A new report from Digi-Capital finds that Chinese computer vision and AR investment surged to $3.9 billion in the last 12 months, while North American AR/VR investment fell from nearly $1.5 billion in the fourth quarter of 2017 to less than $120 million in the third quarter of 2018. At the same time, VC sentiment on VR softened significantly.

A new report from Digi-Capital finds that Chinese computer vision and AR investment surged to $3.9 billion in the last 12 months, while North American AR/VR investment fell from nearly $1.5 billion in the fourth quarter of 2017 to less than $120 million in the third quarter of 2018. At the same time, VC sentiment on VR softened significantly.

Digi-Capital MD Tim Merel says that mobile AR is in its very early stages, and could see $50 to $100 million exits in 2018 and 2019. Dominant companies will take time to emerge, and it will also take time for developers to learn what works and for consumers and enterprises to adopt mobile AR at scale. VCs are most interested in native mobile AR with critical use cases, not ports from other platforms.

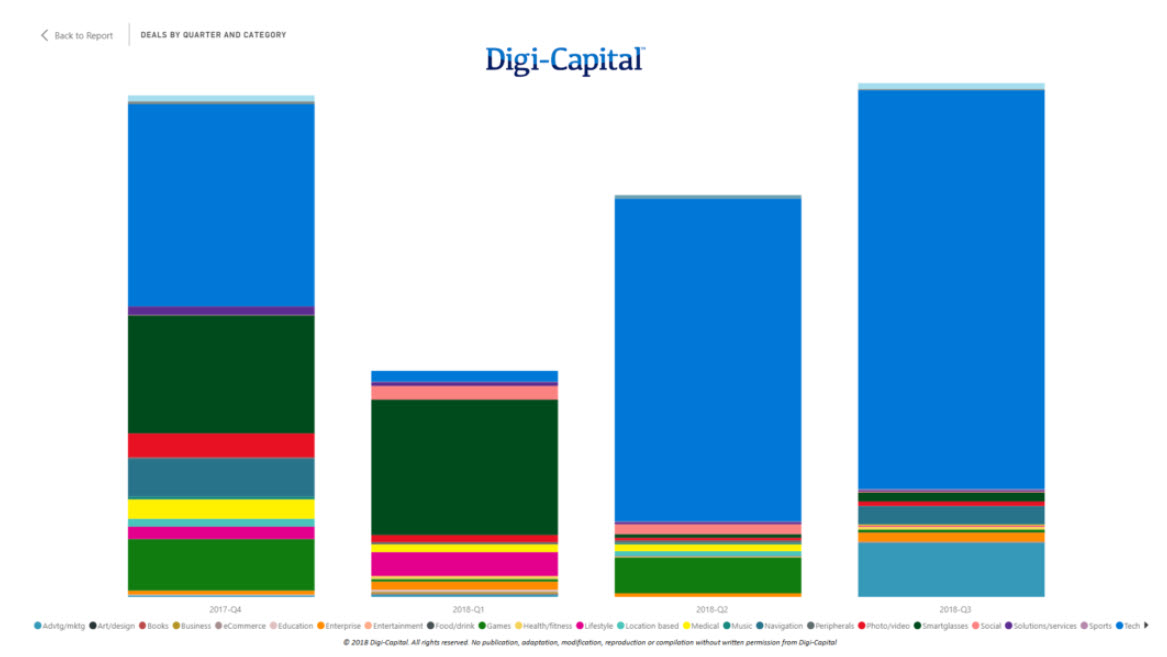

Deal volume declined steadily by 10% per quarter over the last 12 months, around two-thirds the level in the third quarter of 2018 than it was in the fourth quarter of 2017. Most of the decline happened in the US and Europe, where VCs increasingly stayed on the sidelines by looking for short-term traction as a sign of long-term growth.

The biggest casualties of this short-term approach have been early stage startups raising seed funding (where deal volume was down by more than half) and some Series A rounds (where it was down by a quarter). This trend has been strongest in North America and Europe, but even Asia has not been entirely immune from some early-stage deal volume decline. Merel commented:

“While deal

volume is a great indicator of early-stage investment market trends, deal value gives a clearer picture of where the big money has been going over the last 12 months. Global investment hit its previous quarterly record of over $2 billion in the fourth quarter of 2017, driven by a few very large deals. It then dropped back to around $1 billion in the first quarter of this year. Since then, deal value has steadily climbed quarter-on-quarter, to reach a new record-high of well over $2 billion in the third quarter of 2018″.

Over $4 billion of the total $7.2 billion in the last 12 months was invested in computer vision and AR tech, with well over $1 billion going into smart glasses — the bulk of which went into Magic Leap. The next-largest sectors were advertising and marketing at a quarter of a billion dollars and games at around $400 million. The remaining 22 industry sectors raised in the low hundreds of millions down to single-digit millions in the last 12 months.

Magic Leap One

American and Chinese investment had an inverse relationship in the last 12 months. American investors increasingly chose to stay on the sidelines, while Chinese investor confidence grew. “The differences in the data couldn’t be starker,” Merel said, adding:

“North American investment was almost triple that of Asian investment in the fourth quarter of 2017, with a record-high of nearly $1.5 billion dollars for the quarter. Despite 2018 being a transitional year for the market, North American quarterly investment fell over 90% to less than $120 million in the third quarter of 2018. American VCs appear to have taken a long-term solution to a short-term problem”.

Chinese VCs have been focused on the long-term potential of the intersection between computer vision and AR, with later-stage Series C and Series D rounds raising hundreds of millions of dollars a time. This trend increased dramatically in the last 12 months, with SenseTime Group raising over $2 billion in multiple rounds and Megvii close behind at over $1 billion, also from multiple rounds.

Smaller investments (by Chinese standards) in the hundreds of millions have gone into companies Westerners might not know, including Beijing Moviebook Technology, Kujiale and more. All this saw Chinese quarterly investment triple in the last 12 months.

Merel suggests that American VCs might continue to wait for market traction before providing the fuel needed for that traction, even if that seems counterintuitive, which could pose an existential threat to some early-stage startups in North America. Conversely, Chinese VCs continue to back domestic companies which could dominate the future of computer vision and AR. The next six months will determine if this is a long-term trend. Merel concluded:

“If mobile AR revenue accelerates in 2019 as critical use cases and apps emerge, this could become a catalyst for renewed investment by American VCs. The big unknown is whether Apple enters the smartphone-tethered smart glasses market in late 2020. This could be the tipping point for the market as a whole, not just the investment market.

However, Apple timing is hard to predict, with any potential launch date known only to Tim Cook and his immediate circle. Chinese VCs embraced a ‘Jobsian’ approach over the last 12 months, with Western VCs increasingly dot-connecting (or not). It will be interesting to see how this plays out for computer vision and AR investment over the next 12 months, so watch this space”.