Next, David Hsieh of IHS asked “Is low cost the only path to success?”.

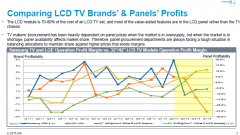

He started by showing an interesting chart on the relationship between the profits for brands and for panel makers.

Samsung & LG should have really good advantages in the market because of their vertical integration and the chart shows that LCD TV and panel profitability depend on each other. When one goes up, the other goes down (Like a Swiss weather clock, I always think – both people never come out at the same time – Man. Ed.) Last year, there were some panel shortages and the panel price went up, so TV-makers’ profit went down. However, the panel makers realise that it’s not a good long term solution for customers not to make a profit.

Looking ahead, for the next couple of years, there will be stable demand and supply, he forecast. Both grow, but in a very balanced way, so there should be a better chance for the whole supply chain to achieve profit.

Every product seems to be moving to being smart displays, the panels need to follow, Hsieh said.

Panel and set makers have innovated, but the reality is that customers just want big and cheap TVs. In 10 years, the TV size will have grown from 31″ in 2007 to 41″ in 2017. The TV size growth of 1″ per year has helped to absorb capacity for the LCD industry. There have been lots of developments in TV, including PDP dropping away which helped the LCD to get into the bigger sizes. 2008-10 were the peak years of LCD growth. Between 2008 and 2009 there was growth of 50 million sets and between 2009 and 2010, 58 million.

Hsieh said that although it varies a lot around the world, TVs typically last 8-9 years on average. TV sets will get bigger “but your lounge doesn’t”. That could be a problem in the future if brands and the panel industry assume that the size growth will continue for ever.

Mobile applications have also seen more demand for high resolution and larger panels and that is helping to absorb capacity.

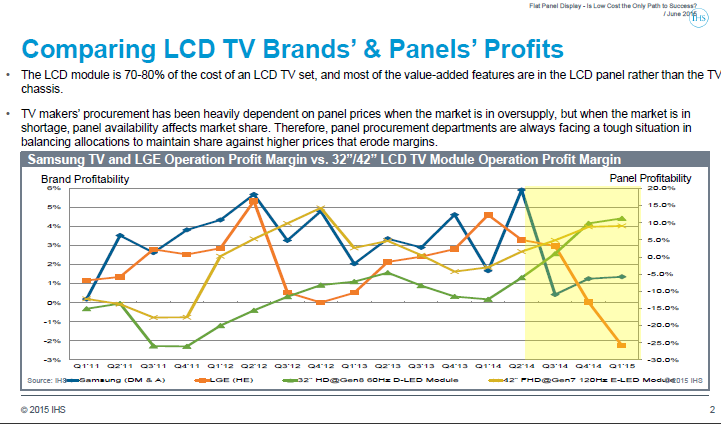

Last year was the first year of UltraHD growth in TV. Now it is coming into mobile, automotive, PID and other applications. The UltraHD/4k market will reach over 50 billion dollars by 2020.

OLED is interesting for flexible displays, the Note Edge has inspired a lot of interest in the area, but there are many challenges to be overcome to really exploit the flexibility.

For LCD, there is a question of how to increase value and makers are trying to do this with curved TVs and also QD-based wide colour gamut (WCG) sets. China used to be an important market for new features e.g. LED BLU and UltraHD, but China has the lowest penetration for curved. In Europe, curved is really important, but not so much in other regions.

QD technology is also important for adding value, but colour is a “bit arbitrary and subjective”, Hsieh said. “Does the consumer really need WCG?”, he asked.

Profitability can come from bringing the cost down or pushing the value up. There are many process improvements coming to reduce cost and a big development will be the introduction of automation in the module assembly process.

The market value is going up and one reason is that there are more “odd” sizes – almost every inch size is now available. High Dynamic Range sets may be a help. India is becoming more important as a TV market and the volume LCD market is starting with consumers buying larger sizes of 40″ and up.

Value will also be helped by niche markets such as automotive and public display.

Hsieh said his conclusion is that value up and cost down both need to happen to deliver profits for the industry.