely to see are going to be enough to re-ignite demand in the TV segment enough to push panel pricing back up again. In the end, history shows that it will happen, but there is likely to be considerable pain and some re-structuring among LCD panel makers to enable it.

As I look ahead to next month’s Display Week, the mood of the volume panel business and its key customers is going to be very different to last year, I think. Of course, I’ll be reporting after the Business Conference. If you are a reader and will be attending this year, I look forward to seeing you at that Conferences (where I will be on a panel discussing IT displays) and I will be moderating the CEO Forum as well as spending time on the show floor. (BR)