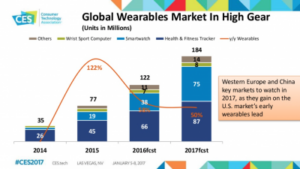

The VR AR space is a niche market at best, barely showing up as a rounding error in the recent CEA market update given on press day one at CES 2017. The CTA Extended Forecast 2015 to 2020 report was used as the basis of the numbers offered to the press at the opening even. It represented the wearable headset market simply as “other” in its global wearables market review with the larger wearables category shipping 122M units in 2016. The group said only 11M of that was in AR VR and other devices in the sub-category. Top wearable devices in units shipped include 66M health and fitness trackers, and 38M smartwatches (not counting the 7M wrist sport computers) shipped in 2016, according to the group presentation given the press on day one of two press days that came before the official show opening last week.

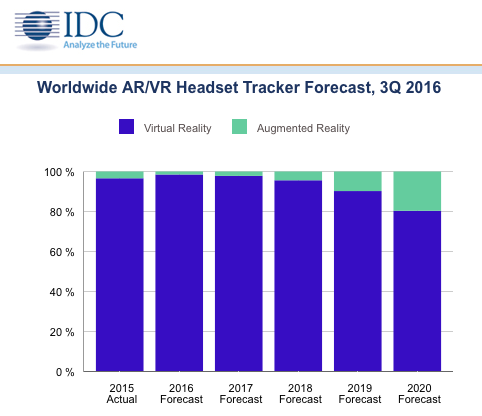

That number also sits pretty well with market research firm International Data Corp. (IDC). In December 2017, IDC said (IDC Looks at A/R & V/R) that worldwide AR VR (headset only) shipments reached 10.1M units for virtual reality headsets, and a whopping two orders of magnitude smaller, or 0.1M (100K), for AR devices. On the headset side, three categories of devices are considered; screen-less viewers (excludes Google and other cardboard-based devices but includes Samsung’s Gear VR that also requires a smartphone); tethered devices like Oculus Rift and HTC Vive that sport their own micro display device; untethered devices like the Microsoft Hololens.

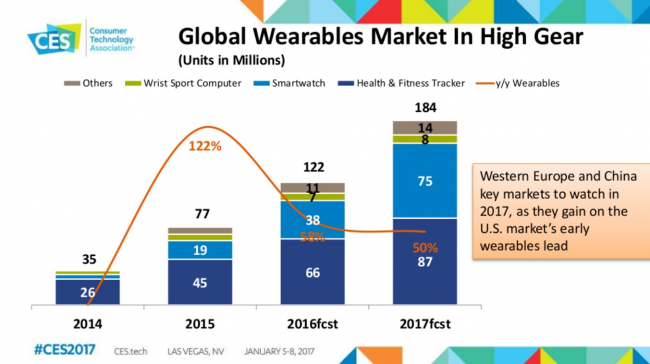

What’s helping drive the industry forward is the promise for large returns in the space with year 2020 growth in VR devices leading to sales of 61M devices (and a change in average growth rate of 100.7% for the five year period 2015 to 2020). For its part, AR is forecast to reach a more modest 15M devices, but with a much larger 196.4% CAGR by the end of the decade. This is according to the IDC Worldwide quarterly augmented and virtual reality headset tracker. The report is managed by senior research analyst Jitesh Ubrani (IDC Mobile Device Tracker.) He said the long term growth has the potential to rival the smartphone, but with the caveat that “… the technology is still in its infancy and has a long runway ahead before reaching mass adoption.”

What’s helping drive the industry forward is the promise for large returns in the space with year 2020 growth in VR devices leading to sales of 61M devices (and a change in average growth rate of 100.7% for the five year period 2015 to 2020). For its part, AR is forecast to reach a more modest 15M devices, but with a much larger 196.4% CAGR by the end of the decade. This is according to the IDC Worldwide quarterly augmented and virtual reality headset tracker. The report is managed by senior research analyst Jitesh Ubrani (IDC Mobile Device Tracker.) He said the long term growth has the potential to rival the smartphone, but with the caveat that “… the technology is still in its infancy and has a long runway ahead before reaching mass adoption.”

IDC’s program VP for Devices & AR/VR expects to see “…a growing number of hardware vendors enter the space with products that cover the gamut from simple screenless viewers to tethered HMDs to standalone HMDs,” he said in the December press release, and CES did not disappoint. The group also expects AR to be the long-term play “Augmented reality represents the larger long-term opportunity,,” and VR to, “capture the lion’s share of shipments and media attention,” in the near term.

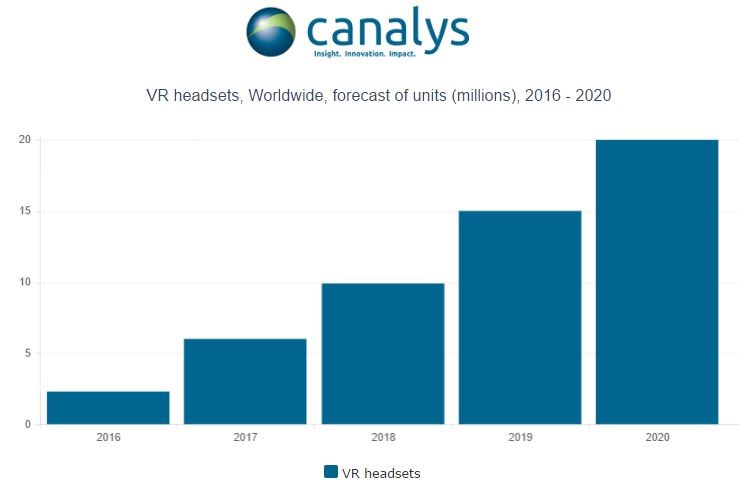

That said marketing firm Canalys is not as upbeat on the 2016 numbers. The group reckons only 2M VR devices shipped in 2016 with expected growth to top out at 20M by 2020 (Canalys Says Over 2 Million VR headsets to Ship in 2016). Part of this difference is the exclusion of screen-less devices from their count, and are “shipping in the millions”. These include the Samsung Gear VR mentioned above and the Google Daydream View. Both rely on other devices (primarily smartphones running a split screen app) but do offer the benefit of low barrier to entry and an untethered experience. Canalysis calls the independent screen versions of VR “smart VR headsets”.

That said marketing firm Canalys is not as upbeat on the 2016 numbers. The group reckons only 2M VR devices shipped in 2016 with expected growth to top out at 20M by 2020 (Canalys Says Over 2 Million VR headsets to Ship in 2016). Part of this difference is the exclusion of screen-less devices from their count, and are “shipping in the millions”. These include the Samsung Gear VR mentioned above and the Google Daydream View. Both rely on other devices (primarily smartphones running a split screen app) but do offer the benefit of low barrier to entry and an untethered experience. Canalysis calls the independent screen versions of VR “smart VR headsets”.

We see the Canalysis figures as more helpful to the market giving developers a better understanding of what is really going on in the space. To date, “hundreds of millions” of cardboard and other low cost VR devices have shipped to local school districts wanting to give kids a first hand look at what’s possible in VR education, to gamers and ‘bleeding edge’ folks, curious about the coming device space. Ultimately content will drive the stand-alone VR platform (or not) but we see entertainment and particularly games, and yes even porn, as helping move the space forward towards a 61M device level in 2020, or Canalysis’ much lower 20M figure for those higher end systems with integrated screen technology. – Steven Sechrist