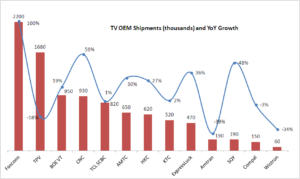

Sigmaintell reported in Augusts that shipments of TVs by global TV OEMs increased by 6.1% on an annual basis and up 8.1% on the July result. The increase in demand was largely because of demand for the peak TV sales season in the US. Next month, the company expects a flattening of production. The increase in demand is mainly in 50″, 55″ and 65″, while demand in 32″ and below is ‘steady’.

- Foxconn is reported to have offset some decline in volume from Sharp by increasing volume to Sony.

- TPV is mainly seeing growth in overseas shipments

- TCL is benefiting from a deal with Xiaomi in China and also in India

- HKC also did well with Xiaomi and had good sales to Haier.

- BOE has been focusing on boosting its profitability, rather than volume at the moment.

Analyst Comment

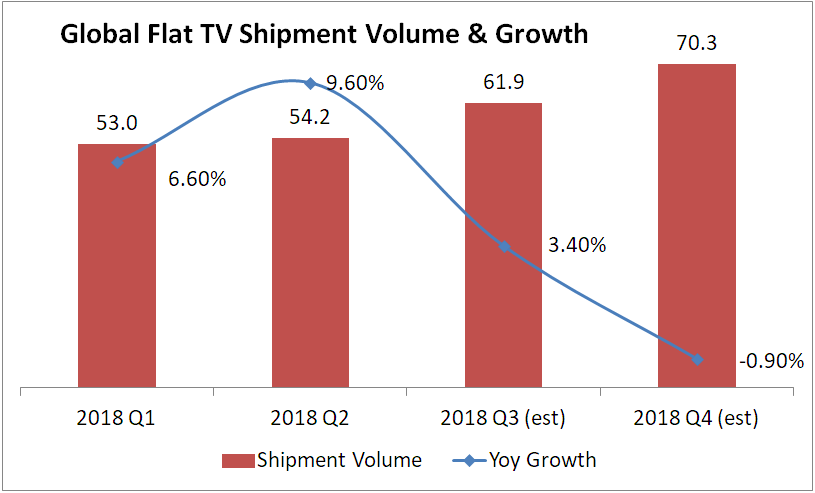

Sigmaintel also said that non-Chinese TV brands had increased their inventory levels to 11.9 weeks (against a target of 8 weeks, generally) in July. On the other hand, Chinese brands is also up over the year, by around 1.4 weeks, but levels are at 7.9 weeks. Inventory increased as TV brands took advantage of lower panel prices. The World Cup helped with Q2 demand and some emerging economies in Asia are doing quite well. However, the relatively high inventory and an expectation of only low growth in the second half of the year will mean that panel purchasing may be weak and probably around 0.8% below last year’s level in Q3. The company sees the supply demand balance at around 4.5%, which is moderately tight supply at the moment, but it is expected to increase in Q4, with a possibility of panel price drops in Q4. (BR)

TV Global Shipments – Source Data:SIgmaintell. Chart:Meko

TV Global Shipments – Source Data:SIgmaintell. Chart:Meko