Paul Gagnon of IHS ran the session on TV. He said that in the past of the TV industry, there was a very measured approach to new technologies and brands took time to migrate features and technologies through the range, but this changed with the arrival of flat panel TVs. Traditional CRT and R/P TVs died away between 2004 and 2014. The market has some growth still in unit terms.

The revenue of the industry peaked in around 2010 at $118 billion, but since then revenues have been sliding. Margins have always been a challenge in consumer electronics and TV has been the hardest category. The Japanese brands often struggled with profits, but 2011 really was bad and business models had to change; several big brands gave up completely. Now there is more of an emphasis on profit in the TV market. The Japanese are still slightly in the red, but the others have kept in the black.

Price per inch came down to around to $15 per inch to drive value and this year it will get below $10 (and down to $6 to $7 for basic HD sets).

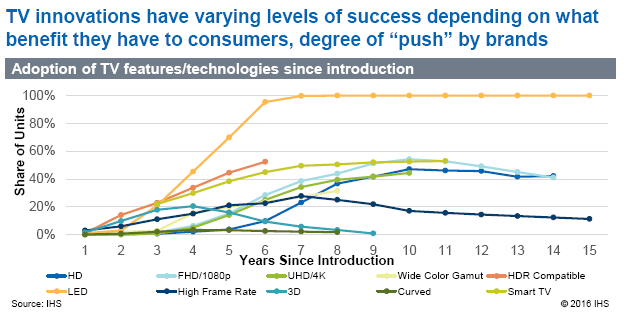

TV innovations have different levels of success depending on the value recognised by consumers. FullHD came in faster than HD, but UltraHD is rolling out at about the same speed as FullHD. Wide Colour Gamut (WCG) will see a big boost this year, but will then slow down in adoption as there is still not much content. HDR-compatibility will be adopted much more quickly to get to more than 50% share by the sixth year. Because there are no regulations on what HDR is, so even low brightness TVs that are capable of recognising HDR signals will be sold as ‘HDR’.

IHS TV Feature Introductions – click for higher resolution

IHS TV Feature Introductions – click for higher resolution

LED-backlit sets came into the market very quickly, but that was because makers wanted to drive out the alternative, and so the premium disappeared and nobody made any money from the change. High Frame Rate was not really recognised by buyers and 240Hz sets have disappeared, while the premium for 120Hz is down to 10% or less. 3D is even worse and 2018 may be the last year of 3D TVs.

Curved TVs are available, but only have a very small share. Even early promoters are backing off from promoting curved sets – they are now offering the alternative of flat or curved.

SmartTV is different, it’s not just a display feature and it is starting to gain momentum.

Picture quality is consistently across every region and over time the most important feature for consumers. A close second is high resolution. Quantum dots and better colour are focuses for consumers at the moment.

Analyst Comment

It’s amazing to be talking about $6 or $7 per inch. I remember going to SID when the target to get the market started was $100 per inch!

I’m not surprised that 240Hz didn’t do well. In side by side comparisons, I could see a useful difference between 60Hz and 120Hz, but little difference with the shift to 240Hz. (BR)