In the IHS-organised Wearable-Flexible business conference at Display Week, highlights included a market survey of current conditions (where the market is) and a survey of trends portending where the technology is headed. To quote hockey legend Wayne Gretzky on why he is so successful, he said, “I skate to where the puck is going to be.”

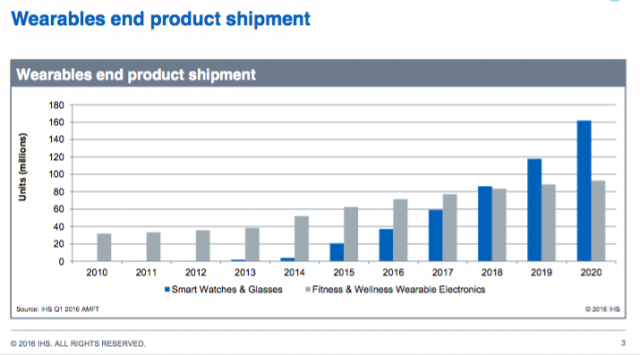

IHS director Jeremie Bouchaud gave the official company rundown on (first) the wearables market, starting with a shipment overview between the two leading categories in the space: fitness and wellness wearables, and smartwatches and glasses. The former began in 2010 and the latter only began showing up in 2013. Numbers this year are expected to top 100M units with the lion’s share (approx 70M) going to the fitness category (see chart.)

IHS director Jeremie Bouchaud gave the official company rundown on (first) the wearables market, starting with a shipment overview between the two leading categories in the space: fitness and wellness wearables, and smartwatches and glasses. The former began in 2010 and the latter only began showing up in 2013. Numbers this year are expected to top 100M units with the lion’s share (approx 70M) going to the fitness category (see chart.)

Sensors make it sell

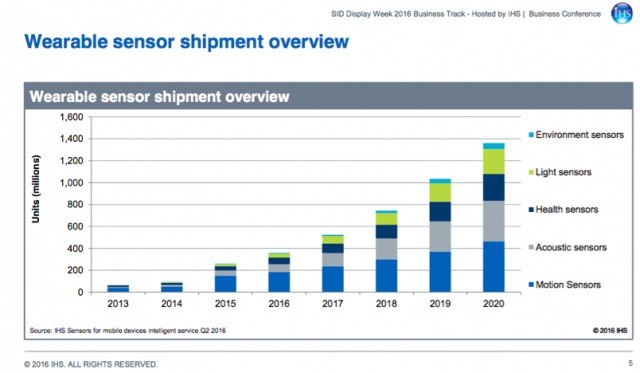

Bouchaud said current trends indicate the disparity between device types will continue until 2018, when both devices will hit approximate parity at around 80M units each. To IHS, it’s the sensors that make the devices sell, and those fall into five major categories including (ranked by current dominance) motion tracking, acoustic, health, light and environment.

Health sensors are of particular interest, according to Bouchaud, as they are already delivering a measurable impact on health and well being, which translates directly into insurance premium savings to health care insurers. This is evidenced by United Healthcare’s published research showing the inverse correlation between activity (the kind you can measure with a simple wearable device) and health care claims.

Consequently, the group is offering its customers a cash premium of $4/day for activity and they can claim up to $1460 per year, with over 200K active users engaged in the program so far this year (2016) and “millions” expected by the end of next.

IHS also gave some technology examples of coming trends in healthcare tracking device services, include WISDM Lab‘s data mining and Fordham University’s Android app ‘Actitracker‘, which uses the simple activity tracking service on smartphones with an accelerometer and advanced algorithms. The motion tracking covers number, frequency and intensity of steps plus gait, the last of which is also used to identify registered users. Gait is also used when someone is looking to cheat by giving it to someone else to ‘run up the number’.

Wearable sensors in smart watches and glasses stack up about the same with motion, acoustic, health, light and environment that represent the high to low number shipped into the category.

Gating Issue: Battery Life

For now the issue blocking penetration of sensor devices in the consumer market seems to be battery life, with overall performance tied directly to device use. IHS calls this “the key factor” across all wearables. Speaking of all wearable devices, it’s the heart rate monitor (HRM) that is the stand out sensor considered “key” in all wearables going forward, according to the group.

If there is a sense of what the future holds (where the puck is going to be) in wearable technology going forward, look no further than the booming sensor market, activity tracking devices and on-line services that can provide a data deep dive with a clear picture of real activity (or not) in a user’s lifestyle. These are all key drivers and differentiator in these devices now, and in the future.

For now, battery life remains the critical determiner in device usage. However, long-lived device or not, users may find it just too expensive not to start wearing that fitness device, smart watch or activity tracker as bonuses. It could even be that mandated wearables become popular, imposed by an overburdened health care system. We may also see the rise of subsidized devices from health care providers, keen to reduce cost of coverage that will continue to drive adoption (and device sales.)

There is no doubt they can help cut cost by improving activity, and consequently health. Taken to its extreme, it may someday become a requirement for coverage of high risk patients to wear, and/or pay a premium for the privilege of a sedentary life style. And while individual rights (privacy) is at the center of this debate (and well beyond the scope of this coverage), rest assured a wearable device will be there to track a sedentary or active lifestyle. – Steve Sechrist