Vinita Jakhanwal is from IHS and she spoke about smartphones – nobody can live without them these days, she said. However, the smartphone market is showing saturation with only around 1% growth this year. So, you need to look at the layers within the market to find the opportunities. Nearly 42% of the market will sell for under $150. 85% will be shipped to EMEA, China and APAC and 40% will be from Chinese brands.

Vinita Jakhanwal is from IHS and she spoke about smartphones – nobody can live without them these days, she said. However, the smartphone market is showing saturation with only around 1% growth this year. So, you need to look at the layers within the market to find the opportunities. Nearly 42% of the market will sell for under $150. 85% will be shipped to EMEA, China and APAC and 40% will be from Chinese brands.

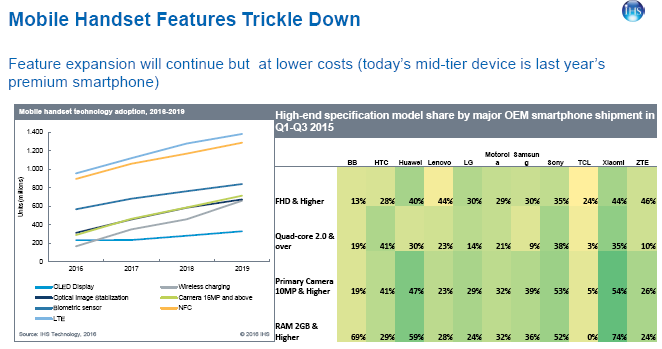

Features are trickling down to lower priced models. Last year’s high end have become this year’s mid-range. There is a continuous challenge to add new high end features. High end displays are already established as a standard feature, as Apple exploited the Retina display concept and Samsung had the OLED uniquely, but now everyone has those features.

Makers are looking for new opportunities in VR cameras and phones. There are ideas for development in modular mobiles, with multi-camera innovations using, for example, infrared cameras in addition to visible light devices. Google is everywhere.

Jakhanwal then said that smartphone displays are showing revenue and area growth and OLED will take more than 30% by 2019. High resolution continues to develop with FullHD and panels larger than 4.8″ being mainstream. Shipments of panels with 400ppi or more will steadily increase. However, ASPs are dropping for LCDs.

Embedded touch continues to rapidly gain share so the market will see almost 60% share with embedded touch by 2019. There are a number of variations in the way touch is implemented. Each panel maker has its own version of integrated touch.

The other trend is to AMOLED and flexible display use. Around 600M AMOLED units will be sold by 2019 – but flexible displays will be up by a factor of six by 2019. OEMs are boosting AMOLED use and they will be aimed at the high end with flexible, while rigid display goes to the mainstream. At the lower end, there will be some use of OLED, but at the bottom, LCD will remain the key technology.

There needs to be more LTPS investment to support both LCDs and OLEDs. Looking at the plans, there is a potential for over-supply, but because AMOLED demand will grow and there needs to be a lot of work to ramp up, so there could be some short term shortage from time to time.