Amal Ghosh kicked off the Business conference for Display Week 2015 and he is the President of SID. He started by saying that attendance at the Business conference is up 40% on last year.

Ian Weightman of IHS introduced his company which organised the event and which has a bigger display team after the acquisition of DisplaySearch, iSuppli, DisplayBank, Screen Digest and IMS Research.

The keynote speaker was Feng (Philip) Yuan, Chief Strategic Marketing Officer and a VP of BOE, the Chinese panel maker, and his topic was “Innovation in a commoditised business”.

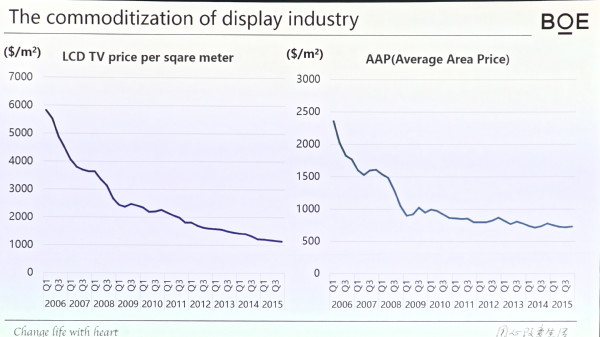

Yuan pointed out that a 32″ LCD TV had dropped by 80% from $1500 in 2006 to $299 in 2015. The price per sq metre has been coming down continuously.

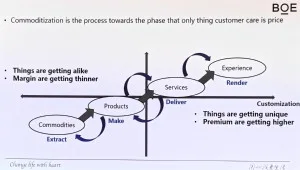

However to understand this, you have first to understand commoditisation. As products get more mature, the pressure for commoditisation increases. Yuan referred to the writings of Joseph Pine.

Materials and objects that get extracted from the ground get commoditised easily and that means agriculture, minerals and raw materials all became commodities quite early in the development of societies. Then with the move to a manufacturing economy, products were developed from these materials. Products got developed further to today and now people no longer care where products are made or who made them. Price becomes the key driver in many markets

The next phase in economic development is to add services, but even services are becoming commoditised. The answer is customisation and also providing experiences – Disneyland is a good example. We are moving to an experience economy, Yuan said.

To decide how to innovate, one approach is that you can look at the business model of the industry.

Yuan said that the LCD industry sees double performance every three years – BOE believes that this is a law of the industry (and called it Wang’s Law, in the hope, I guess of upstaging Moore – Man. Ed.).

However, bigger panels earn more money per sq m so BOE is focusing on large size and high resolution.

BOE’s strategy is based on differentiating with “5P + H” – that is to say, Picture, Power, Panel as System & Service, Pilot of Fashion, Price and Health. In particular, BOE wants to focus on resolution and size to try to keep away from the commoditisation trend. Products it is developing include a 4.7″ UltraHD LTPS LCD with 941 ppi, a 5.5″ UltraHD 800+ panel and a 5.5″ FullHD panel with wide colour gamut at 100% of NTSC. (for more see BOE Has Impressively Wide Range)

In large sizes, it has developed a 110″ 8K x 4K panel that is for medical and scientific applications and a 82″ 10K x 4K panel with 21:9 aspect ratio that is expected to be used in museums & art galleries.

The second way to avoid commoditisation is segmentation to develop special products for particular clients. Target areas for the company include automotive, displays for wearable, smart home-related displays and health care. It also plans to look at emerging markets including MEA, India, Brazil etc

BOE will also look at segmentation based on new and growing applications such as public and video wall displays, transparent and mirror displays

The firm has developed a 9.55″ 30% transparent display that can be folded to a 10mm radius and a 4.8″ flexible armband display.

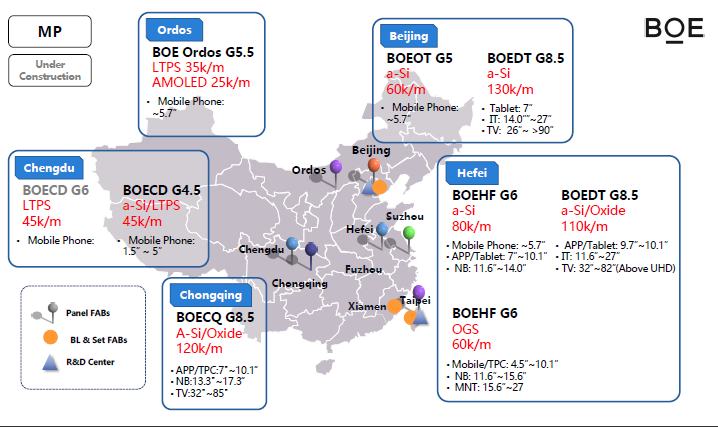

To boost its development around the world, BOE has offices in the US (Santa Clara), Europe (Frankfurt), Singapore, Korea (Gyeonggi-do) and Japan (Tokyo) as well as several offices in China.

The third way to avoid commoditisation is to pursue system development and to understand what customers really value beyond price. Cooperation and customisation and to customer value.

In line with this strategy, BOE has developed a 700 cd/m² grey scale monitor with 10 bits, a 27″ FullHD panel for medical applications, a 65″ 4K OGS Touch (Yuan said that OGS improves touch compared to ITO and the panel is said to offer an “excellent” interactive experience”.

To summarise the company’s current market position, he said that BOE has

- 20% of the mobile phone panel market (#1)

- 31% of tablet panels (#1)

- the #1 position in China.

- 7 fabs and one line in development. (see slide below)

- #1 position in patents in the industry and is spending 7% on R&D.

- 38% of BOE products were “first global launch” in the market.

In the future, value add and customisation is critical.