The second keynote was from TCL’s CEO Dongsheng Li who is also Chairman of CSOT.

Li started by looking at an overview of the market. The global business is still in some trouble and economies are weak. China has now overtaken Japan as the biggest creditor of the US. China is the second largest economy in the world and the increase in GDP is around $700 billion in a single year. Increasingly, the Chinese economy has shifted from export to investment to consumption, but there is a policy to continue to drive investment.

Turning to displays, there is growth in the area of LCD being made and sold in China. TV growth is fairly low in the developed world, but there is still nearly 10% growth in the Chinese market.

The Chinese market is being driven by increasing size of TVs, the penetration of SmartTVs, and in addition, UHDTV is very popular. Finally, sales of PID sets have increased a lot, said Li.

China has all the recent capacity additions for G8.5 fabs and this has allowed balance between supply and demand and met the need for area growth.

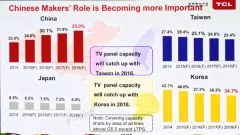

China will catch up with Korea and the self sufficiency in LCD panels will be over 80% by 2018.

Smartphone sales have been growing really well and this year 80% of all phones sold in China will be smartphones. This is driving the demand for higher specification displays. Samsung and Apple are the global leaders, but the Chinese are increasing and six of the top ten brands are now Chinese. TCL/Alcatel has grown by 122% in the last year.

Developing regions are growing much faster than the developed world.

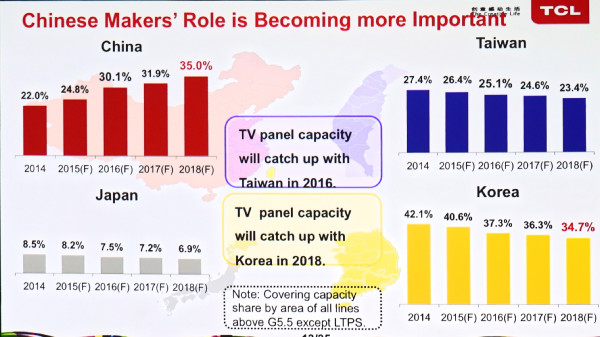

There are a lot of LTPS/IGZO and AMOLED lines being developed in China to meet the demand for smartphone panels. This could cause some overcapacity in the future.

In the second part of his presentation, Li looked at future trends. TCL and other Chinese companies have worked to add patents. In the last five years, TCL has applied for 7296 patents in the display field.

TCL has been developing its TV technology and believes that QD technology will be important in the market. Will OLED become a mainstream technology in TV? Li said that this is unlikely and he believes that QD-based LCD technology will compete strongly with OLED TVs.

Samsung is already promoting QD products at the high end and that reinforces TCL’s view. There is research work on QD emissive displays in China and that is driving a lot of interest, since a publication in Nature. Lifetime could be 100,000 hours and the technology should out-perform OLED and may be in mass production in the near future.

In small displays, ppi will continue to increase to over 600 ppi in the future. New LC and transistor technology will enable this and backlights will evolve from LED to QD backlights.

For large OLEDs, printing looks like a good option. OLEDs are simple in structure, but have challenges so new techniques are needed. In the future, R2R printing technology could be used to create displays.

TCL has developed soluble OLED materials and is working with partners to develop manufacturing and mass production.

Finally, Li looked at the development strategy of TCL and its panel subsidiary, CSOT. TV and mobile phones are the big markets for TVs and the firm wants to be in the top three in each market and that means a big demand for panels. Therefore, CSOT as a supplier has to be competitive and will develop technologies to ensure that, said Li.

IGZO will be used for large panels and LTPS for smaller ones. For colour RG phosphor, QD and QD-LED will all be used. Fine Metal Mask will allow High PPI for OLED, with white OLED leading to printed OLEDs.

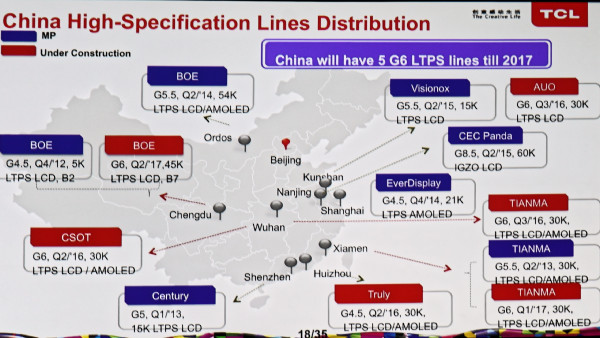

CSOT is claimed to be the global leader in efficiency and profitability.

In summary, China is the biggest market in the display industry and more capacity will be added (although at risk of overcapacity). Second, Quantum Dots will be a key technology and third, printing will become the main manufacturing technology.