American consumers’ status as a binge watching, streaming, multitasking nation enters 2017 with strong momentum according to Deloitte’s 11thDigital Democracy Survey. With 84% of Americans on social networks – social media has evolved well beyond ‘socialising’ and is being used to discover new content, get news and resolve customer service issues.

“American consumers continued to stream, binge watch and demand more media in 2016. As the growing forces of social media and over-the-top services continue to accelerate, particularly among millennials and Generation Z, the consumer rules,” said Kevin Westcott, vice chairman and US media and entertainment leader, Deloitte LLP. “The shift to streaming, mobile, on-demand services and personalisation are significant opportunities in 2017. Brands can bring new value, services and incredibly entertaining content to the empowered consumers across all age groups in a manner that can be monetised.”

Deloitte’s survey examines the way Americans consume media across generations, the value consumers place on products and services, as well as attitudes and behaviors toward advertising, social networks and mobile technologies.

Among the key findings from Deloitte’s Digital Democracy Survey:

Streaming, pay TV, binge watching – full speed ahead

- Almost half (49%) of US consumers and nearly 60% of generation Z (Gen Z), millennials and Generation X (Gen X) subscribe to at least one paid streaming video service. However, the survey notes that despite the growth of paid streaming services, US consumers spend more time streaming video via free services (40%) than paid streaming subscriptions (35%).

- 74% of consumers across US households still subscribe to pay-TV such as cable or satellite, but 66% of subscribers say they keep their pay-TV because it is bundled with their Internet.

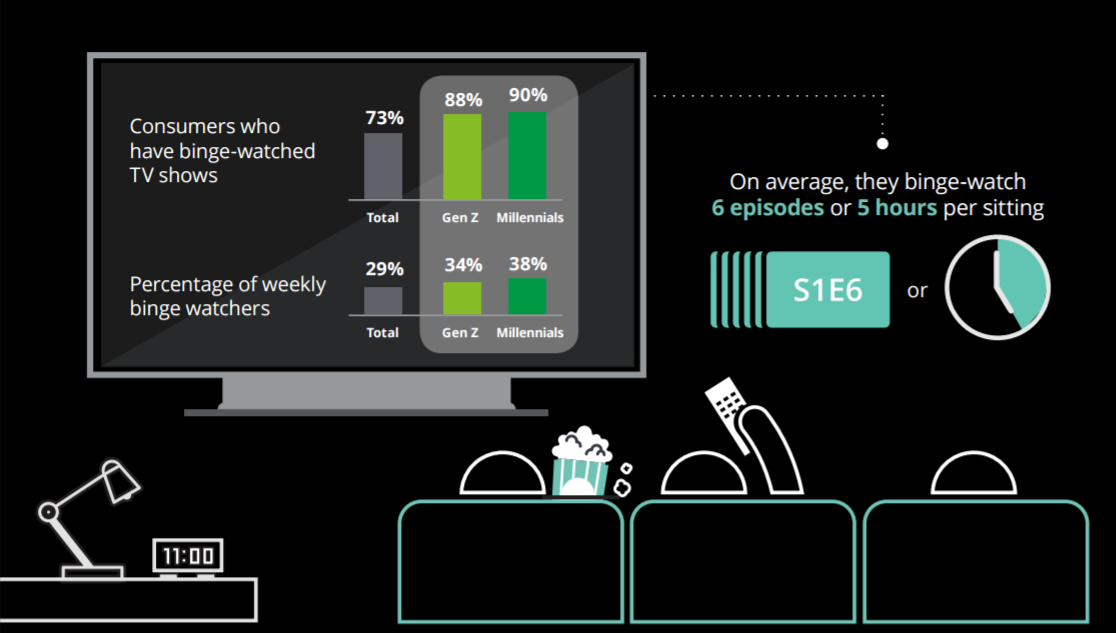

- Nearly three quarters (73%) of US consumers (up 3% from 2015) and nearly 90% of millennials and Gen Z have binge watched video content; almost 40% of millennial and Gen Z binge watchers do so weekly. Millennial and Gen Z binge watchers report watching an average of six episodes, or five hours of content, in a single sitting.

- The device of choice for key demographics remains split; Gen Z and millennials spend about half their time watching television shows and movies on devices other than a TV. Additionally, Gen X favours the TV by over 60% and Baby Boomers watch over 80% of programming on the TV.

- Nearly all (99%) millennials and Gen Z are multitasking while watching TV, averaging four additional activities, such as texting, browsing the web, using social networks, reading email and online shopping.

Deloitte says that binge watchers spend, on average, 5 hours watching. Is there scope for some kind of more comfortable watching mode?

Deloitte says that binge watchers spend, on average, 5 hours watching. Is there scope for some kind of more comfortable watching mode?

Advertising – big opportunities for mobile and online in 2017

- 67% of consumers, and over 70% of Gen Z and millennials, find mobile ads on their phone to be irrelevant; however, 37% of consumers find it valuable to receive location-based ads on their smartphone and use them regularly.

- More than 80% of consumers will skip an online video ad if allowed.

- Almost half (46%) of consumers said they pay more attention to an ad they can skip versus an ad they cannot skip.

- Online recommendations on social media (27%) are more influential than TV ads (18%) for Gen Z in influencing buying decisions.

The Social Network is the Network

- 84% of all consumers and over 90% of Gen Z and millennials are on social networks.

- Over 50% of Gen Z and millennials use social networks to learn about new TV shows, citing it to be more useful than TV commercials.

- 33% of millennials and Gen Z get their news primarily from social media, with 21% saying that TV is still their most popular news platform.

- Over 70% of millennials have used social media to interact with corporate customer service in the last year; 71% of those that have used social media to resolve customer service issues believe they will get a better company response because it’s public.

The 11th edition of the Digital Democracy Survey focuses on five generations, providing insight into how consumers ages 14 and above are interacting with media, products and services, mobile technologies, the Internet, attitudes and behaviours toward advertising and social networks, and what their preferences might be in the future.

The report can be freely downloaded